- Canada

- /

- Industrial REITs

- /

- TSX:DIR.UN

3 Stocks That May Be Priced Below Their Estimated Value In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments, with central banks around the world making significant policy moves, investors are keenly observing how these shifts impact various indices. Notably, while most major stock indexes have recently seen declines, the Nasdaq Composite has achieved new highs, highlighting a complex market environment where growth stocks continue to outperform value stocks. In such fluctuating conditions, identifying undervalued stocks—those trading below their intrinsic value despite strong fundamentals—can be an appealing strategy for investors looking to capitalize on potential price corrections and long-term gains.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.67 | US$53.13 | 49.8% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.35 | CN¥33.16 | 50.7% |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.59 | CN¥19.09 | 49.8% |

| Xiamen Bank (SHSE:601187) | CN¥5.70 | CN¥11.35 | 49.8% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.18 | HK$18.27 | 49.8% |

| Musashi Seimitsu Industry (TSE:7220) | ¥4170.00 | ¥8105.47 | 48.6% |

| BYD Electronic (International) (SEHK:285) | HK$39.85 | HK$79.36 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.30 | CLP579.37 | 49.7% |

| Constellium (NYSE:CSTM) | US$10.91 | US$21.69 | 49.7% |

Let's review some notable picks from our screened stocks.

Saudi Pharmaceutical Industries and Medical Appliances (SASE:2070)

Overview: Saudi Pharmaceutical Industries and Medical Appliances Corporation develops, manufactures, and markets medicinal and pharmaceutical products in the Kingdom of Saudi Arabia with a market cap of SAR3.81 billion.

Operations: The company's revenue segments consist of Pharmaceutical Manufacturing at SAR1.25 billion, Trading & Distribution Services at SAR209.67 million, and Healthcare Services at SAR166.75 million.

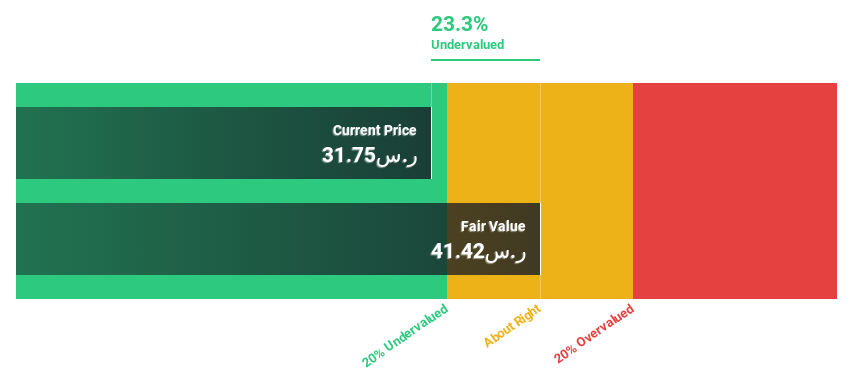

Estimated Discount To Fair Value: 23.3%

Saudi Pharmaceutical Industries and Medical Appliances is trading at SAR31.75, below its estimated fair value of SAR41.42, indicating potential undervaluation based on cash flows. The company has become profitable this year with earnings forecasted to grow significantly by 33.5% annually over the next three years, outpacing the Saudi Arabian market's growth rate of 6.3%. However, interest payments are not well covered by earnings, which may pose a financial risk.

- According our earnings growth report, there's an indication that Saudi Pharmaceutical Industries and Medical Appliances might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Saudi Pharmaceutical Industries and Medical Appliances.

Dream Industrial Real Estate Investment Trust (TSX:DIR.UN)

Overview: Dream Industrial Real Estate Investment Trust is an unincorporated, open-ended REIT that focuses on industrial property investments with a market cap of CA$3.51 billion.

Operations: The primary revenue segment for this unincorporated, open-ended trust is Investment Properties, generating CA$484.15 million.

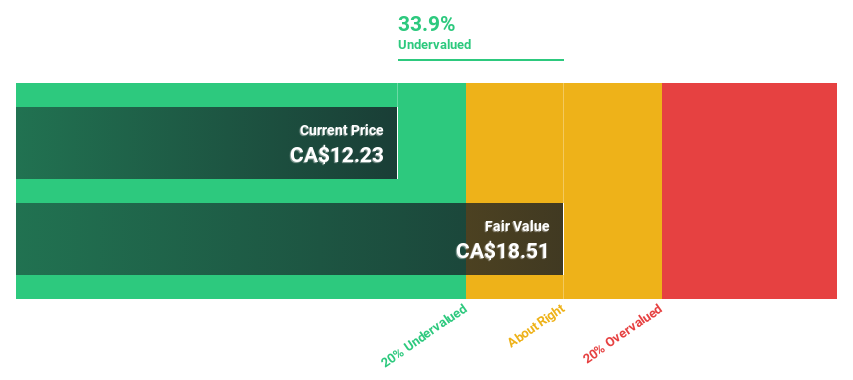

Estimated Discount To Fair Value: 33.9%

Dream Industrial Real Estate Investment Trust, trading at CA$12.23, is undervalued with an estimated fair value of CA$18.51, showing potential based on cash flows. Earnings are expected to grow significantly at 29.7% annually, outpacing the Canadian market's 15.5%. The company pays a reliable dividend and is actively pursuing acquisitions in strategic markets with a flexible balance sheet, though its debt coverage by operating cash flow remains weak.

- Upon reviewing our latest growth report, Dream Industrial Real Estate Investment Trust's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Dream Industrial Real Estate Investment Trust with our detailed financial health report.

FuSheng Precision (TWSE:6670)

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally, with a market cap of NT$41.46 billion.

Operations: The company's revenue primarily comes from its Golf Division, generating NT$23.09 billion, and its Sports Assembly Division, contributing NT$2.44 billion.

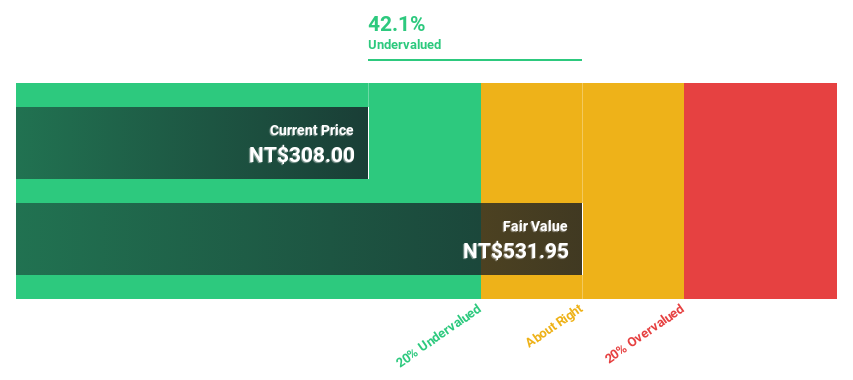

Estimated Discount To Fair Value: 42.1%

FuSheng Precision, trading at NT$308, is undervalued with a fair value estimate of NT$531.95, offering potential based on cash flows. Recent earnings grew by 14%, with forecasts indicating a 9.6% annual growth rate for profits and 9.3% for revenue—both outpacing the Taiwan market averages. Despite an unstable dividend history, its return on equity is projected to reach 23%, and it trades at good value compared to industry peers.

- Our comprehensive growth report raises the possibility that FuSheng Precision is poised for substantial financial growth.

- Dive into the specifics of FuSheng Precision here with our thorough financial health report.

Where To Now?

- Click through to start exploring the rest of the 871 Undervalued Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DIR.UN

Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an owner, manager and operator of a global portfolio of well-located, diversified industrial properties.

Reasonable growth potential with proven track record and pays a dividend.