- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

3 Growth Companies With High Insider Ownership Delivering 51% Return On Equity

Reviewed by Simply Wall St

In the current global market, uncertainty surrounding policy changes under the Trump 2.0 administration has led to fluctuating stock performances, with sectors like financials and energy benefiting from deregulation hopes while healthcare faces challenges due to potential regulatory shifts. Amidst this backdrop, identifying growth companies with high insider ownership can be appealing as they often demonstrate strong alignment between management and shareholder interests, potentially leading to robust returns even in volatile times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Underneath we present a selection of stocks filtered out by our screen.

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €22.37 billion.

Operations: Unfortunately, there are no specific revenue segments provided in the text for CVC Capital Partners plc to summarize.

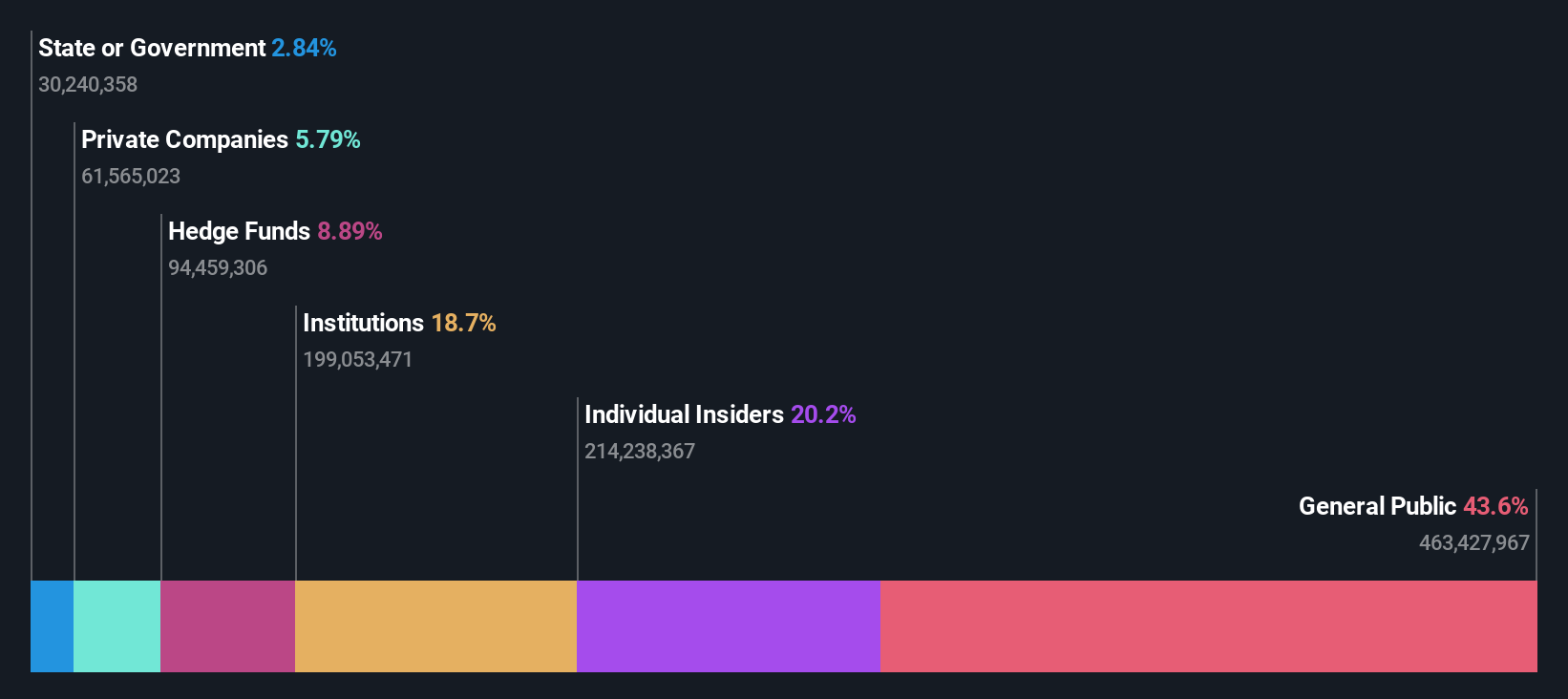

Insider Ownership: 20.2%

Return On Equity Forecast: 49% (2027 estimate)

CVC Capital Partners demonstrates strong growth potential with earnings forecasted to grow significantly at 41.9% annually, outpacing the Dutch market. Despite high debt levels, the company is trading at a discount of 18.7% below its estimated fair value. Recent M&A activity, including bids for Orthomol and DB Schenker, indicates strategic expansion efforts. Insider ownership remains substantial, aligning management interests with shareholder value creation while maintaining robust return on equity projections of very high levels in three years.

- Click to explore a detailed breakdown of our findings in CVC Capital Partners' earnings growth report.

- The valuation report we've compiled suggests that CVC Capital Partners' current price could be inflated.

Dixon Technologies (India) (NSEI:DIXON)

Simply Wall St Growth Rating: ★★★★★★

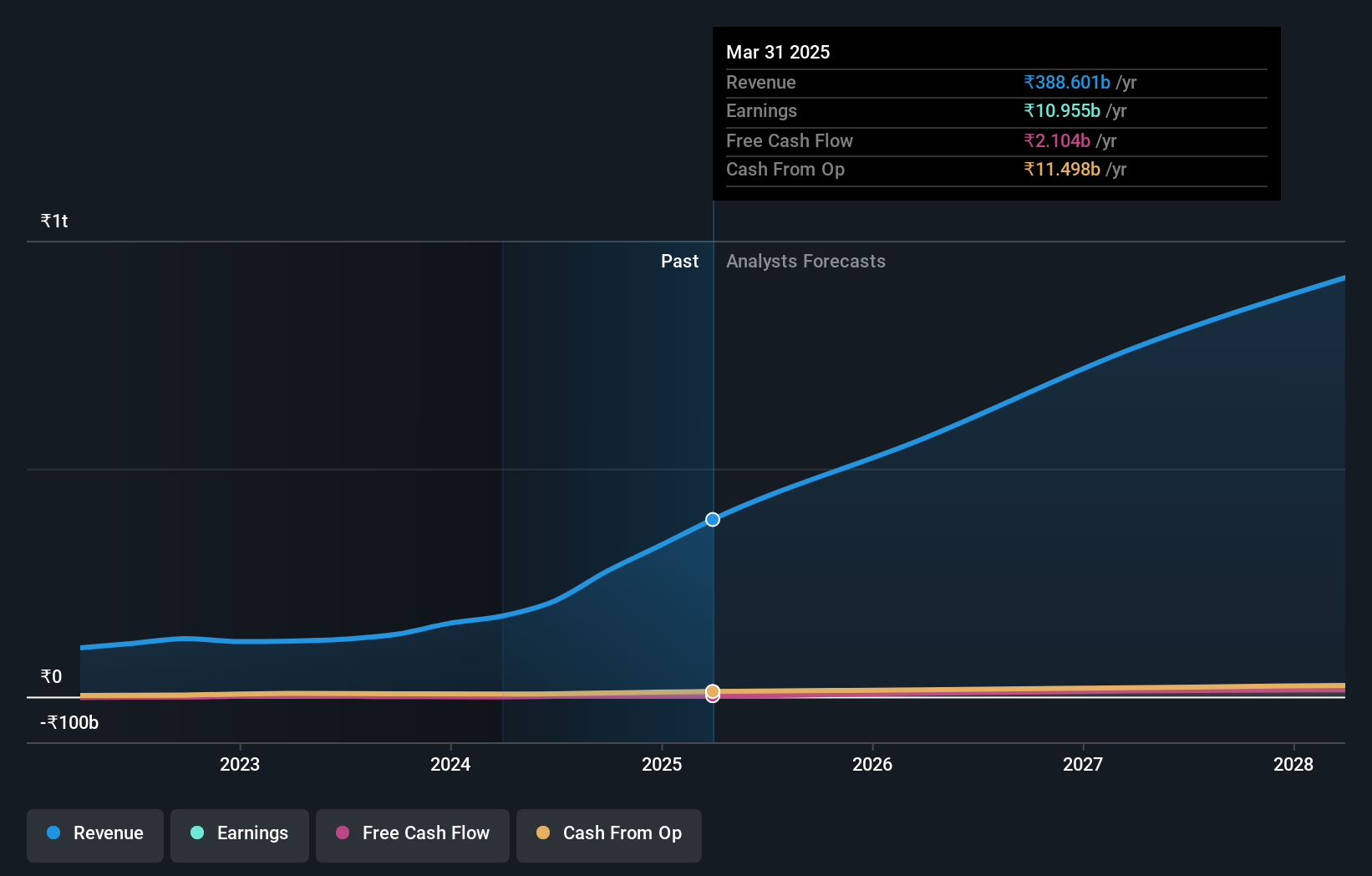

Overview: Dixon Technologies (India) Limited provides electronic manufacturing services both domestically and internationally, with a market cap of ₹890.15 billion.

Operations: The company's revenue segments include Consumer Electronics at ₹63.98 billion, Lighting Products at ₹16.82 billion, Home Appliances at ₹8.26 billion, Mobile Phones at ₹30.57 billion, and Security Systems at ₹0.32 billion.

Insider Ownership: 24.2%

Return On Equity Forecast: 32% (2027 estimate)

Dixon Technologies (India) showcases robust growth prospects with earnings projected to grow significantly at 26.1% annually, surpassing the Indian market average. Revenue is also expected to expand rapidly at 24.4% per year, driven by strategic initiatives like incorporating Dixon Teletech for IT product manufacturing and a partnership with Cellecor Gadgets for washing machine production. Recent earnings reports reflect substantial revenue and profit increases, underscoring its strong position despite no significant insider trading activity reported recently.

- Unlock comprehensive insights into our analysis of Dixon Technologies (India) stock in this growth report.

- Our comprehensive valuation report raises the possibility that Dixon Technologies (India) is priced higher than what may be justified by its financials.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

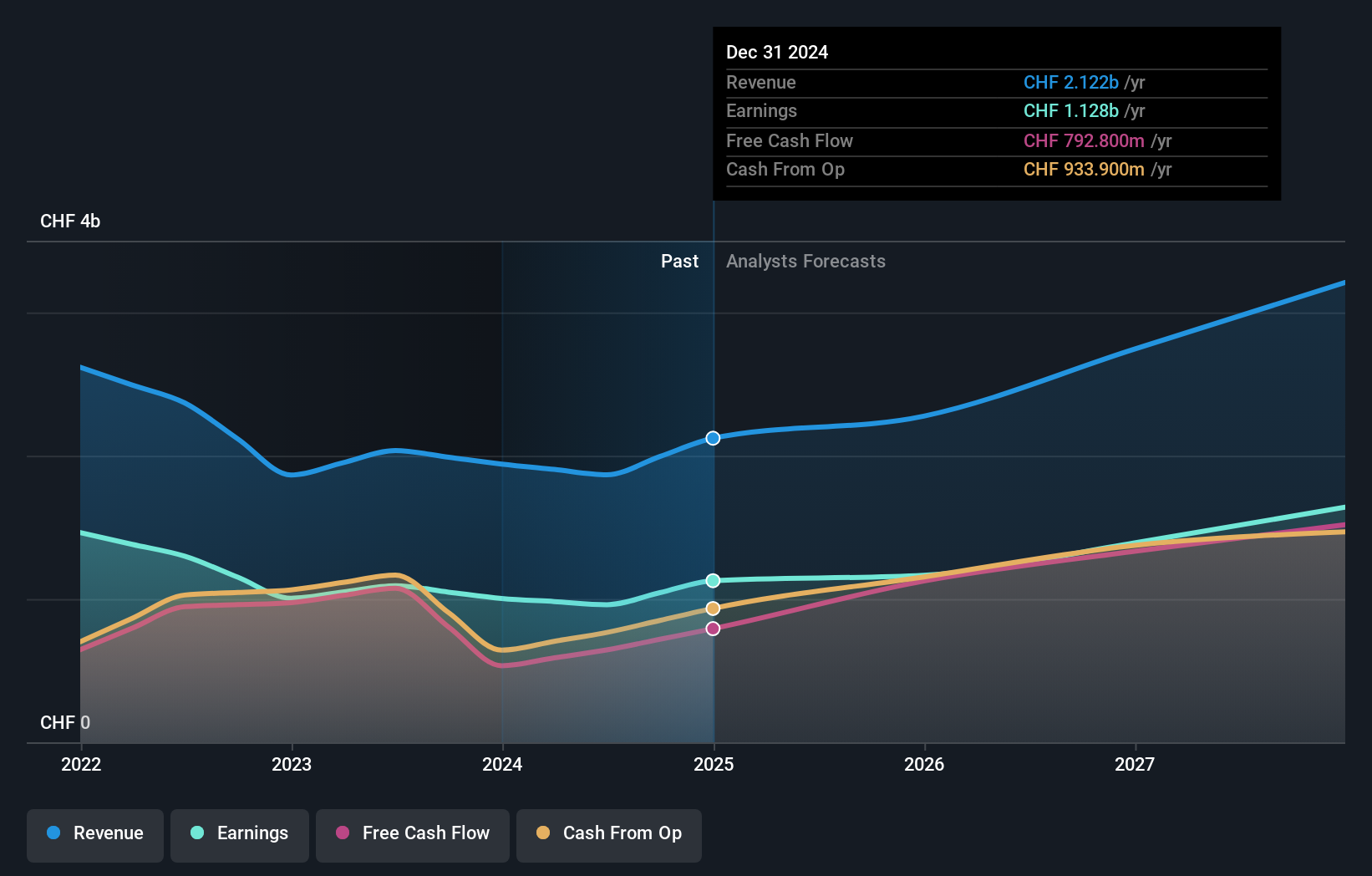

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF31.85 billion.

Operations: The company's revenue is derived from several segments, including Private Equity (CHF1.19 billion), Infrastructure (CHF254.90 million), Private Credit (CHF218.90 million), and Real Estate (CHF190.90 million).

Insider Ownership: 17%

Return On Equity Forecast: 51% (2027 estimate)

Partners Group Holding is poised for growth, with revenue forecast to increase by 15.4% annually, outpacing the Swiss market. Despite high debt levels, its projected return on equity of 51.1% in three years indicates strong financial performance potential. Recent discussions about selling a stake in International Schools Partnership could unlock significant value, given ISP's estimated worth exceeding €5 billion (US$5.38 billion). No substantial insider trading activity has been reported recently.

- Dive into the specifics of Partners Group Holding here with our thorough growth forecast report.

- According our valuation report, there's an indication that Partners Group Holding's share price might be on the expensive side.

Next Steps

- Get an in-depth perspective on all 1541 Fast Growing Companies With High Insider Ownership by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Solid track record with reasonable growth potential.