- Saudi Arabia

- /

- Real Estate

- /

- SASE:4310

The 6.0% return this week takes Knowledge Economic City's (TADAWUL:4310) shareholders five-year gains to 46%

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the Knowledge Economic City Company (TADAWUL:4310) share price is up 46% in the last 5 years, clearly besting the market return of around 5.7% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 7.1%.

Since it's been a strong week for Knowledge Economic City shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Knowledge Economic City

Given that Knowledge Economic City didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last half decade Knowledge Economic City's revenue has actually been trending down at about 24% per year. Even though revenue hasn't increased, the stock actually gained 8%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

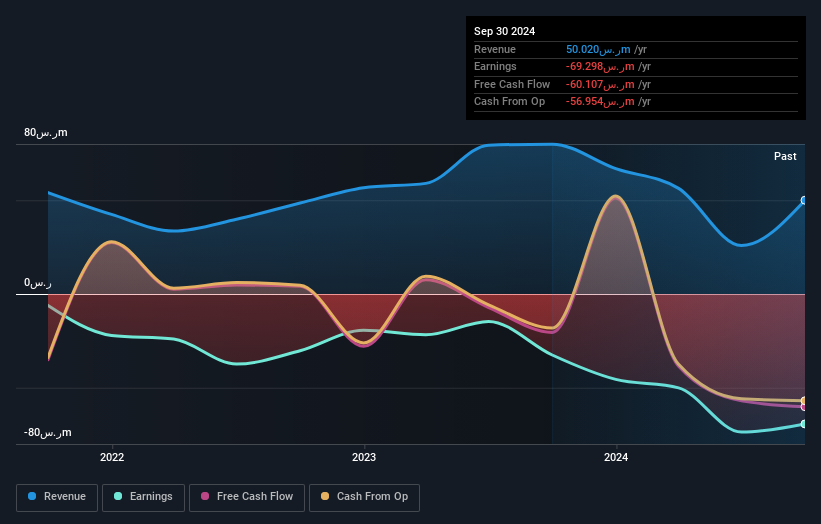

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Knowledge Economic City stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Knowledge Economic City shareholders have received a total shareholder return of 7.1% over one year. However, that falls short of the 8% TSR per annum it has made for shareholders, each year, over five years. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Knowledge Economic City .

But note: Knowledge Economic City may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Knowledge Economic City might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4310

Knowledge Economic City

Together with subsidiaries, engages in the development of the real estate, economic cities, and other development projects in the Kingdom of Saudi Arabia.

Mediocre balance sheet very low.