- Saudi Arabia

- /

- Chemicals

- /

- SASE:2010

3 Global Stocks Estimated To Be Up To 42.2% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets reach new heights driven by favorable trade deals and robust business activity in the services sector, investors are keenly observing opportunities that may be undervalued amidst the optimism. In this environment, identifying stocks that are trading below their intrinsic value can provide a strategic advantage, especially when market sentiment is buoyed by positive economic indicators and geopolitical developments.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266) | CN¥111.83 | CN¥222.46 | 49.7% |

| StrongPoint (OB:STRO) | NOK11.20 | NOK22.39 | 50% |

| SpiderPlus (TSE:4192) | ¥498.00 | ¥993.77 | 49.9% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥23.17 | CN¥46.13 | 49.8% |

| Selvita (WSE:SLV) | PLN34.90 | PLN69.79 | 50% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$10.38 | HK$20.75 | 50% |

| Green Oleo (BIT:GRN) | €0.79 | €1.58 | 50% |

| Atea (OB:ATEA) | NOK142.40 | NOK282.90 | 49.7% |

| Aquila Part Prod Com (BVB:AQ) | RON1.44 | RON2.88 | 50% |

| ALUX (KOSDAQ:A475580) | ₩11360.00 | ₩22576.31 | 49.7% |

We'll examine a selection from our screener results.

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation is involved in the manufacturing, marketing, and distribution of chemicals, polymers, plastics, and agri-nutrients globally with a market cap of SAR166.05 billion.

Operations: The company's revenue segments include Agri-Nutrients, generating SAR11.32 billion, and Petrochemicals & Specialties, contributing SAR130.57 billion.

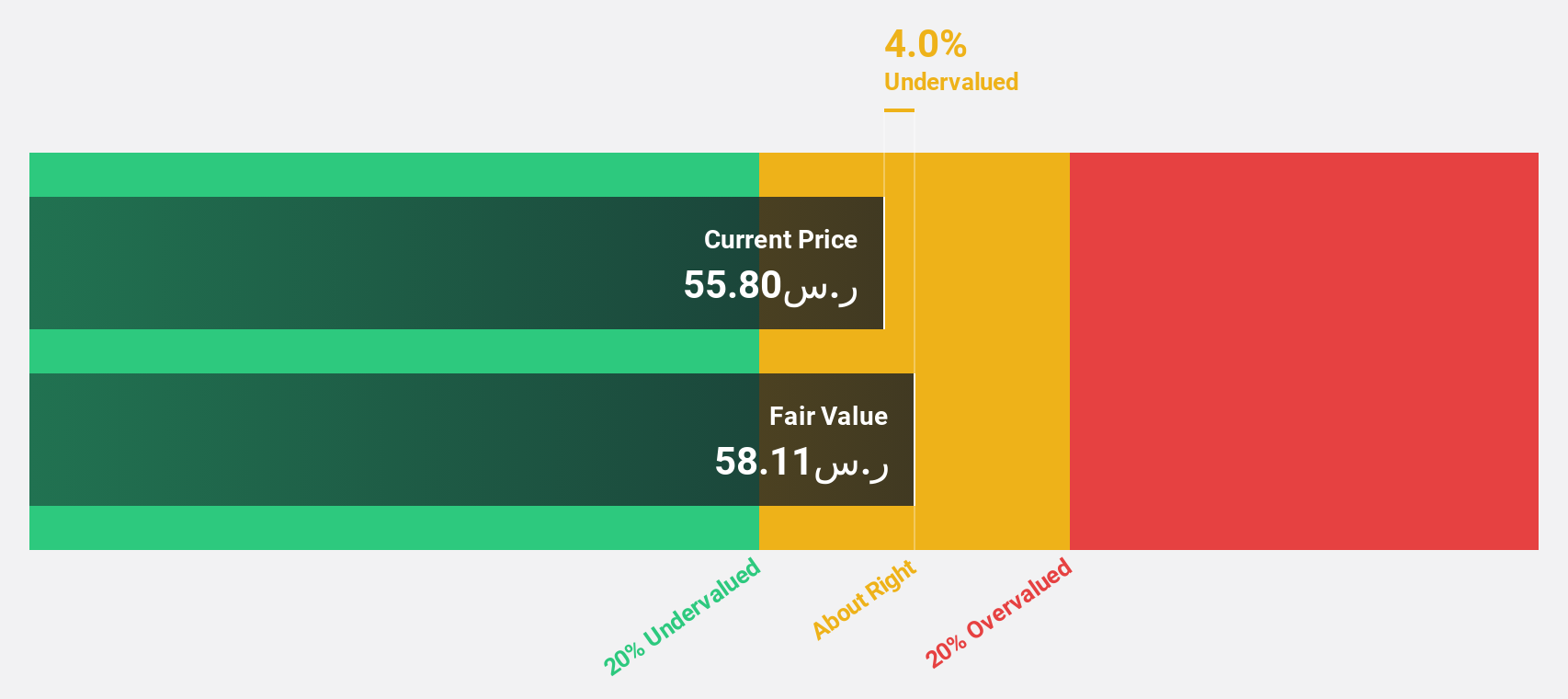

Estimated Discount To Fair Value: 18.7%

Saudi Basic Industries is trading at SAR55.3, below its estimated fair value of SAR68.04, indicating undervaluation based on discounted cash flow analysis. Despite a recent net loss of SAR1.21 billion in Q1 2025, the company anticipates significant earnings growth of 47.25% annually over the next three years, outpacing the Saudi Arabian market's average growth rate. However, profit margins have declined to 0.2%, and dividend coverage remains weak against earnings and free cash flows.

- The analysis detailed in our Saudi Basic Industries growth report hints at robust future financial performance.

- Click here to discover the nuances of Saudi Basic Industries with our detailed financial health report.

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. is involved in the research, development, production, and sales of optical communication transceiver modules and optical devices in China, with a market cap of CN¥234 billion.

Operations: Zhongji Innolight Co., Ltd. generates revenue through its activities in the research, development, production, and sales of optical communication transceiver modules and optical devices in China.

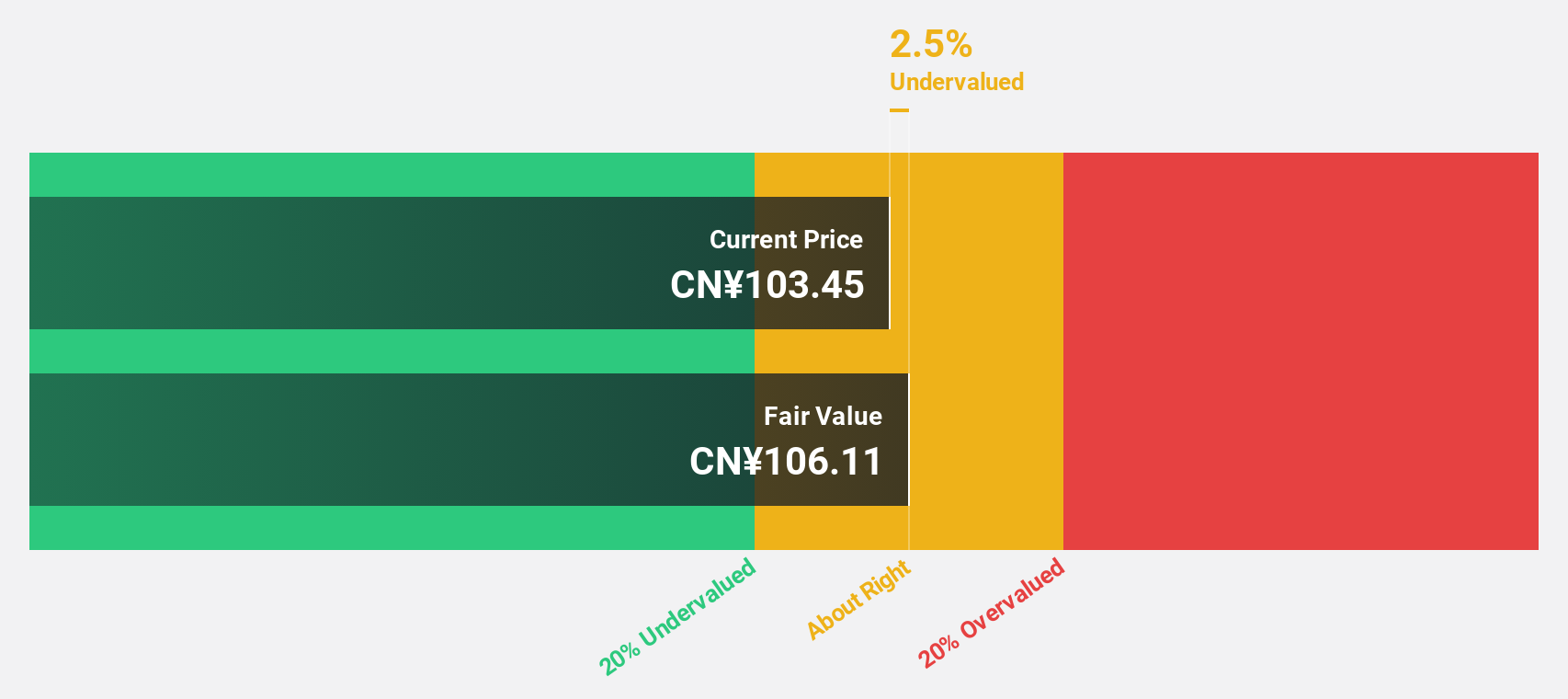

Estimated Discount To Fair Value: 42.2%

Zhongji Innolight, priced at CN¥217.61, is significantly undervalued relative to its estimated fair value of CN¥376.8 according to discounted cash flow analysis. Despite high share price volatility recently, the company has shown robust earnings growth of 95.9% over the past year and expects further annual earnings growth of 22.51%. Although forecasted revenue growth surpasses market averages, projected earnings growth slightly trails behind the broader Chinese market's expectations.

- Our comprehensive growth report raises the possibility that Zhongji Innolight is poised for substantial financial growth.

- Dive into the specifics of Zhongji Innolight here with our thorough financial health report.

Elite Material (TWSE:2383)

Overview: Elite Material Co., Ltd. produces and sells copper clad laminates, electronic-industrial specialty chemicals, raw materials, and electronic components in Taiwan, China, and internationally with a market cap of NT$348.51 billion.

Operations: The company's revenue is primarily derived from its Foreign Departments, contributing NT$69.60 billion, with an additional NT$16.17 billion generated from the Domestic Segment.

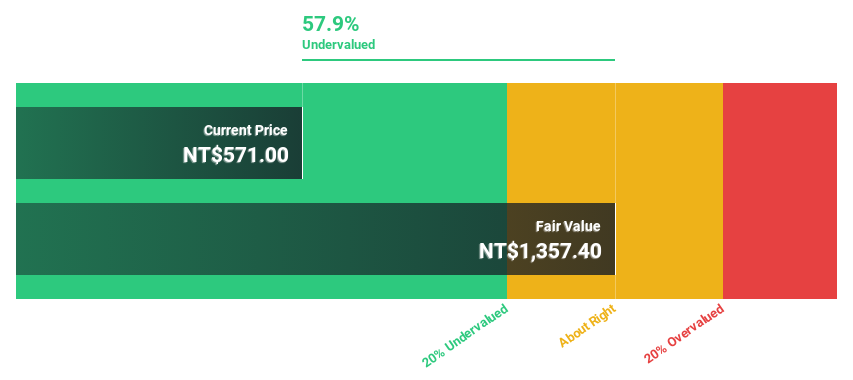

Estimated Discount To Fair Value: 12.6%

Elite Material's recent earnings report reveals strong financial performance, with second-quarter sales reaching TWD 22.51 billion and net income at TWD 3.48 billion, showcasing significant year-over-year growth. The stock trades at NT$1,105, slightly below its fair value estimate of NT$1,264.18 based on discounted cash flow analysis. Forecasts indicate annual earnings growth of 24.2%, outpacing the Taiwan market average while maintaining high non-cash earnings quality despite recent share price volatility.

- Our earnings growth report unveils the potential for significant increases in Elite Material's future results.

- Get an in-depth perspective on Elite Material's balance sheet by reading our health report here.

Taking Advantage

- Take a closer look at our Undervalued Global Stocks Based On Cash Flows list of 489 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2010

Saudi Basic Industries

Manufactures, markets, and distributes chemicals, polymers, plastics, and agri-nutrients worldwide.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives