- Saudi Arabia

- /

- Real Estate

- /

- SASE:9521

Undiscovered Gems with Promising Potential This December 2024

Reviewed by Simply Wall St

As we approach December 2024, global markets are experiencing a mixed landscape, with major U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs while small-cap stocks in the Russell 2000 have seen recent declines. This divergence highlights the importance of identifying undiscovered gems within smaller-cap sectors that may offer promising potential amidst broader market dynamics. In such an environment, a good stock is often characterized by its ability to navigate economic shifts effectively and leverage sector-specific opportunities, making it crucial for investors to consider companies with strong fundamentals and growth prospects that align with current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Enma Al Rawabi (SASE:9521)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Enma Al Rawabi Company is involved in the establishment and ownership of real estate properties in Saudi Arabia, with a market capitalization of SAR 956 million.

Operations: Enma Al Rawabi generates revenue through its real estate properties in Saudi Arabia. The company's net profit margin is 23%, indicating its efficiency in converting revenue into actual profit.

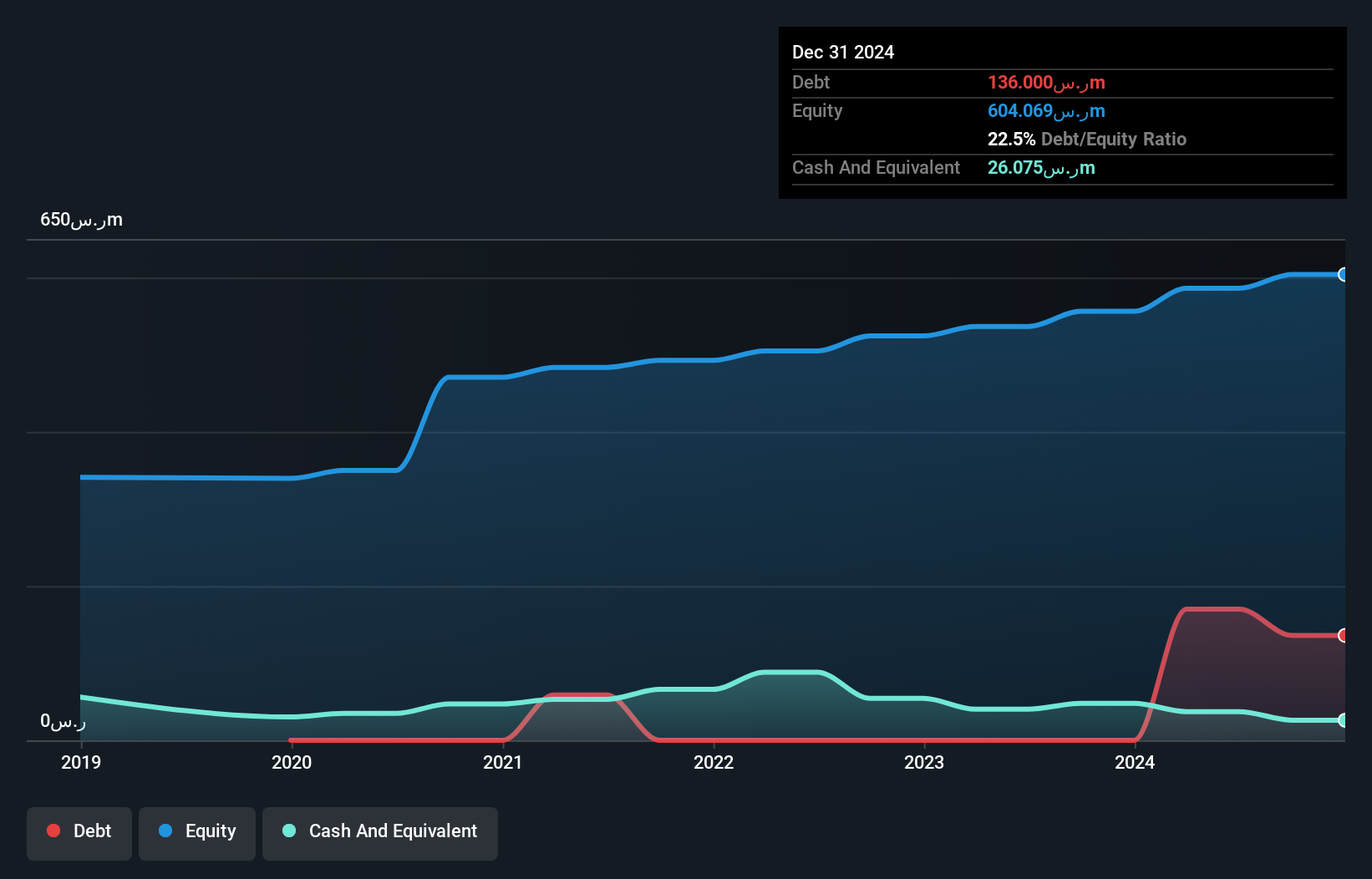

Enma Al Rawabi, a nimble player in its sector, has demonstrated impressive earnings growth of 120% over the past year, outpacing the Real Estate industry's 15%. The company seems to offer good value with a price-to-earnings ratio of 13.7x compared to the SA market's 23.8x. Its net debt to equity ratio stands at a satisfactory 22.7%, though it has increased from 0% over five years. Despite high-quality earnings and profitability ensuring no cash runway concerns, recent share price volatility could be a consideration for potential investors looking at this promising yet fluctuating stock.

- Delve into the full analysis health report here for a deeper understanding of Enma Al Rawabi.

Assess Enma Al Rawabi's past performance with our detailed historical performance reports.

Shanghai Kai Kai Industry (SHSE:600272)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Kai Kai Industry Company Limited is involved in the production, wholesale, and retail of apparel such as shirts, t-shirts, and sweaters as well as Chinese and Western medicines in China, with a market capitalization of CN¥2.51 billion.

Operations: Shanghai Kai Kai Industry generates revenue through the production, wholesale, and retail of apparel and medicines in China. The company's net profit margin trends provide insights into its profitability over time.

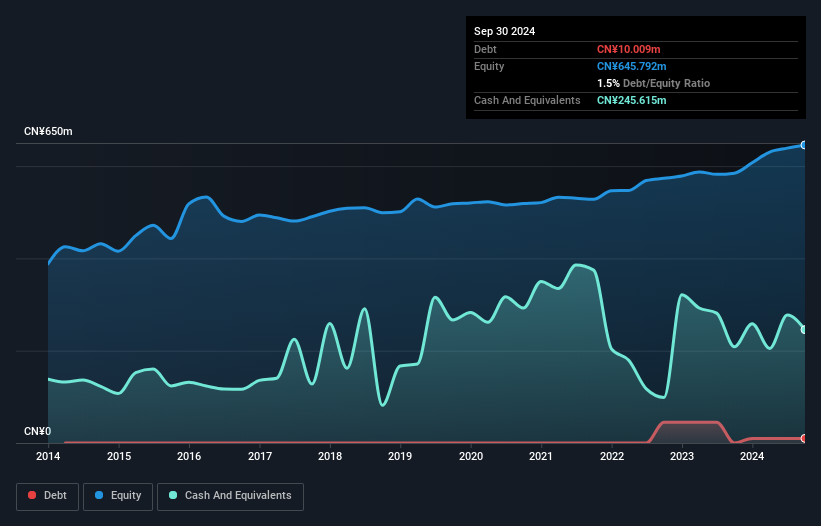

Shanghai Kai Kai Industry, a smaller player in its field, has shown impressive growth with earnings surging by 105.5% over the past year, outpacing the Pharmaceuticals industry's -2.5%. The company's recent financials reveal a net income of CN¥34.6 million for the first nine months of 2024, up from CN¥19.79 million last year, reflecting strong performance despite a one-off gain of CN¥76.5 million impacting results. Their basic earnings per share rose to CN¥0.142 from CN¥0.081 previously, indicating solid profitability and potential value for investors seeking emerging opportunities in this space.

- Dive into the specifics of Shanghai Kai Kai Industry here with our thorough health report.

Gain insights into Shanghai Kai Kai Industry's past trends and performance with our Past report.

Ningxia Western Venture IndustrialLtd (SZSE:000557)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningxia Western Venture Industrial Co., Ltd. operates in diverse industrial sectors and has a market capitalization of CN¥8.85 billion.

Operations: Ningxia Western Venture Industrial Co., Ltd. generates revenue from multiple industrial sectors, contributing to its market capitalization of CN¥8.85 billion. The company's financial performance includes a focus on optimizing profit margins, with net profit margin trends providing insights into its operational efficiency and cost management strategies.

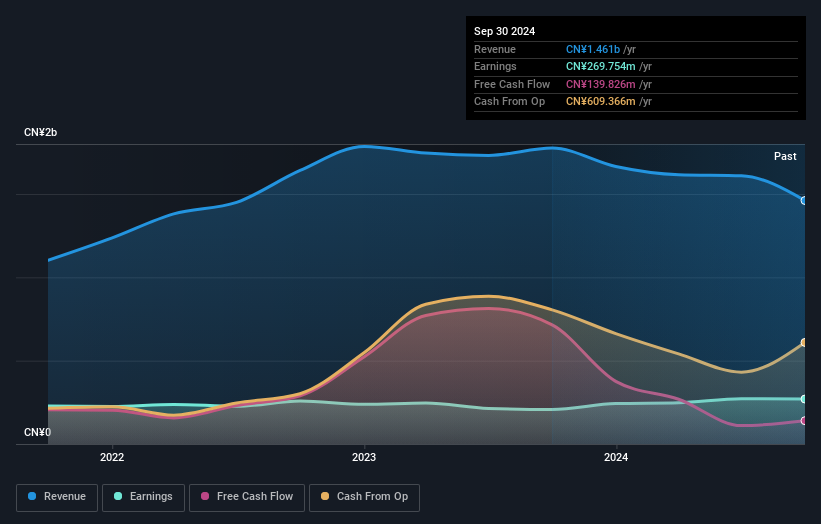

Ningxia Western Venture Industrial, a relatively small player in its field, has shown notable financial resilience. Over the past year, earnings grew by 30.1%, outpacing the Transportation industry's modest 1.9% growth. The company is debt-free and boasts high-quality earnings, with a price-to-earnings ratio of 32.8x below the CN market's 37.3x benchmark, indicating good value potential. Recent developments include an acquisition move by CHN Energy Group for a 5% stake valued at approximately CNY 440 million (US$), adding strategic interest to its profile amidst solid financial performance despite revenue dipping to CNY 994 million from CNY 1 billion last year but net income rising to CNY 224 million from CNY196 million previously reported figures for nine months ending September this year compared same period last year respectively .

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4628 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enma Al Rawabi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:9521

Enma Al Rawabi

Engages in establishing and owning real estate properties in the Kingdom of Saudi Arabia.

Proven track record with adequate balance sheet.