- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3001

Does Hail Cement's (TADAWUL:3001) Share Price Gain of 74% Match Its Business Performance?

By buying an index fund, you can roughly match the market return with ease. But if you pick the right individual stocks, you could make more than that. For example, the Hail Cement Company (TADAWUL:3001) share price is up 74% in the last three years, clearly besting the market return of around 17% (not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 16%.

View our latest analysis for Hail Cement

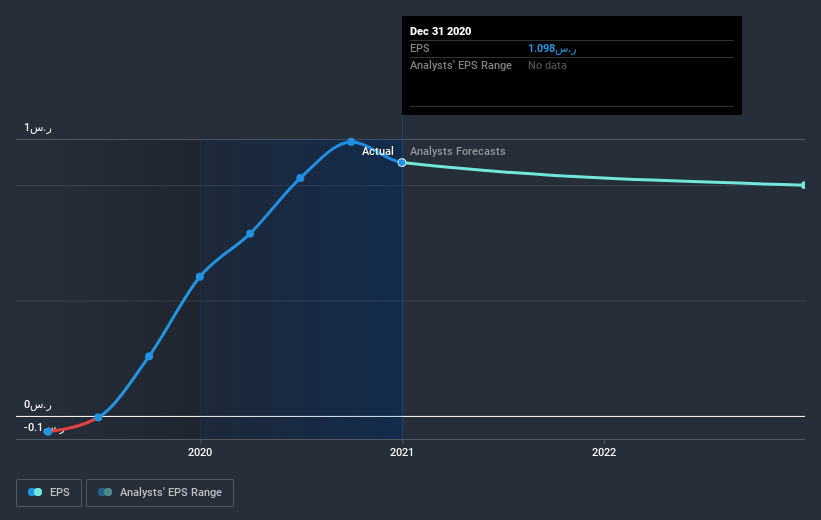

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Hail Cement achieved compound earnings per share growth of 91% per year. The average annual share price increase of 20% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Hail Cement has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Hail Cement's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Hail Cement shareholders have received a total shareholder return of 16% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 10% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Hail Cement better, we need to consider many other factors. Even so, be aware that Hail Cement is showing 1 warning sign in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you’re looking to trade Hail Cement, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Hail Cement, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hail Cement might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:3001

Hail Cement

Produces and distributes cement and related products in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives