- Saudi Arabia

- /

- Chemicals

- /

- SASE:2310

Take Care Before Diving Into The Deep End On Sahara International Petrochemical Company (TADAWUL:2310)

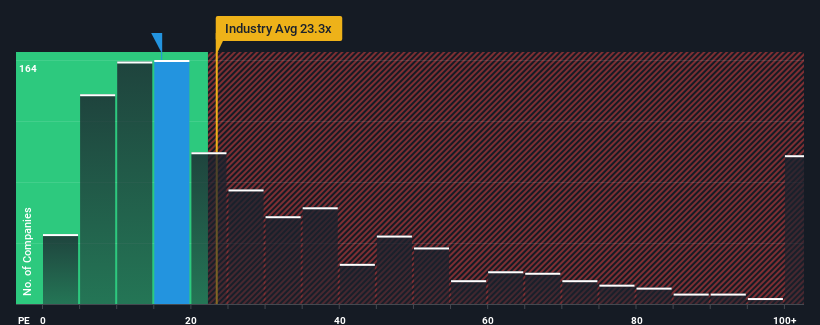

When close to half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") above 24x, you may consider Sahara International Petrochemical Company (TADAWUL:2310) as an attractive investment with its 15.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Sahara International Petrochemical hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Sahara International Petrochemical

Is There Any Growth For Sahara International Petrochemical?

The only time you'd be truly comfortable seeing a P/E as low as Sahara International Petrochemical's is when the company's growth is on track to lag the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 66%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the eight analysts watching the company. With the market predicted to deliver 16% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Sahara International Petrochemical's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Sahara International Petrochemical currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Sahara International Petrochemical (1 is a bit concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Sahara International Petrochemical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2310

Sahara International Petrochemical

Owns, establishes, operates, and manages industrial projects related to chemical and petrochemical industries in the Kingdom of Saudi Arabia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives