- Saudi Arabia

- /

- Media

- /

- SASE:4210

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

In recent weeks, global markets have been buoyed by the anticipation of regulatory and tax reforms following the U.S. election results, with small-cap indices like the Russell 2000 experiencing notable gains despite not reaching record highs. As investors navigate this optimistic yet uncertain landscape, identifying high-growth tech stocks involves assessing factors such as innovation potential, market adaptability, and financial resilience in response to evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1278 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Saudi Research and Media Group (SASE:4210)

Simply Wall St Growth Rating: ★★★★☆☆

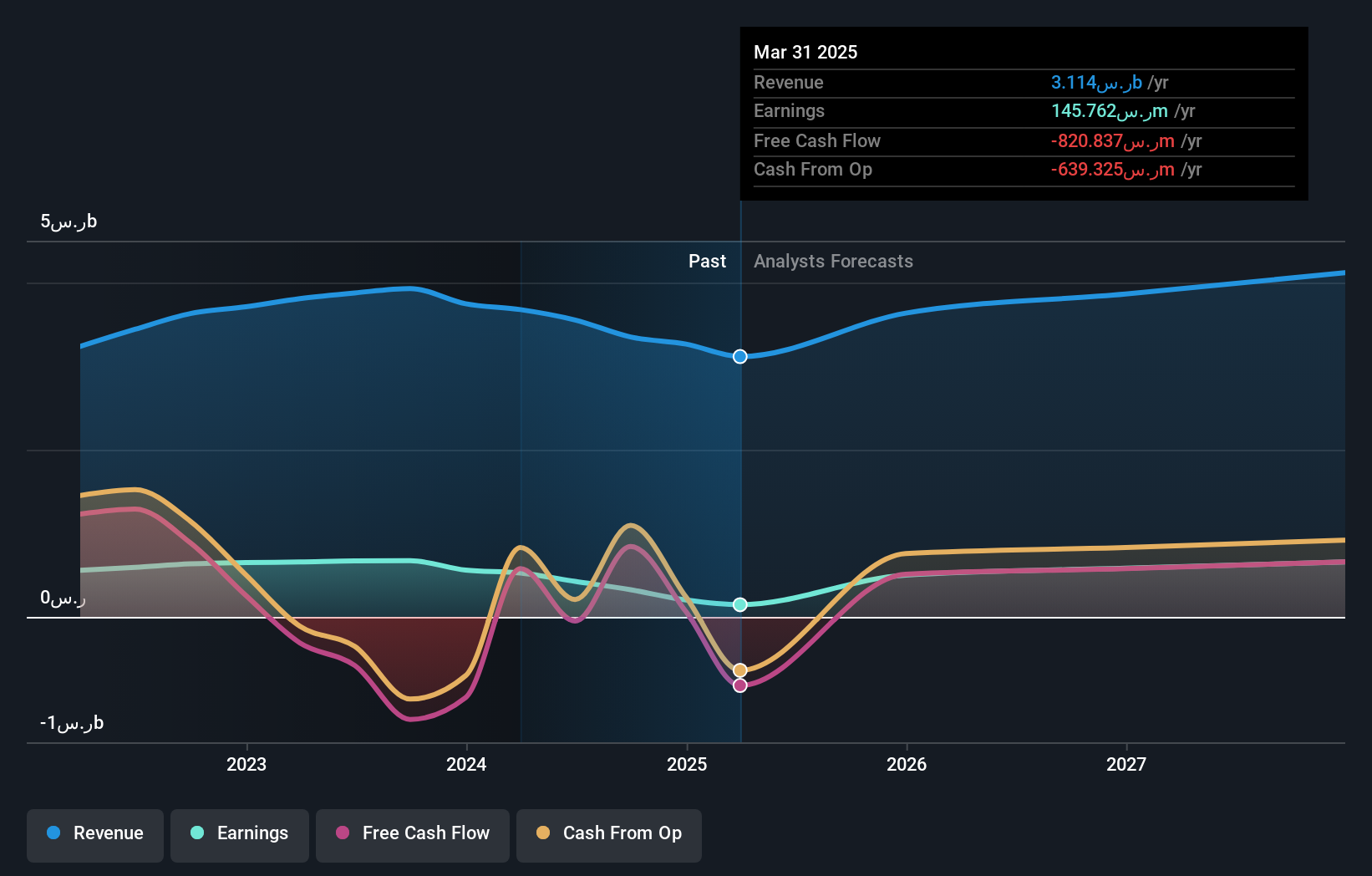

Overview: Saudi Research and Media Group is a diversified company involved in publishing, media, advertising, promotions, distribution, printing, and public relations across Europe, North America, Africa, Asia, the Middle East, and North Africa with a market cap of SAR20.80 billion.

Operations: The group generates revenue primarily from publishing, visual, and digital content (SAR2.27 billion), followed by public relations and advertisements (SAR1.10 billion), and printing and packaging (SAR737.69 million).

Saudi Research and Media Group, amidst a challenging landscape, has demonstrated resilience with expected earnings growth of 26.8% annually, outpacing the Saudi market's average of 7.5%. Despite a revenue forecast growing at 16.4% per year—slower than some high-growth benchmarks but still above the regional market average of 1.7%—the company faces pressures from a recent downturn in net income and sales as reported in their latest half-year results. These figures reflect a strategic pivot towards optimizing their operational efficiency and possibly reallocating resources to areas with higher growth potential such as digital media platforms which are becoming increasingly central to the media industry's revenue streams.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market cap of ¥1.07 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (IAB), which accounts for ¥362.56 billion, followed by the Social Systems, Solutions and Service Business (SSB) at ¥157.64 billion. The Healthcare Business (HCB) contributes ¥148.58 billion, while the Devices & Module Solutions Business (DMB) adds ¥139.57 billion to the company's earnings portfolio.

OMRON's strategic maneuvers, including a recent upward revision in earnings guidance and consistent dividend payments, signal robust financial health and investor confidence. The company forecasts significant growth with net income expected to surge by 44.73% annually, outpacing its previous projections. This is complemented by a steady R&D commitment, which has consistently hovered around 5.8% of revenues, underscoring OMRON's dedication to innovation in automation technology—a sector poised for expansion as industries increasingly adopt smart manufacturing solutions. These developments not only reflect OMRON’s adaptive strategies in response to dynamic market demands but also highlight its potential role in shaping future technological landscapes.

Chicony Electronics (TWSE:2385)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chicony Electronics Co., Ltd. is a company that manufactures and sells electronic parts and components both in Taiwan and internationally, with a market cap of NT$113.16 billion.

Operations: Chicony Electronics generates revenue primarily from the manufacture and sale of electronic parts and components across various international markets. The company focuses on leveraging its production capabilities to serve a diverse clientele, contributing to its substantial market presence.

Chicony Electronics, despite a challenging period marked by a net loss of TWD 6.63 billion for the nine months ending September 2024, is positioning itself for recovery with projected earnings growth of 108.1% annually. The company's commitment to innovation is evident in its R&D expenditures, which are substantial yet necessary to stay competitive in the rapidly evolving tech landscape. With revenue growth forecasted at a steady 9.1% per year, Chicony is strategically navigating through its current unprofitability towards anticipated profitability within three years, reflecting an adaptive approach to market dynamics and potential future gains in the tech sector.

- Delve into the full analysis health report here for a deeper understanding of Chicony Electronics.

Explore historical data to track Chicony Electronics' performance over time in our Past section.

Turning Ideas Into Actions

- Click here to access our complete index of 1278 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Saudi Research and Media Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4210

Saudi Research and Media Group

Operates as a publishing company, engages in trading, media, advertising, promotions, distribution, printing and publishing, and public relations in Europe, North America, Africa, Asia, the Middle East, and North Africa.

Flawless balance sheet with moderate growth potential.