- Saudi Arabia

- /

- Real Estate

- /

- SASE:4020

Undiscovered Gems in the Middle East to Explore This December 2025

Reviewed by Simply Wall St

As most Gulf bourses ride the wave of rising oil prices and potential U.S. rate cuts, the Middle East market is experiencing a period of optimism, with key indices such as Saudi Arabia's benchmark index and Dubai’s main share index posting gains. Amidst this positive sentiment, discerning investors may find opportunities in lesser-known stocks that have the potential to benefit from regional economic shifts and strategic sectoral investments.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 17.65% | 4.48% | 4.46% | ★★★★★★ |

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| Y.D. More Investments | 51.67% | 27.49% | 36.12% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Payton Industries | NA | 3.44% | 14.24% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

RAK Properties PJSC (ADX:RAKPROP)

Simply Wall St Value Rating: ★★★★★★

Overview: RAK Properties PJSC, along with its subsidiaries, focuses on the investment, development, and management of real estate properties in the UAE and has a market capitalization of AED3.96 billion.

Operations: RAK Properties PJSC generates revenue primarily from real estate sales (AED1.39 billion), followed by hotel operations (AED216.77 million) and property leasing (AED71.92 million).

RAK Properties PJSC, a notable player in the Middle East's real estate sector, has demonstrated impressive financial performance with earnings surging by 72.6% last year, outpacing the industry's 38% growth. The company reported third-quarter sales of AED 390.71 million and net income of AED 56.22 million, marking significant improvements from the previous year. Its net debt to equity ratio stands at a satisfactory 11.9%, while interest payments are well-covered by EBIT at 7.1 times coverage. Furthermore, RAK Properties is trading at a substantial discount of approximately 89% below its estimated fair value, offering potential upside for investors seeking undervalued opportunities in this dynamic market.

- Get an in-depth perspective on RAK Properties PJSC's performance by reading our health report here.

Understand RAK Properties PJSC's track record by examining our Past report.

Lila Kagit Sanayi Ve Ticaret (IBSE:LILAK)

Simply Wall St Value Rating: ★★★★★☆

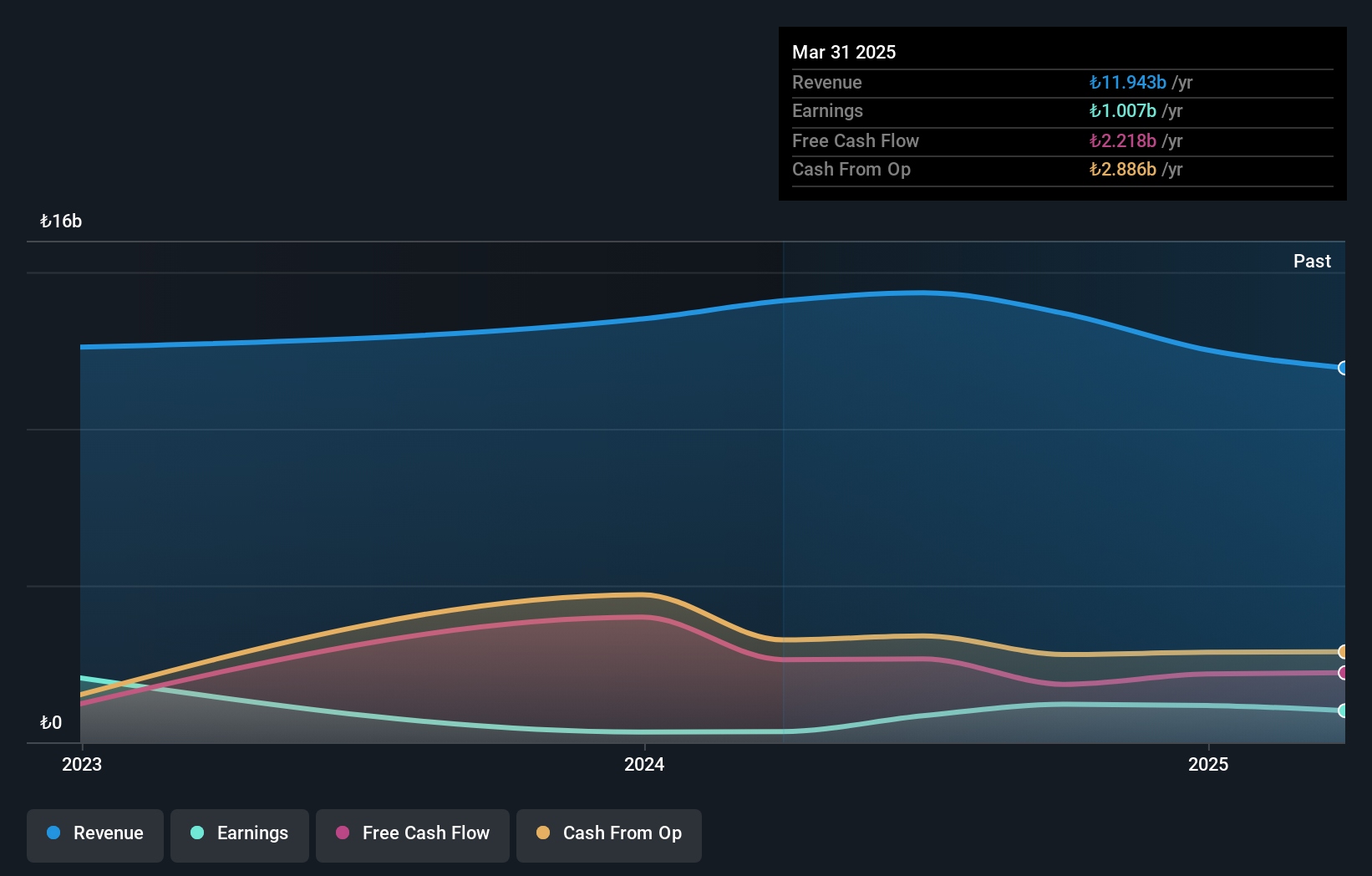

Overview: Lila Kagit Sanayi Ve Ticaret A.S. is a company that produces and sells roll papers primarily in Turkey, with a market capitalization of TRY15.17 billion.

Operations: Lila Kagit generates revenue mainly from its Paper & Paper Products segment, which amounted to TRY10.28 billion.

Lila Kagit, a notable player in the Middle Eastern market, shows a mixed financial performance. Its recent quarterly sales were TRY 3,187.89 million, down from TRY 4,029.44 million the previous year. Despite this dip in sales, net income for the nine months grew to TRY 1,411.25 million from TRY 1,307.53 million last year. The company maintains high-quality earnings and holds more cash than its total debt—a positive sign for investors concerned about leverage risks. However, it faces challenges with negative earnings growth of -14.8% compared to industry averages over the past year.

- Take a closer look at Lila Kagit Sanayi Ve Ticaret's potential here in our health report.

Learn about Lila Kagit Sanayi Ve Ticaret's historical performance.

Saudi Real Estate (SASE:4020)

Simply Wall St Value Rating: ★★★★★☆

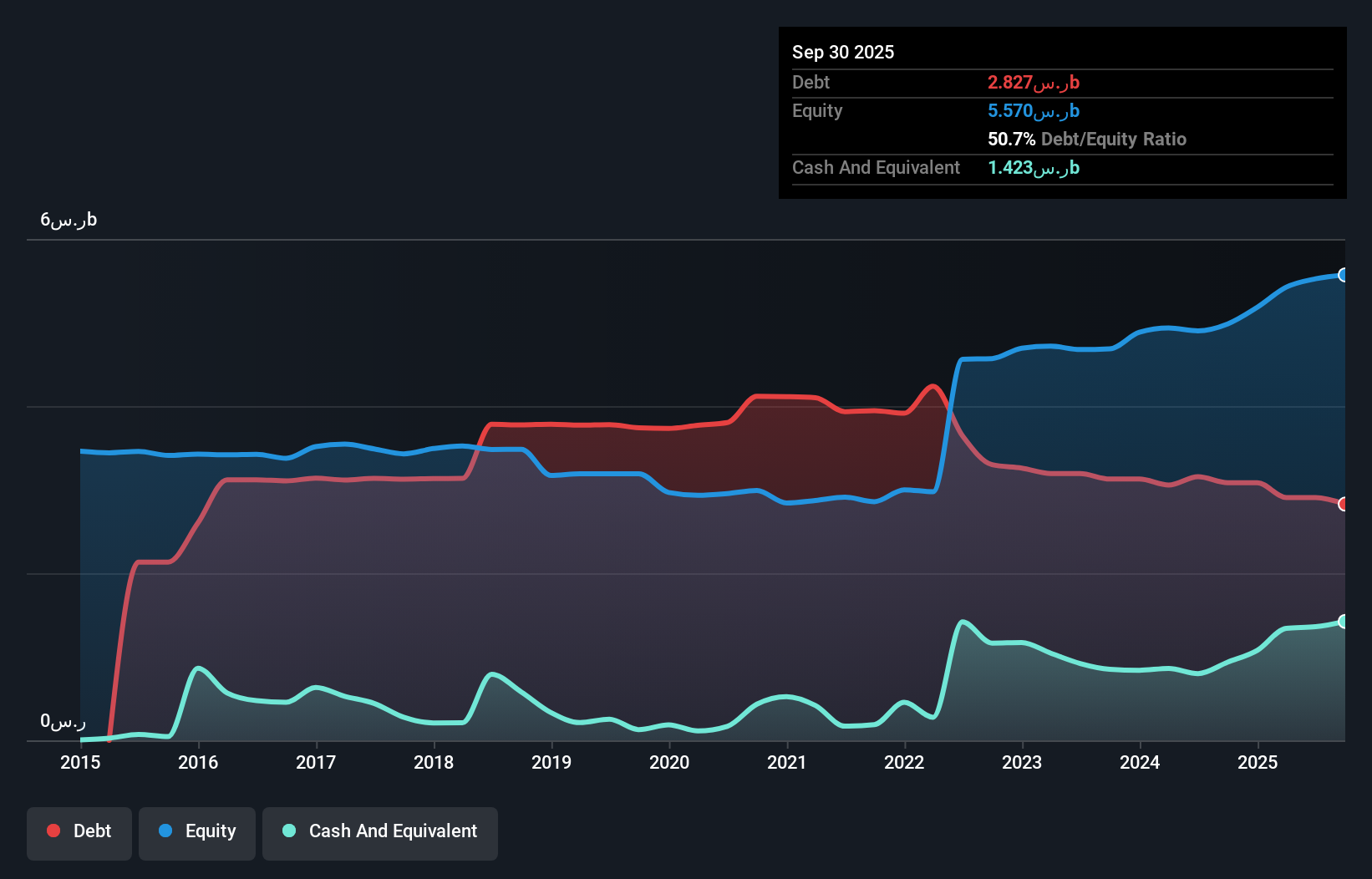

Overview: Saudi Real Estate Company, with a market cap of SAR 4.89 billion, operates as a real estate development company in Saudi Arabia through its various subsidiaries.

Operations: The company generates revenue primarily from property sales (SAR 969.32 million) and infrastructure projects (SAR 869.99 million), complemented by rental income, facility management, and construction projects. The net profit margin reflects the company's overall profitability after accounting for expenses across its diverse operations.

Saudi Real Estate, a notable player in the region's property market, has demonstrated impressive financial performance with earnings surging by 148.5% over the past year, outpacing the industry's 22.1%. The company's debt to equity ratio has improved significantly from 137.7% to 50.7% over five years, indicating prudent financial management. Its price-to-earnings ratio of 10.7x remains attractive compared to the SA market average of 17.8x, suggesting good value potential for investors. Recent developments include a SAR 425 million project award for a residential complex in Riyadh, likely boosting future revenue streams and solidifying its growth trajectory.

- Delve into the full analysis health report here for a deeper understanding of Saudi Real Estate.

Examine Saudi Real Estate's past performance report to understand how it has performed in the past.

Taking Advantage

- Embark on your investment journey to our 183 Middle Eastern Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4020

Saudi Real Estate

Operates as a real estate development company in Saudi Arabia.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026