- Saudi Arabia

- /

- Real Estate

- /

- SASE:4220

Even after rising 6.9% this past week, Emaar The Economic City (TADAWUL:4220) shareholders are still down 27% over the past three years

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Emaar The Economic City (TADAWUL:4220) shareholders have had that experience, with the share price dropping 27% in three years, versus a market return of about 15%. Furthermore, it's down 10% in about a quarter. That's not much fun for holders.

On a more encouraging note the company has added ر.س612m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for Emaar The Economic City

Emaar The Economic City wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Emaar The Economic City grew revenue at 29% per year. That's well above most other pre-profit companies. The share price drop of 8% per year over three years would be considered disappointing by many, so you might argue the company is getting little credit for its impressive revenue growth. It's possible that the prior share price assumed unrealistically high future growth. Before considering a purchase, investors should consider how quickly expenses are growing, relative to revenue.

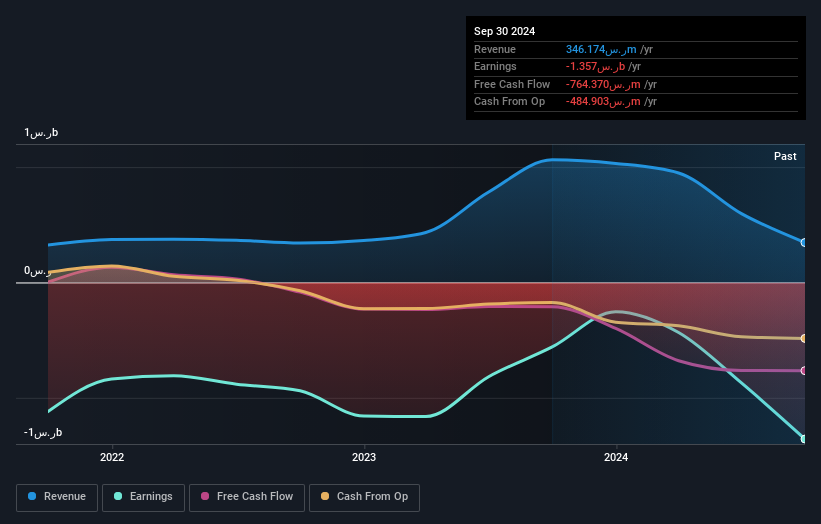

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Emaar The Economic City stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Emaar The Economic City shareholders have received a total shareholder return of 10% over one year. Notably the five-year annualised TSR loss of 1.7% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Emaar The Economic City better, we need to consider many other factors. Take risks, for example - Emaar The Economic City has 2 warning signs we think you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Emaar The Economic City might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4220

Emaar The Economic City

Engages in the development of real estate properties in the economic or other zones in Saudi Arabia.

Very low with worrying balance sheet.

Market Insights

Community Narratives