- Saudi Arabia

- /

- Chemicals

- /

- SASE:2350

Take Care Before Diving Into The Deep End On Saudi Kayan Petrochemical Company (TADAWUL:2350)

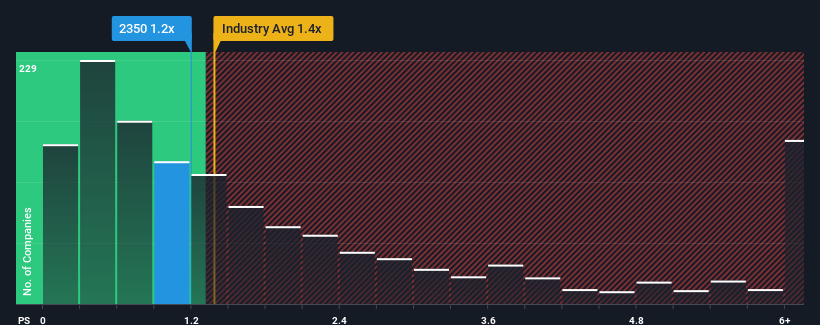

Saudi Kayan Petrochemical Company's (TADAWUL:2350) price-to-sales (or "P/S") ratio of 1.2x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Chemicals industry in Saudi Arabia have P/S ratios greater than 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Saudi Kayan Petrochemical

What Does Saudi Kayan Petrochemical's Recent Performance Look Like?

Recent times have been pleasing for Saudi Kayan Petrochemical as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is low because investors think the company's revenue is going to fall away like everyone else's soon. Those who are bullish on Saudi Kayan Petrochemical will be hoping that this isn't the case and the company continues to beat out the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Saudi Kayan Petrochemical.How Is Saudi Kayan Petrochemical's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Saudi Kayan Petrochemical's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.2%. Still, lamentably revenue has fallen 25% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 3.6% per annum over the next three years. That's shaping up to be similar to the 4.5% per year growth forecast for the broader industry.

With this information, we find it odd that Saudi Kayan Petrochemical is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Saudi Kayan Petrochemical currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Saudi Kayan Petrochemical with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2350

Saudi Kayan Petrochemical

Manufactures and sells chemicals, polymers, and specialty products.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives