- Saudi Arabia

- /

- Real Estate

- /

- SASE:4090

Taiba Investment Company (TADAWUL:4090) Not Flying Under The Radar

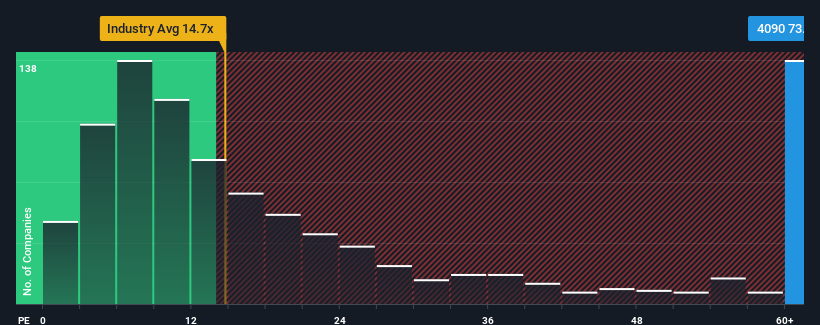

When close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") below 25x, you may consider Taiba Investment Company (TADAWUL:4090) as a stock to avoid entirely with its 73x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

As an illustration, earnings have deteriorated at Taiba Investment over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Taiba Investment

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Taiba Investment's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's bottom line. Even so, admirably EPS has lifted 111% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that Taiba Investment's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Taiba Investment's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Taiba Investment revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Taiba Investment (1 doesn't sit too well with us!) that you need to be mindful of.

If you're unsure about the strength of Taiba Investment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Taiba Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4090

Taiba Investment

Invests in, buys, owns, develops, sells, leases, operates, maintains, markets, and manages real estate properties in the Kingdom of Saudi Arabia.

Mediocre balance sheet with questionable track record.