- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3080

Eastern Province Cement (TADAWUL:3080) Is Paying Out Less In Dividends Than Last Year

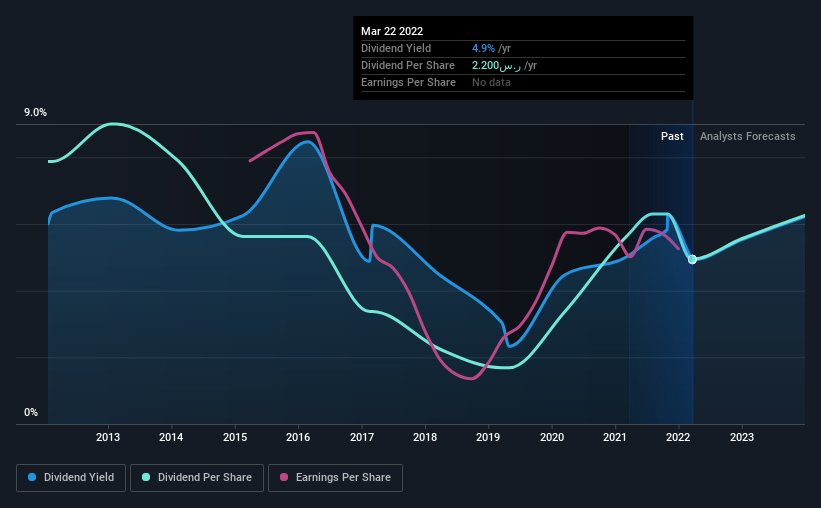

Eastern Province Cement Company (TADAWUL:3080) has announced it will be reducing its dividend payable on the 26th of April to ر.س1.10. However, the dividend yield of 5.6% still remains in a typical range for the industry.

See our latest analysis for Eastern Province Cement

Eastern Province Cement Doesn't Earn Enough To Cover Its Payments

We aren't too impressed by dividend yields unless they can be sustained over time. Prior to this announcement, the company was paying out 107% of what it was earning. This situation certainly isn't ideal, and could place significant strain on the balance sheet if it continues.

Over the next year, EPS is forecast to expand by 8.9%. If the dividend continues on its recent course, the payout ratio in 12 months could be 99%, which is a bit high and could start applying pressure to the balance sheet.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2012, the dividend has gone from ر.س3.50 to ر.س2.20. Doing the maths, this is a decline of about 4.5% per year. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though Eastern Province Cement's EPS has declined at around 2.4% a year. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

We're Not Big Fans Of Eastern Province Cement's Dividend

In summary, it's not great to see that the dividend is being cut, but it is probably understandable given that the current payment level was quite high. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, this doesn't get us very excited from an income standpoint.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Eastern Province Cement that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Province Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:3080

Eastern Province Cement

Produces and sells clinker and cement in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives