- Saudi Arabia

- /

- Paper and Forestry Products

- /

- SASE:2300

Saudi Paper Manufacturing (TADAWUL:2300) Has Rewarded Shareholders With An Exceptional 342% Total Return On Their Investment

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. Take, for example Saudi Paper Manufacturing Company (TADAWUL:2300). Its share price is already up an impressive 133% in the last twelve months. On top of that, the share price is up 15% in about a quarter. Looking back further, the stock price is 57% higher than it was three years ago.

Check out our latest analysis for Saudi Paper Manufacturing

Saudi Paper Manufacturing isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Saudi Paper Manufacturing saw its revenue shrink by 1.2%. We're a little surprised to see the share price pop 133% in the last year. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

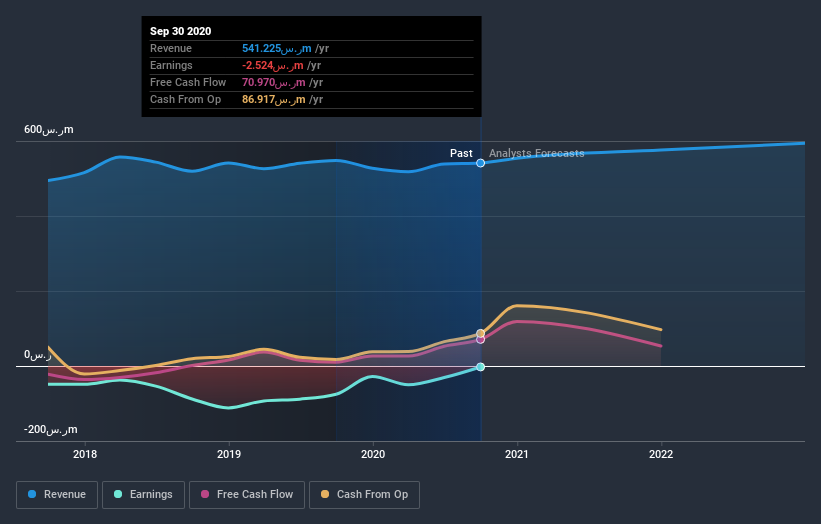

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Saudi Paper Manufacturing's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Saudi Paper Manufacturing's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Saudi Paper Manufacturing's TSR of 342% for the year exceeded its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Saudi Paper Manufacturing shareholders have received a total shareholder return of 342% over the last year. That gain is better than the annual TSR over five years, which is 12%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Saudi Paper Manufacturing (1 is concerning) that you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade Saudi Paper Manufacturing, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2300

Saudi Paper Manufacturing

Engages in the manufacture and sale of tissue papers in the Kingdom of Saudi Arabia, Gulf Cooperation Council countries, and internationally.

Outstanding track record with adequate balance sheet.

Market Insights

Community Narratives