Tamkeen Human Resources And 3 Undiscovered Gems In The Middle East

Reviewed by Simply Wall St

As Middle Eastern stock markets gain momentum on hopes of U.S. interest rate cuts, with Saudi Arabia's benchmark index notably rising by 1.8%, investor optimism is palpable across the region. In this climate, identifying promising stocks involves looking for companies that can capitalize on increased foreign investment and economic shifts, such as Tamkeen Human Resources and other undiscovered gems in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Tamkeen Human Resources (SASE:1835)

Simply Wall St Value Rating: ★★★★★★

Overview: Tamkeen Human Resources Company provides labor recruitment and manpower services in the Kingdom of Saudi Arabia, with a market capitalization of SAR1.54 billion.

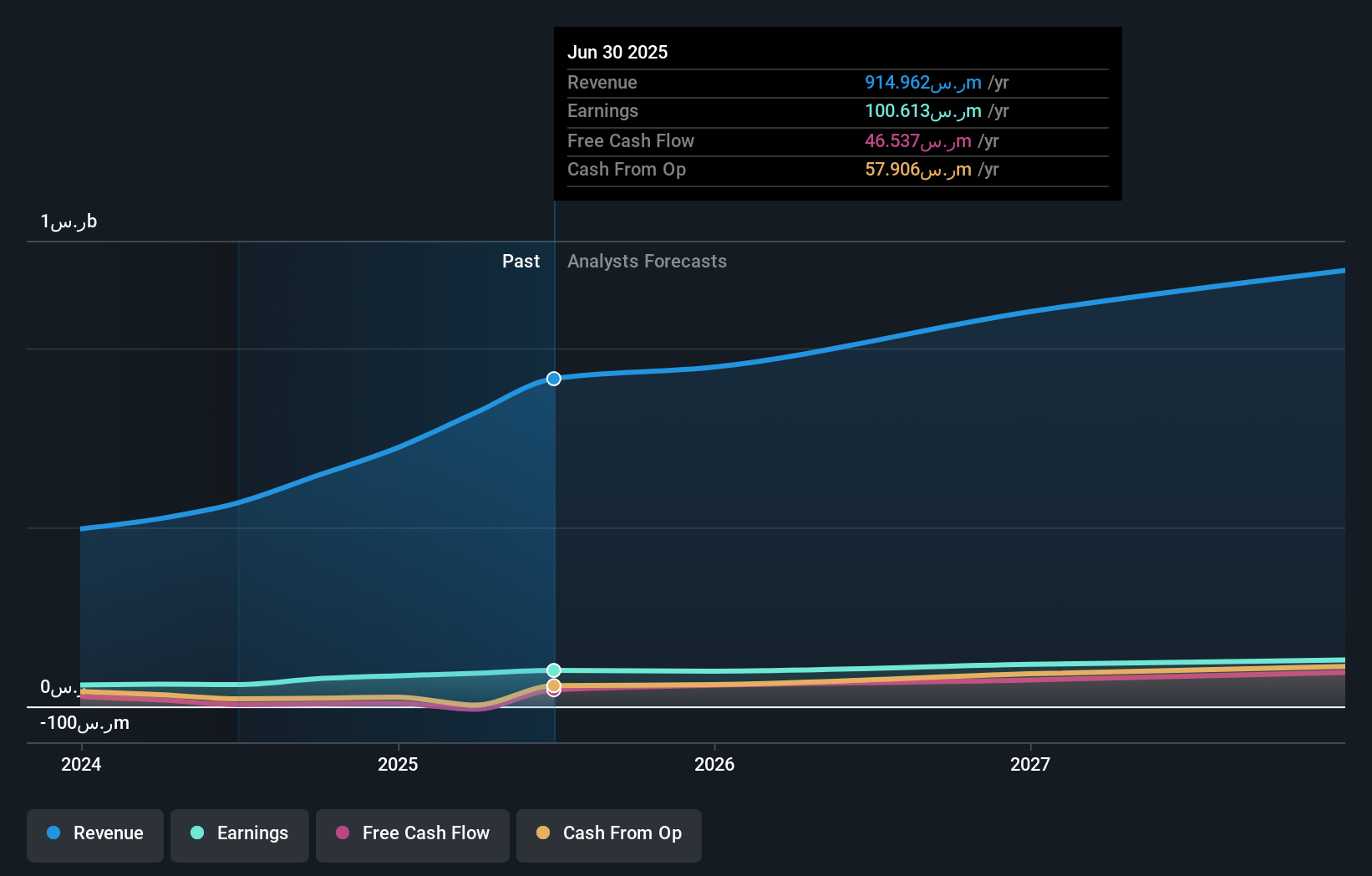

Operations: Tamkeen generates revenue primarily from its Corporate segment, contributing SAR714.57 million, and the Individuals segment, adding SAR200.39 million.

Tamkeen Human Resources, a nimble player in the Middle East, has shown impressive performance with earnings surging 65.7% over the past year, outpacing industry growth of 7.9%. The company reported second-quarter sales of SAR 265.19 million and net income of SAR 26.7 million, reflecting robust operational strength. With no debt on its books and trading at a good value compared to peers, Tamkeen appears financially sound. Additionally, dividends were affirmed at SAR 1.4 per share for the first half of fiscal year 2025, indicating shareholder-friendly policies amidst strong earnings momentum and forecasted revenue growth of nearly 10% annually.

- Get an in-depth perspective on Tamkeen Human Resources' performance by reading our health report here.

Understand Tamkeen Human Resources' track record by examining our Past report.

Mohammed Hadi Al-Rasheed (SASE:9601)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mohammed Hadi Al-Rasheed Company specializes in the production of silica sand for various industrial applications and has a market capitalization of SAR1.32 billion.

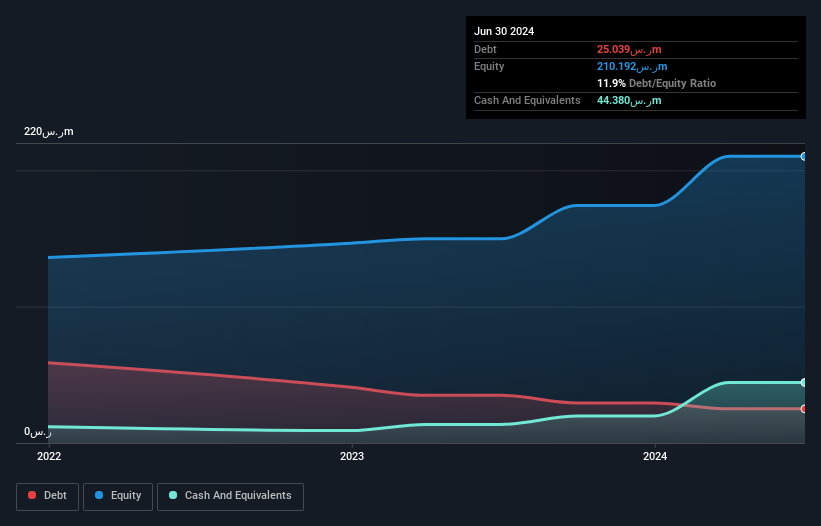

Operations: The company generates revenue primarily from sales, contributing SAR273.90 million, and contracting services, adding SAR33.12 million.

Earnings for Mohammed Hadi Al-Rasheed surged by 80.6% last year, outpacing the Basic Materials industry growth of 57%. The company is trading at a significant discount, about 54.6% below its estimated fair value, suggesting potential upside. Its interest payments are comfortably covered with EBIT covering them 92.7 times over, indicating strong financial health in managing debt obligations. Despite recent share price volatility over three months, the firm boasts high-quality earnings and positive free cash flow, making it a compelling candidate for investors seeking opportunities in emerging markets within the Middle East region.

- Click here and access our complete health analysis report to understand the dynamics of Mohammed Hadi Al-Rasheed.

Assess Mohammed Hadi Al-Rasheed's past performance with our detailed historical performance reports.

Plasson Industries (TASE:PLSN)

Simply Wall St Value Rating: ★★★★★★

Overview: Plasson Industries Ltd is a company that develops, manufactures, and markets technical products across various regions including Israel, Europe, Brazil, Oceania, the United States, Asia, Africa, and the rest of the Americas with a market cap of ₪1.79 billion.

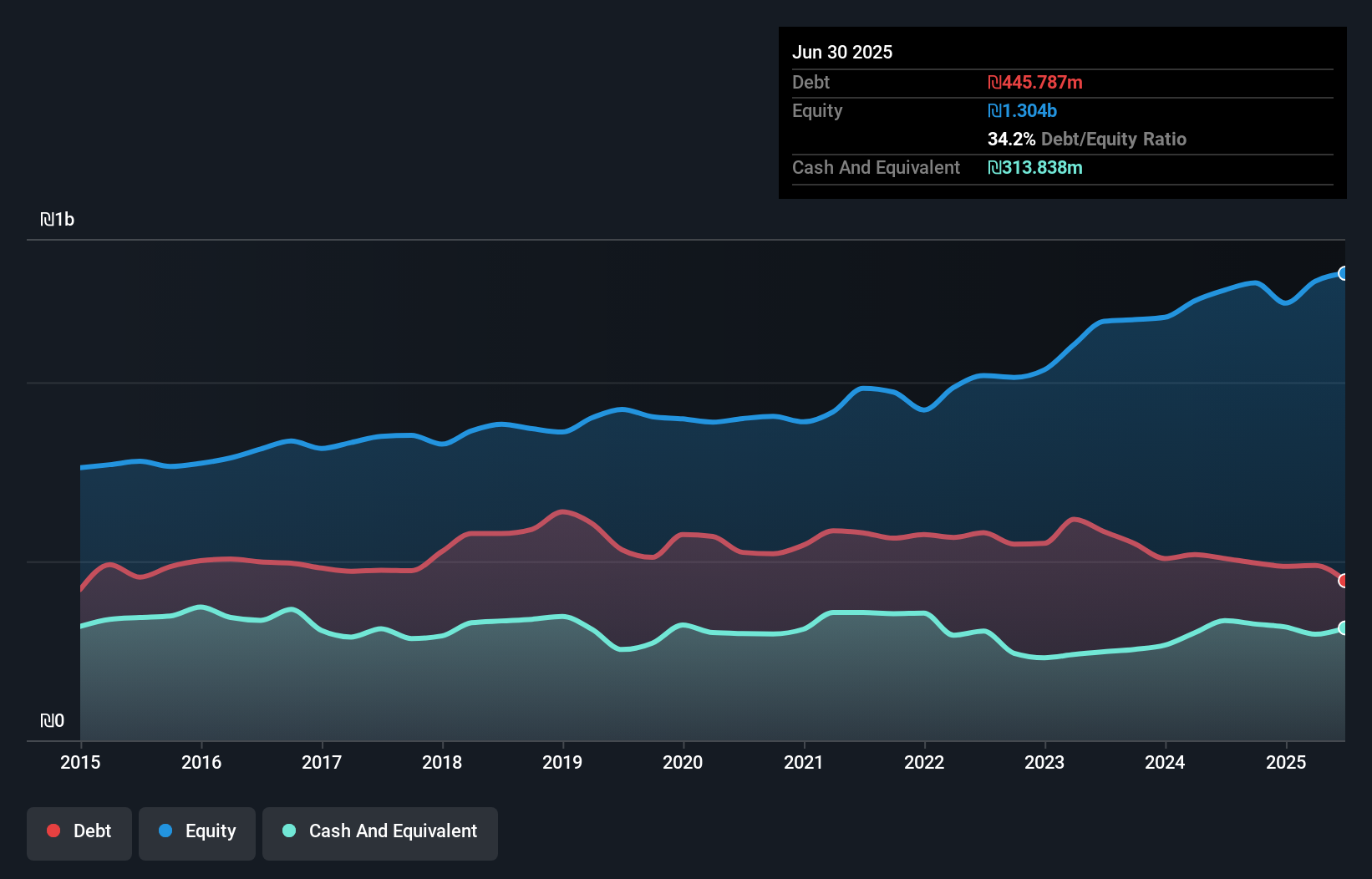

Operations: Plasson Industries generates revenue primarily from connection accessories for plumbing (₪919.20 million) and products for animals (₪621.25 million).

Plasson Industries, a smaller player in the Middle East's machinery sector, has demonstrated robust financial health and growth. Over five years, its debt to equity ratio improved from 58.4% to 34.2%, indicating stronger balance sheet management. The price-to-earnings ratio of 11.9x suggests it is undervalued compared to the IL market's 14.5x benchmark. In recent performance highlights, Plasson reported ILS 482 million in Q2 sales with net income rising to ILS 45 million from last year's ILS 38 million, showcasing a solid earnings trajectory with basic EPS climbing from ILS 3.96 to ILS 4.78 year-on-year.

- Navigate through the intricacies of Plasson Industries with our comprehensive health report here.

Examine Plasson Industries' past performance report to understand how it has performed in the past.

Taking Advantage

- Navigate through the entire inventory of 205 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:PLSN

Plasson Industries

Develops, manufactures, and markets technical products in Israel, Europe, Brazil, Oceania, the United States, Asia, Africa, and rest of the Americas.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives