- Switzerland

- /

- Capital Markets

- /

- SWX:LEON

Three High Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have been buoyed by expectations of faster earnings growth and lower corporate taxes, with major indices like the S&P 500 and Nasdaq Composite reaching record highs. Amidst this optimistic backdrop, identifying growth companies with significant insider ownership can provide valuable insights into potential investment opportunities, as insider confidence often aligns with strong company fundamentals and long-term growth prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Alkami Technology (NasdaqGS:ALKT) | 11.2% | 98.6% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

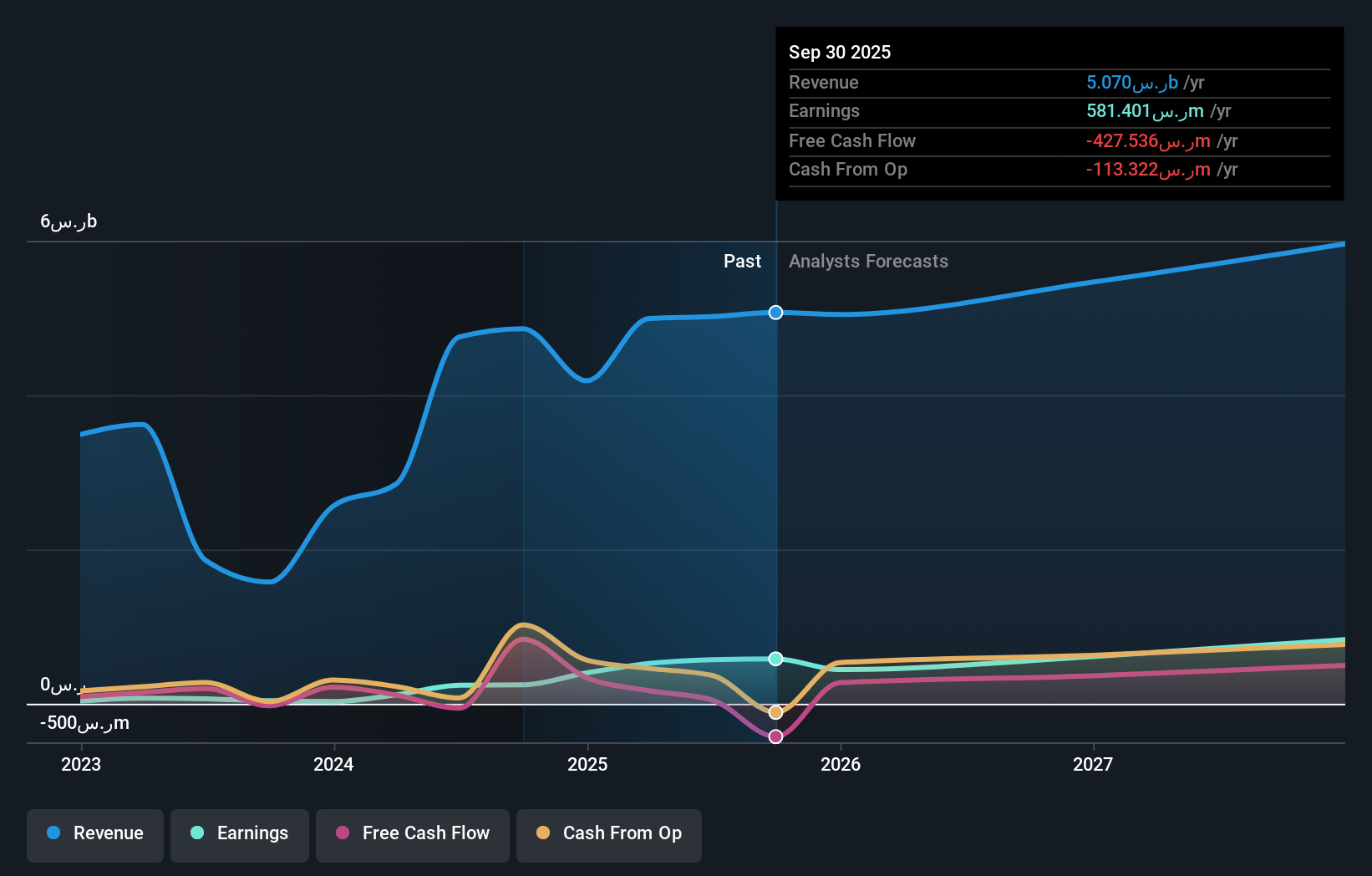

MBC Group (SASE:4072)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MBC Group is a media company operating in the United Arab Emirates, Saudi Arabia, Egypt, Iraq, North Africa, and internationally with a market cap of SAR15.66 billion.

Operations: Revenue segments for the company include Broadcasting at SAR3.25 billion, Digital Media at SAR1.75 billion, and Content Production at SAR2.10 billion.

Insider Ownership: 36%

Earnings Growth Forecast: 33.9% p.a.

MBC Group's earnings are forecast to grow significantly, outpacing the Saudi Arabian market. Despite volatile share prices recently, its revenue is expected to increase over 20% annually. A recent agreement for the Public Investment Fund to acquire a 54% stake for SAR 7.5 billion highlights strong insider ownership dynamics. However, large one-off items have impacted financial results, and future return on equity is projected to be relatively low at 11%.

- Click here and access our complete growth analysis report to understand the dynamics of MBC Group.

- The analysis detailed in our MBC Group valuation report hints at an inflated share price compared to its estimated value.

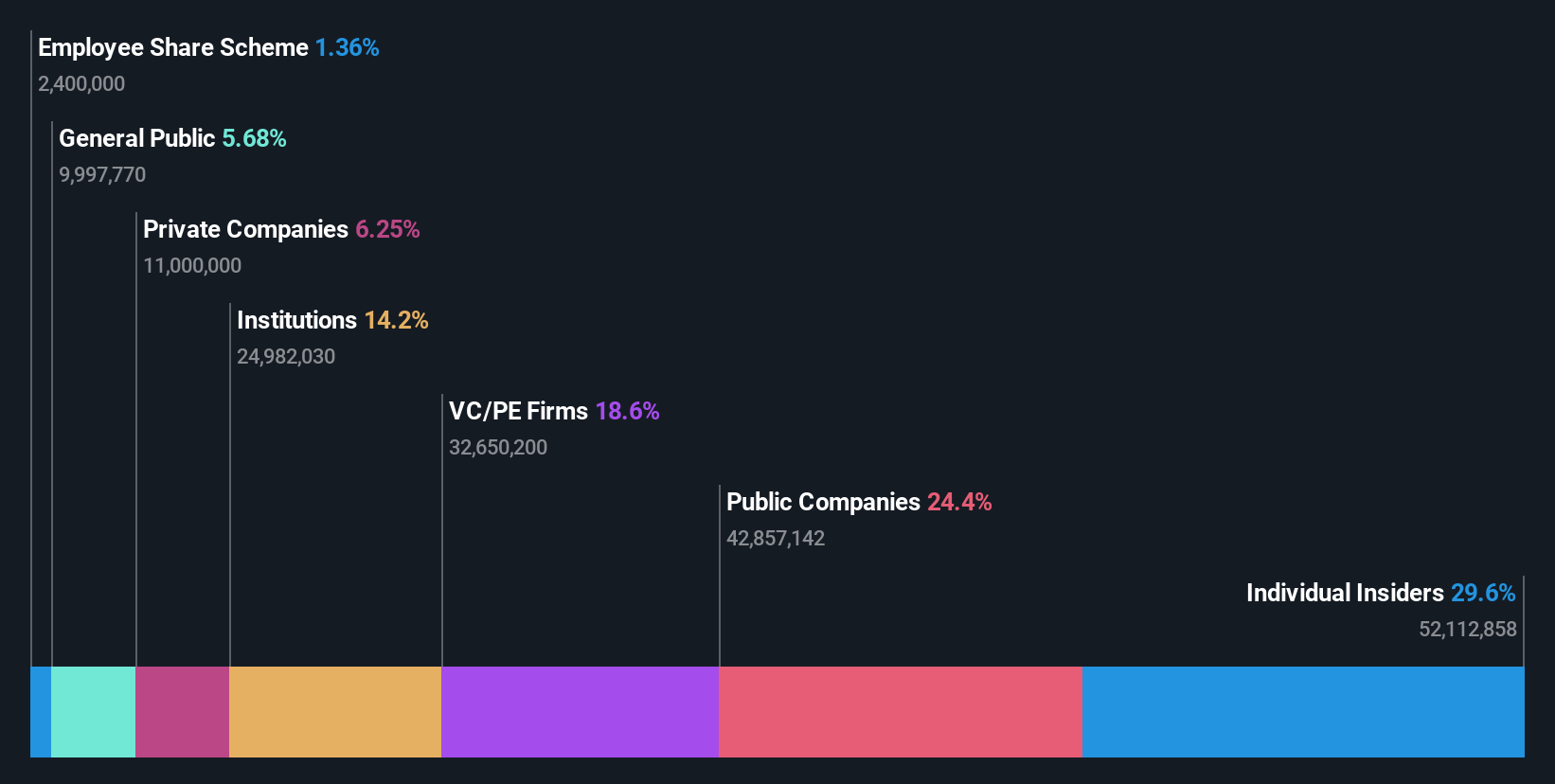

Shanghai INT Medical Instruments (SEHK:1501)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai INT Medical Instruments Co., Ltd. (SEHK:1501) operates in the medical instruments industry and has a market cap of HK$4.93 billion.

Operations: The company's revenue from the Cardiovascular Interventional Business segment is CN¥718.71 million.

Insider Ownership: 29.6%

Earnings Growth Forecast: 27.2% p.a.

Shanghai INT Medical Instruments is poised for substantial growth, with revenue expected to rise 28.7% annually, outpacing the Hong Kong market. Earnings are forecast to grow significantly at 27.2% per year. The company recently reported a half-year net income increase to CNY 100.54 million from CNY 80.5 million year-on-year, despite past shareholder dilution and low future return on equity projections of 14.7%. It trades below estimated fair value by nearly half.

- Unlock comprehensive insights into our analysis of Shanghai INT Medical Instruments stock in this growth report.

- Our valuation report unveils the possibility Shanghai INT Medical Instruments' shares may be trading at a premium.

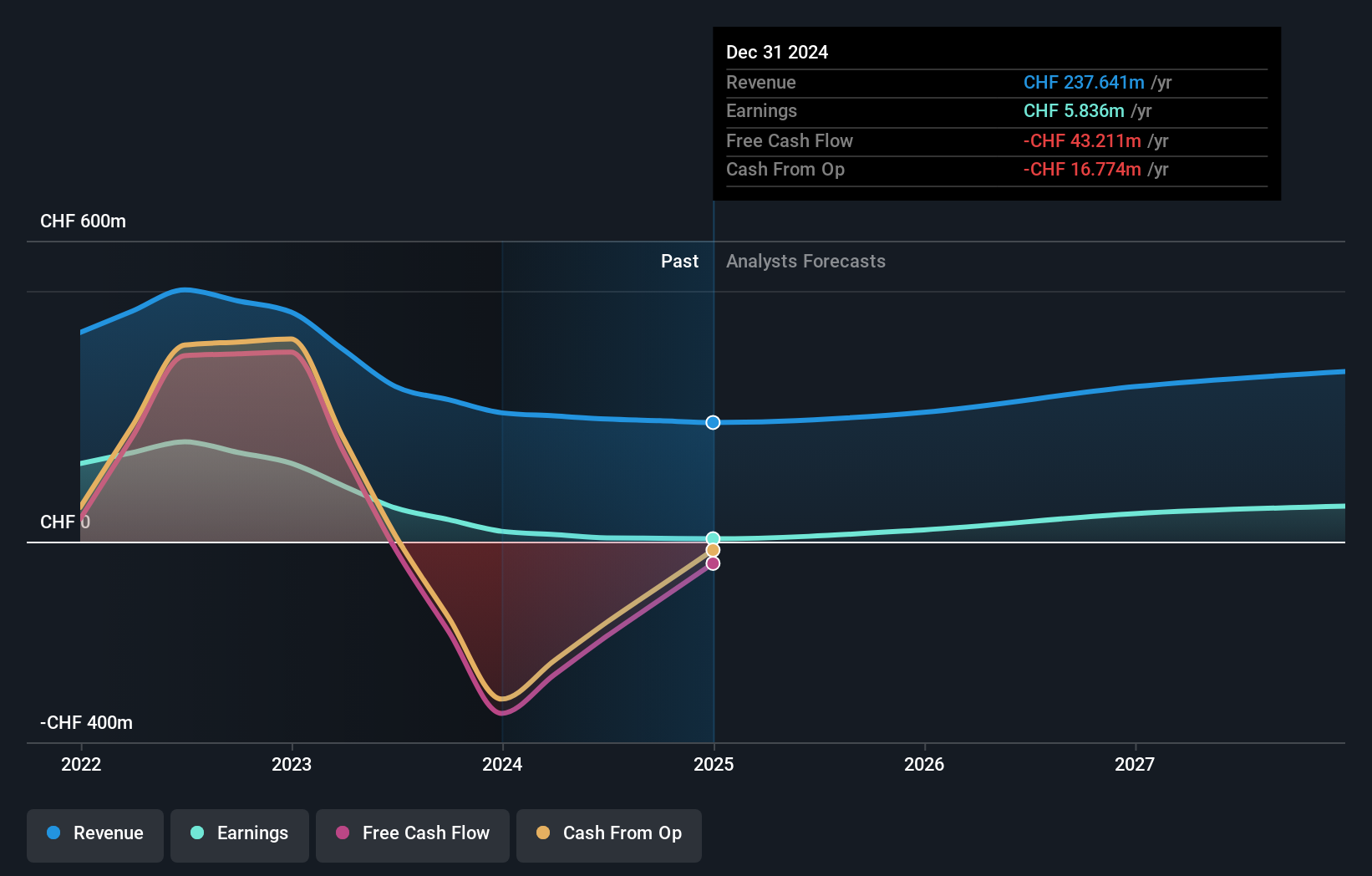

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leonteq AG offers structured investment products and long-term savings and retirement solutions across Switzerland, Europe, and Asia including the Middle East, with a market cap of CHF424.54 million.

Operations: The company's revenue primarily comes from its brokerage segment, which generated CHF244.51 million.

Insider Ownership: 11.9%

Earnings Growth Forecast: 35.1% p.a.

Leonteq is positioned for strong growth, with earnings projected to increase 35.1% annually, surpassing the Swiss market's growth rate. However, its profit margins have declined from 21.7% to 3.1%, and dividends are not well supported by earnings or cash flows. The company trades at a significant discount to its estimated fair value but faces challenges with debt coverage by operating cash flow and a low future return on equity of 10.2%.

- Get an in-depth perspective on Leonteq's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Leonteq's share price might be too optimistic.

Seize The Opportunity

- Click this link to deep-dive into the 1528 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEON

Leonteq

Provides structured investment products and long-term savings and retirement solutions in Switzerland, Europe, and Asia including the Middle East.

Reasonable growth potential slight.