- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3002

Najran Cement Company (TADAWUL:3002) Analysts Are More Bearish Than They Used To Be

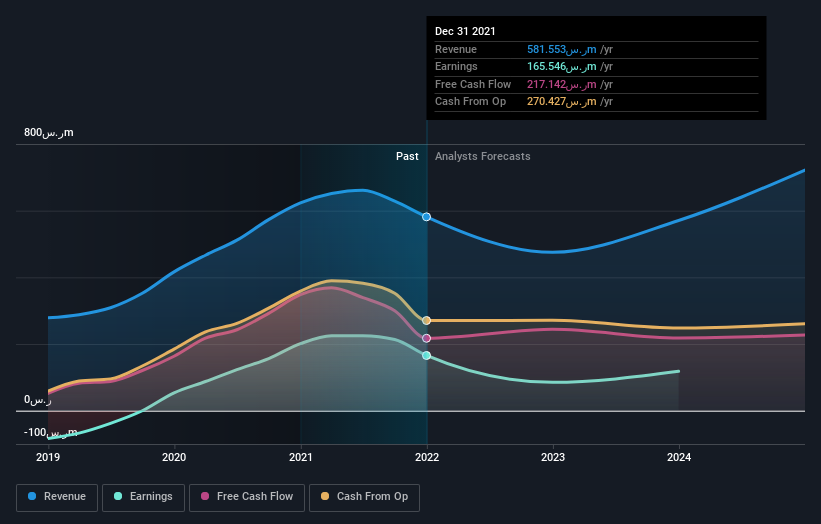

Today is shaping up negative for Najran Cement Company (TADAWUL:3002) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

Following the downgrade, the consensus from dual analysts covering Najran Cement is for revenues of ر.س475m in 2022, implying an uncomfortable 18% decline in sales compared to the last 12 months. Statutory earnings per share are supposed to plummet 49% to ر.س0.50 in the same period. Prior to this update, the analysts had been forecasting revenues of ر.س565m and earnings per share (EPS) of ر.س0.95 in 2022. Indeed, we can see that the analysts are a lot more bearish about Najran Cement's prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

Check out our latest analysis for Najran Cement

Despite the cuts to forecast earnings, there was no real change to the ر.س20.50 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Najran Cement analyst has a price target of ر.س24.00 per share, while the most pessimistic values it at ر.س17.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 24% by the end of 2022. This indicates a significant reduction from annual growth of 10.0% over the last five years. Compare this with our data, which suggests that other companies in the same industry are, in aggregate, expected to see their revenue grow 10% per year. It's pretty clear that Najran Cement's revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Najran Cement's revenues are expected to grow slower than the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on Najran Cement after the downgrade.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Najran Cement going out as far as 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Najran Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:3002

Najran Cement

Engages in manufacture and sale of cement products in the Kingdom of Saudi Arabia.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives