- Saudi Arabia

- /

- Packaging

- /

- SASE:2150

Is National Company for Glass Industries' (TADAWUL:2150) 135% Share Price Increase Well Justified?

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. Take, for example The National Company for Glass Industries (TADAWUL:2150). Its share price is already up an impressive 135% in the last twelve months. Also pleasing for shareholders was the 51% gain in the last three months. And shareholders have also done well over the long term, with an increase of 102% in the last three years.

Check out our latest analysis for National Company for Glass Industries

National Company for Glass Industries isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

National Company for Glass Industries actually shrunk its revenue over the last year, with a reduction of 8.1%. So we would not have expected the share price to rise 135%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

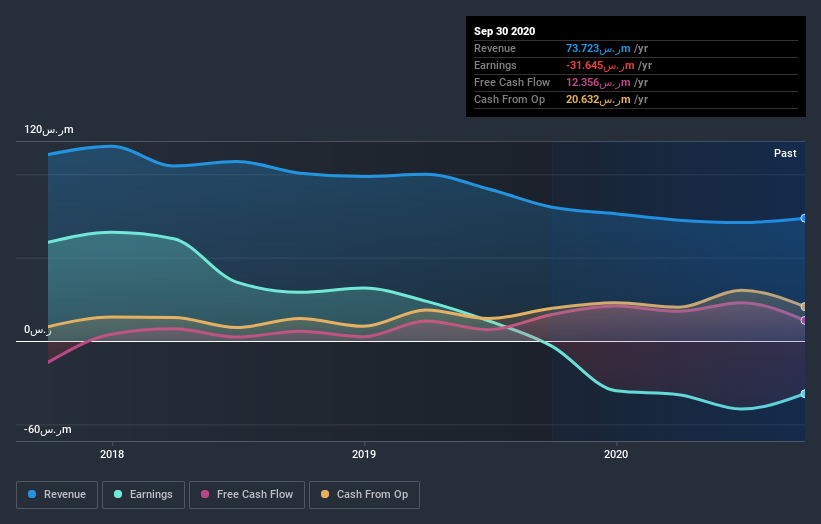

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on National Company for Glass Industries' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that National Company for Glass Industries has rewarded shareholders with a total shareholder return of 135% in the last twelve months. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 20% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand National Company for Glass Industries better, we need to consider many other factors. Take risks, for example - National Company for Glass Industries has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

When trading National Company for Glass Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National Company for Glass Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:2150

National Company for Glass Industries

Produces and sells returnable and non-returnable glass bottles and float glass.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives