- Saudi Arabia

- /

- Media

- /

- SASE:4071

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets navigate the early days of President Trump's administration, U.S. stocks are climbing toward record highs, fueled by optimism over potential trade deals and a surge in AI-related investments. In this dynamic environment, identifying high-growth tech stocks involves assessing their exposure to emerging technologies like AI and their ability to capitalize on favorable market sentiments and policy developments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

izertis (BME:IZER)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Izertis, S.A., along with its subsidiaries, offers technological consultancy services across Spain, Portugal, and Mexico, with a market capitalization of €267.89 million.

Operations: The company's primary revenue stream is derived from its Technologies and Information (IT) segment, which generated €124.33 million. The business focuses on providing technological consultancy services in key markets including Spain, Portugal, and Mexico.

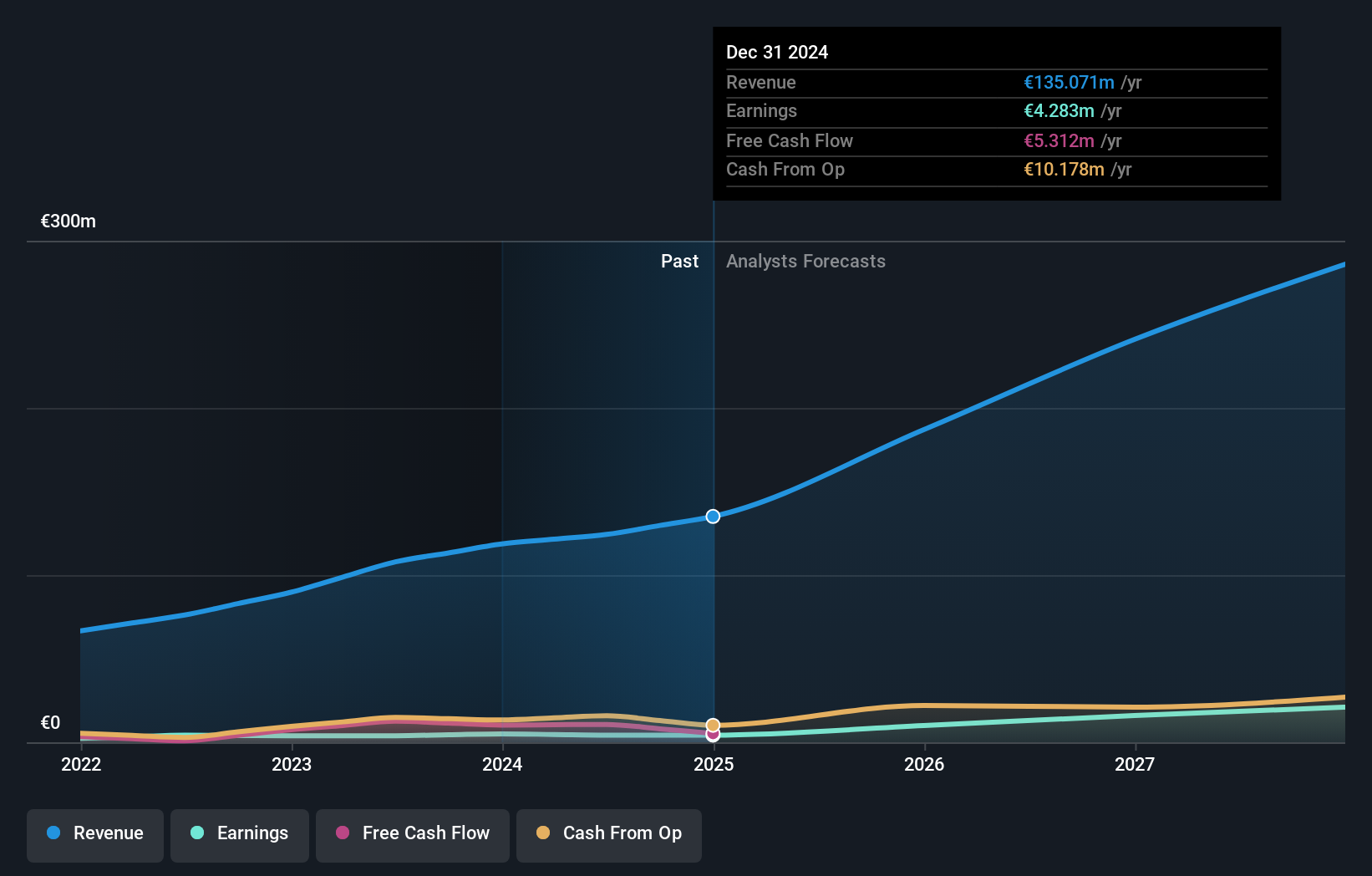

With a robust annual revenue growth of 22.3%, izertis outpaces the broader Spanish market's growth rate of 5.2%. This performance is bolstered by an impressive earnings increase, averaging 40.9% per year, significantly above the market norm of 8.6%. Despite challenges in covering interest payments with earnings, the company's strategic focus on innovation is evident from its R&D investments, crucial for sustaining long-term competitiveness in the rapidly evolving tech landscape. Looking ahead, izertis’s commitment to research and development not only fuels its product enhancements but also positions it well for future technological advancements and market demands.

- Click to explore a detailed breakdown of our findings in izertis' health report.

Evaluate izertis' historical performance by accessing our past performance report.

Arabian Contracting Services (SASE:4071)

Simply Wall St Growth Rating: ★★★★★★

Overview: Arabian Contracting Services Company, with a market cap of SAR8.39 billion, operates in the printing business through its subsidiaries in Saudi Arabia and Egypt.

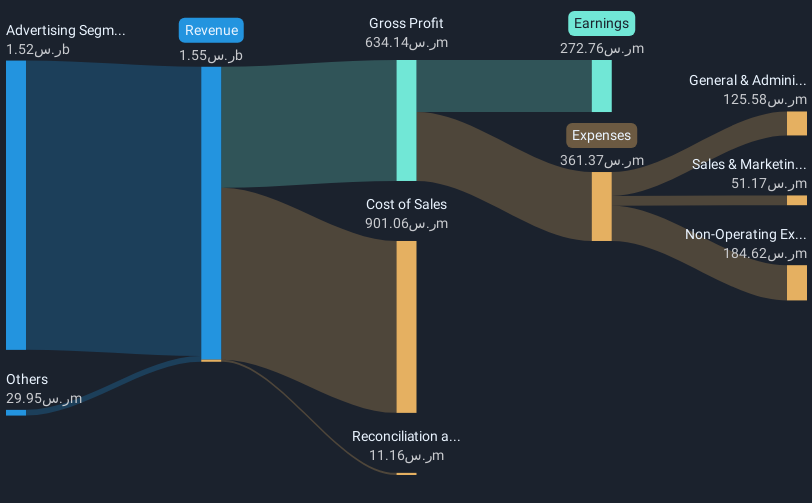

Operations: The company generates revenue primarily from its advertising segment, which amounts to SAR1.52 billion. It operates in the printing sector through subsidiaries located in Saudi Arabia and Egypt.

Arabian Contracting Services has demonstrated a robust trajectory in the tech sector, with its revenue surging by 20.6% annually, outpacing the broader Saudi market's contraction of 0.5%. This growth is complemented by an impressive forecast for earnings to expand by 28.1% per year, signaling strong future prospects despite current challenges such as a decline in net profit margins from 26.6% to 17.8%. The company's recent strategic moves, including a private placement of shares and active shareholder engagements, underscore its commitment to leveraging capital for expansion and innovation in high-growth areas like software development and AI technologies.

- Click here and access our complete health analysis report to understand the dynamics of Arabian Contracting Services.

Understand Arabian Contracting Services' track record by examining our Past report.

Elm (SASE:7203)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elm Company offers ready-made and customized digital solutions in Saudi Arabia with a market capitalization of SAR90.28 billion.

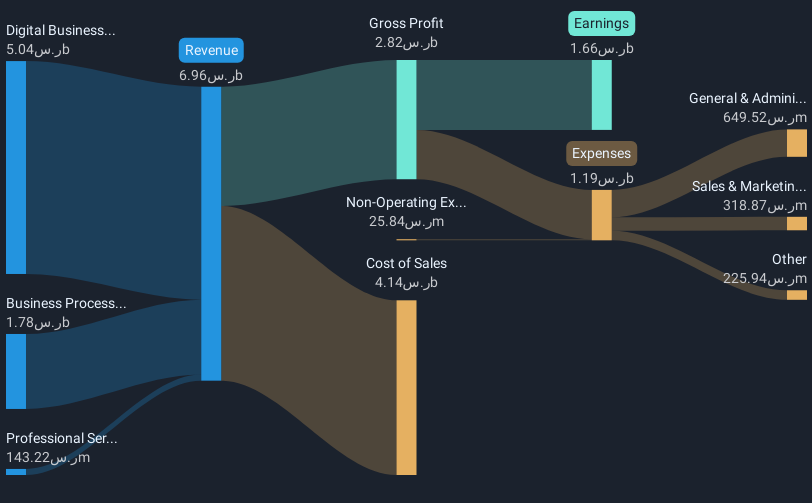

Operations: Elm generates revenue primarily through its Digital Business segment, contributing SAR5.04 billion, followed by Business Process Outsourcing at SAR1.78 billion and Professional Services at SAR143.22 million.

Elm's recent financial performance underscores its robust position in the tech industry, with a notable 33.4% increase in earnings over the past year, outstripping the IT sector's growth of 18.9%. This growth is supported by a strong R&D commitment, as evidenced by their latest report showing R&D expenses reaching SAR 320 million, representing approximately 6.1% of their total revenue. The company has also demonstrated agility in adapting to market demands, significantly enhancing its software solutions portfolio which contributed substantially to a revenue hike to SAR 5.28 billion from SAR 4.21 billion year-over-year. Elm's strategic focus on expanding its technological capabilities and fostering innovation positions it well for sustained growth amidst evolving industry trends.

Next Steps

- Discover the full array of 1231 High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4071

Arabian Contracting Services

Engages in printing business in Saudi Arabia and Egypt.

Exceptional growth potential and fair value.

Market Insights

Community Narratives