- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:2220

Investors in National Metal Manufacturing and Casting (TADAWUL:2220) from a year ago are still down 31%, even after 10% gain this past week

This week we saw the National Metal Manufacturing and Casting Co. (TADAWUL:2220) share price climb by 10%. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 31% in one year, under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for National Metal Manufacturing and Casting

Because National Metal Manufacturing and Casting made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last year National Metal Manufacturing and Casting saw its revenue grow by 18%. We think that is pretty nice growth. Unfortunately that wasn't good enough to stop the share price dropping 31%. You might even wonder if the share price was previously over-hyped. But if revenue keeps growing, then at a certain point the share price would likely follow.

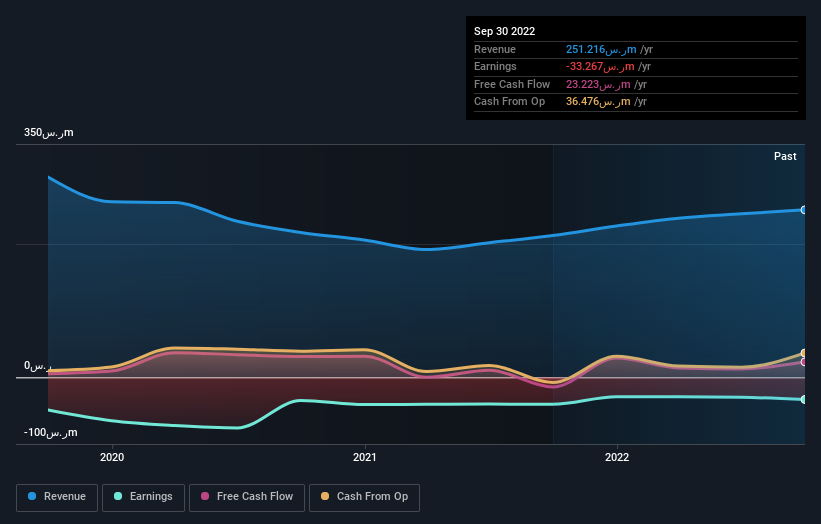

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling National Metal Manufacturing and Casting stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that National Metal Manufacturing and Casting shareholders are down 31% for the year. Unfortunately, that's worse than the broader market decline of 13%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 0.5% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand National Metal Manufacturing and Casting better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for National Metal Manufacturing and Casting (of which 1 is potentially serious!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

Valuation is complex, but we're here to simplify it.

Discover if National Metal Manufacturing and Casting might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2220

National Metal Manufacturing and Casting

National Metal Manufacturing and Casting Co.

Excellent balance sheet minimal.

Market Insights

Community Narratives