- Saudi Arabia

- /

- Chemicals

- /

- SASE:2010

Unpleasant Surprises Could Be In Store For Saudi Basic Industries Corporation's (TADAWUL:2010) Shares

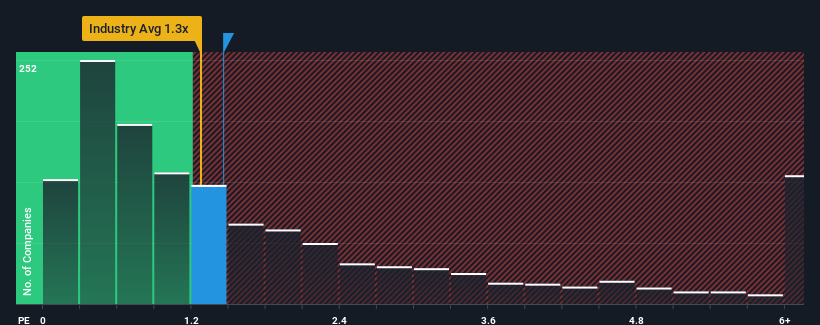

With a median price-to-sales (or "P/S") ratio of close to 1.7x in the Chemicals industry in Saudi Arabia, you could be forgiven for feeling indifferent about Saudi Basic Industries Corporation's (TADAWUL:2010) P/S ratio of 1.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Saudi Basic Industries

How Has Saudi Basic Industries Performed Recently?

Recent times have been more advantageous for Saudi Basic Industries as its revenue hasn't fallen as much as the rest of the industry. It might be that many expect the comparatively superior revenue performance to vanish, which has kept the P/S from rising. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Want the full picture on analyst estimates for the company? Then our free report on Saudi Basic Industries will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Saudi Basic Industries' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 17%. Still, the latest three year period has seen an excellent 39% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 0.6% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 3.0% per year, which is noticeably more attractive.

In light of this, it's curious that Saudi Basic Industries' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Saudi Basic Industries' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Saudi Basic Industries you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:2010

Saudi Basic Industries

Engages in the manufacture, marketing, and distribution of chemicals, polymers, plastics, agri-nutrients, and metal products worldwide.

Flawless balance sheet with reasonable growth potential.