- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:2240

There's No Escaping Zamil Industrial Investment Company's (TADAWUL:2240) Muted Revenues Despite A 31% Share Price Rise

Zamil Industrial Investment Company (TADAWUL:2240) shareholders have had their patience rewarded with a 31% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

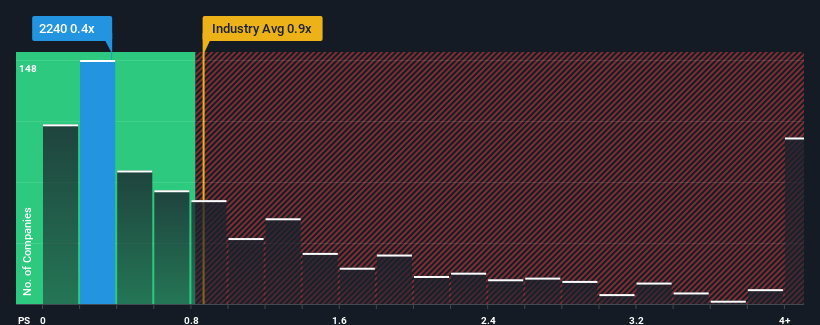

In spite of the firm bounce in price, it would still be understandable if you think Zamil Industrial Investment is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in Saudi Arabia's Metals and Mining industry have P/S ratios above 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Zamil Industrial Investment

What Does Zamil Industrial Investment's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Zamil Industrial Investment has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zamil Industrial Investment.How Is Zamil Industrial Investment's Revenue Growth Trending?

Zamil Industrial Investment's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. The strong recent performance means it was also able to grow revenue by 56% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 4.6% over the next year. With the industry predicted to deliver 8.7% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Zamil Industrial Investment is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Despite Zamil Industrial Investment's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Zamil Industrial Investment maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Zamil Industrial Investment that we have uncovered.

If these risks are making you reconsider your opinion on Zamil Industrial Investment, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zamil Industrial Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2240

Zamil Industrial Investment

Engages in the design and engineering, manufacturing, and fabrication of construction materials, pre-engineering steel buildings, steel structures, air conditions, and climate control systems for commercial, industrial, and residential applications, as well as for telecom and broadcasting towers, process equipment, fiberglass, rockwool and engineering plastic foam insulation, and solar power projects.

High growth potential low.

Similar Companies

Market Insights

Community Narratives