- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3090

Unearthing Hidden Gems with Solid Potential This February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by AI competition fears and fluctuating interest rates, small-cap stocks are drawing attention amidst broader market volatility. With indices like the S&P 600 reflecting these shifts, investors are increasingly seeking opportunities in lesser-known companies that demonstrate resilience and growth potential. In this context, identifying stocks with strong fundamentals and adaptability becomes crucial for uncovering hidden gems in the current economic climate.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Pharmanutra (BIT:PHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pharmanutra S.p.A. is a pharmaceutical and nutraceutical company that focuses on the research, design, development, and marketing of nutritional supplements and medical devices across Italy and various international markets, with a market capitalization of approximately €489.04 million.

Operations: Pharmanutra generates revenue primarily from its operations in Italy, contributing €68.35 million, and international markets, adding €38.40 million, with a smaller segment from Akern at €5.49 million.

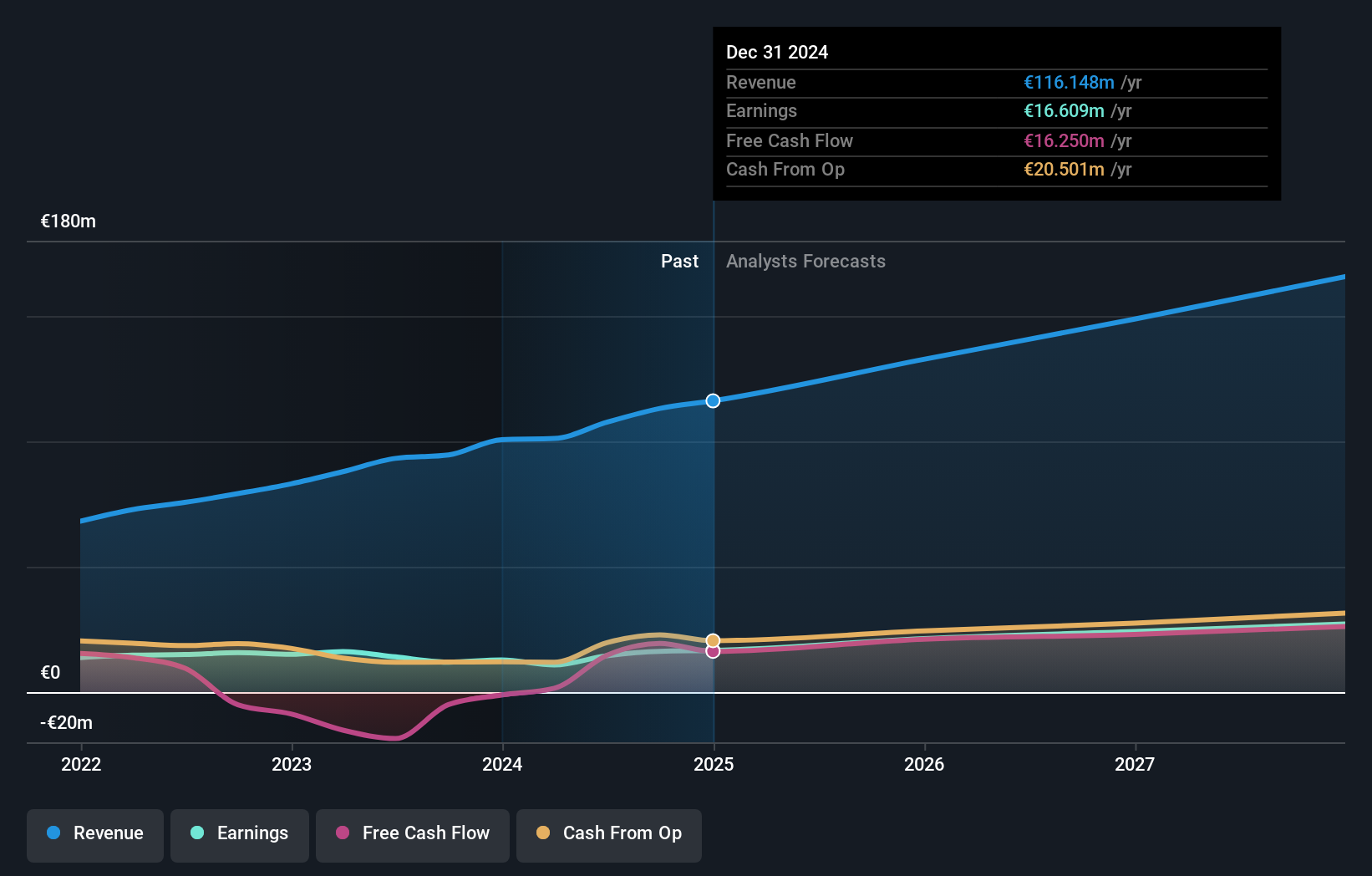

Pharmanutra, a noteworthy player in the personal products sector, has shown impressive growth with earnings increasing by 36.3% over the past year, outpacing industry peers. The company's debt to equity ratio rose from 19.2% to 39.6% in five years, yet it remains financially stable with interest payments well covered by EBIT at 40.7 times coverage and more cash than total debt on hand. Recent results highlight a revenue jump from €72.19 million to €84.5 million and net income climbing from €9.73 million to €13.17 million for the nine months ending September 2024, indicating robust operational performance and promising future prospects with forecasted annual earnings growth of 18%.

- Unlock comprehensive insights into our analysis of Pharmanutra stock in this health report.

Explore historical data to track Pharmanutra's performance over time in our Past section.

Tabuk Cement (SASE:3090)

Simply Wall St Value Rating: ★★★★★★

Overview: Tabuk Cement Company is involved in the manufacturing and sale of cement within the Kingdom of Saudi Arabia, with a market capitalization of SAR1.26 billion.

Operations: Revenue for Tabuk Cement primarily comes from the sale of packed and unpackaged cement, totaling SAR328.89 million.

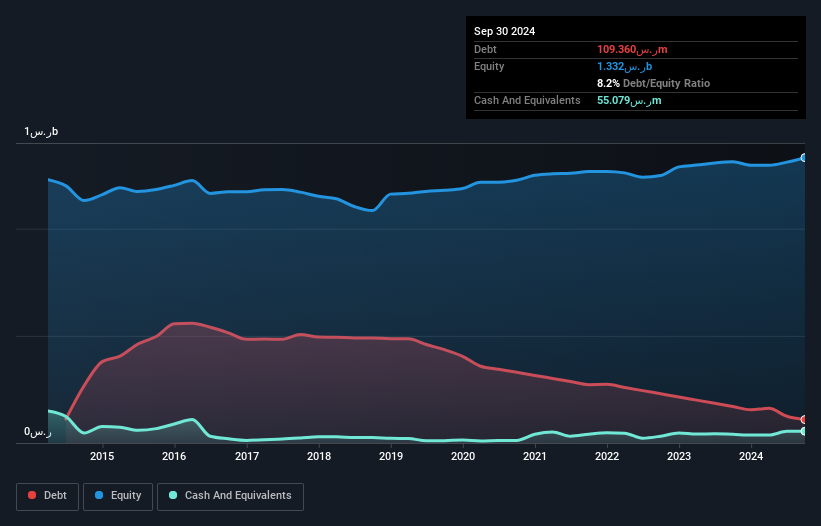

Tabuk Cement, a small player in the industry, reported third-quarter sales of SAR 90.12 million with net income hitting SAR 23.05 million and basic earnings per share at SAR 0.26. Trading at a significant discount to its estimated fair value by around 46%, it seems undervalued compared to peers. The company boasts impressive earnings growth of 52% over the past year, far outpacing the Basic Materials sector's average growth of 12%. With an EBIT covering interest payments by a robust margin of 32 times, Tabuk Cement appears well-positioned financially with high-quality past earnings and satisfactory debt levels.

- Click here and access our complete health analysis report to understand the dynamics of Tabuk Cement.

Review our historical performance report to gain insights into Tabuk Cement's's past performance.

Neto Malinda Trading (TASE:NTML)

Simply Wall St Value Rating: ★★★★★★

Overview: Neto Malinda Trading Ltd. is engaged in the manufacturing, importing, marketing, and distribution of kosher food products with a market capitalization of approximately ₪1.74 billion.

Operations: Neto Malinda Trading generates revenue through three primary segments: import (₪1.99 billion), local market (₪1.93 billion), and Neto Group factories (₪753.64 million). The company's financial performance is characterized by a focus on these diverse revenue streams, each contributing significantly to its overall income.

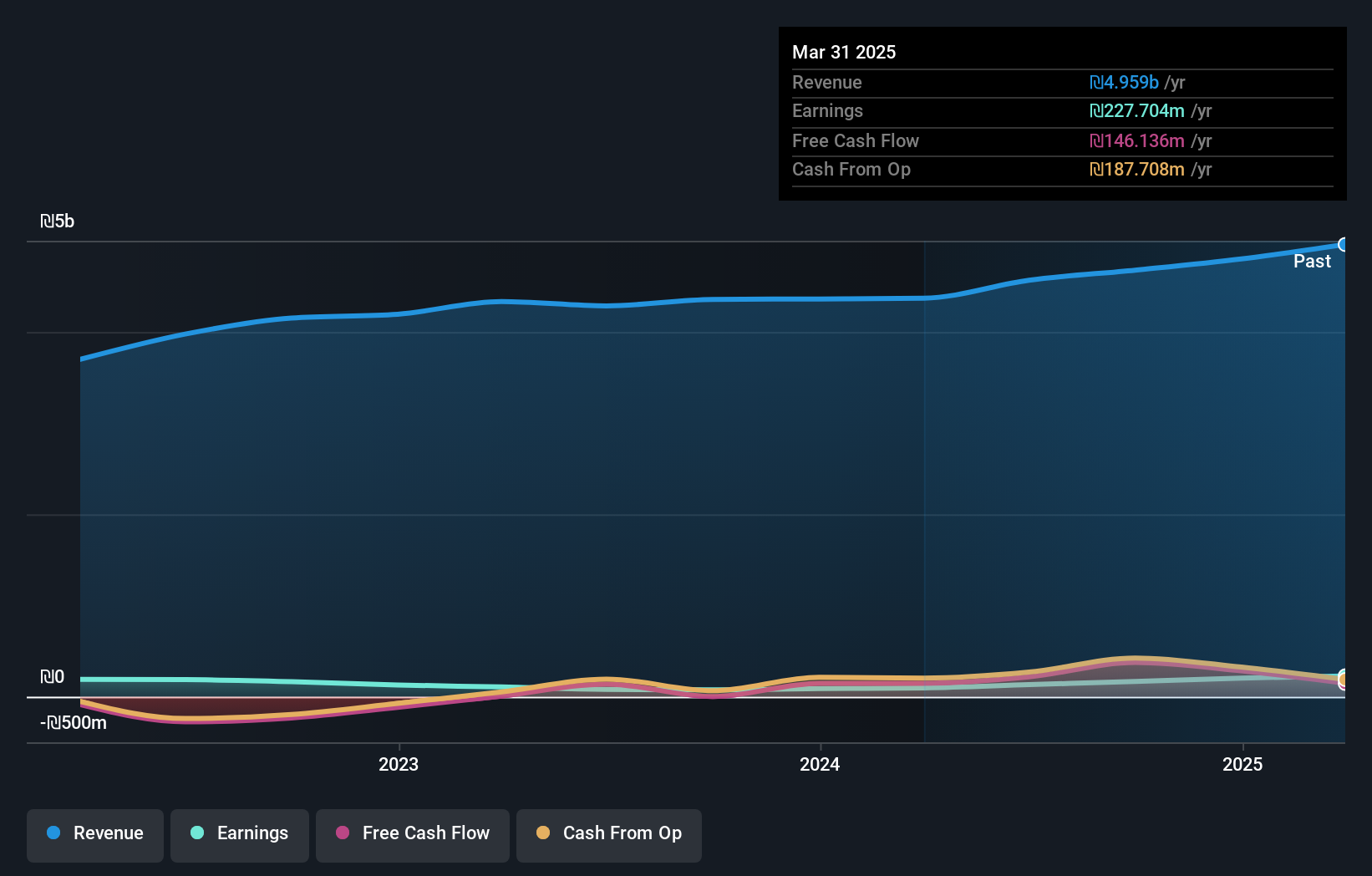

Neto Malinda Trading, a small player in the food sector, boasts impressive financial health with high-quality earnings and a net debt to equity ratio of 4.5%, which is satisfactory. The company's interest payments are well covered by EBIT at 39 times over, reflecting strong operational efficiency. Over the past year, earnings surged by 124.6%, outpacing industry growth of 123.1%. Recent results show sales for Q3 at ILS 1,275 million and net income climbing to ILS 62.89 million from ILS 27.24 million last year, indicating robust performance despite a historical annual decline of just 0.5% over five years in earnings growth rate.

Seize The Opportunity

- Investigate our full lineup of 4664 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tabuk Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:3090

Tabuk Cement

Manufactures and sells cement in the Kingdom of Saudi Arabia.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives