3 Global Stocks Estimated To Be Up To 37.2% Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, global markets have been weighed down by tariff fears, inflation concerns, and uncertain trade policies, leading to significant declines in major indices such as the S&P 500 and Nasdaq Composite. Amidst this volatile environment, investors may find opportunities in stocks that are currently trading below their intrinsic value, offering potential for growth when market conditions stabilize. Identifying undervalued stocks requires careful consideration of a company's fundamentals and market position relative to current economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIT (KOSDAQ:A110990) | ₩13800.00 | ₩27413.16 | 49.7% |

| Insource (TSE:6200) | ¥796.00 | ¥1583.84 | 49.7% |

| Wienerberger (WBAG:WIE) | €34.68 | €69.35 | 50% |

| Net Insight (OM:NETI B) | SEK4.81 | SEK9.62 | 50% |

| LITALICO (TSE:7366) | ¥1062.00 | ¥2121.98 | 50% |

| APAC Realty (SGX:CLN) | SGD0.42 | SGD0.83 | 49.7% |

| Takara Bio (TSE:4974) | ¥843.00 | ¥1675.01 | 49.7% |

| BalnibarbiLtd (TSE:3418) | ¥1089.00 | ¥2171.21 | 49.8% |

| Xplora Technologies (OB:XPLRA) | NOK27.00 | NOK53.73 | 49.7% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15820.00 | ₩31541.08 | 49.8% |

We'll examine a selection from our screener results.

Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi (IBSE:AEFES)

Overview: Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi, along with its subsidiaries, is involved in the production, bottling, distribution, and sale of beer, malt, and non-alcoholic beverages both in Turkey and internationally, with a market cap of TRY107.76 billion.

Operations: The company's revenue is primarily derived from its Beer Group segment, which generated TRY92.18 billion, and its Soft Drinks segment, contributing TRY137.68 billion.

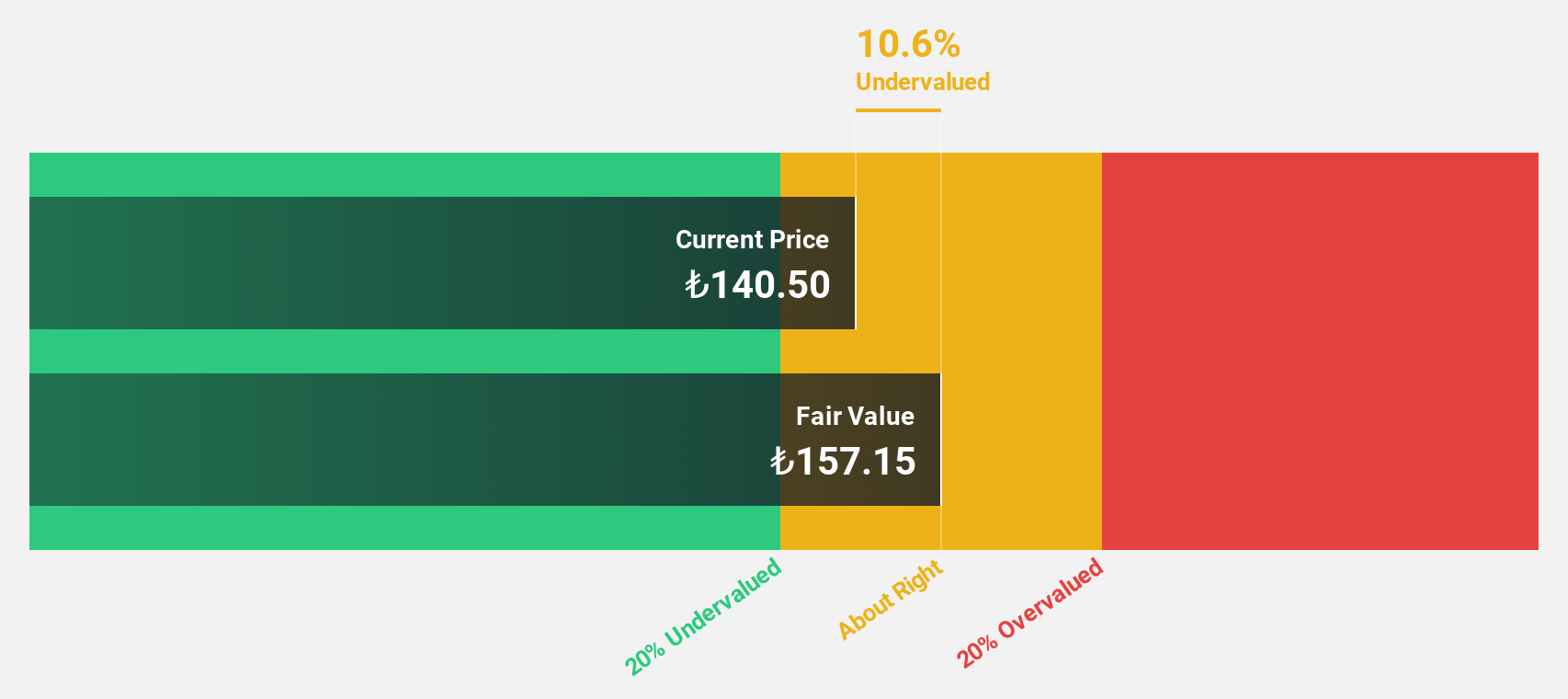

Estimated Discount To Fair Value: 12.5%

Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi is trading at TRY 182, below its estimated fair value of TRY 207.99, indicating potential undervaluation based on cash flows. Despite a volatile share price and declining profit margins from 13.8% to 5.7%, it offers good relative value compared to peers. Earnings are forecast to grow significantly at 27.55% annually over the next three years, though slower than the market average growth rate of 34%.

- Upon reviewing our latest growth report, Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi with our comprehensive financial health report here.

TSE (KOSDAQ:A131290)

Overview: TSE Co., Ltd offers semiconductor test solutions both in South Korea and internationally, with a market cap of approximately ₩517.17 billion.

Operations: TSE Co., Ltd's revenue segments include semiconductor test solutions provided both domestically and internationally.

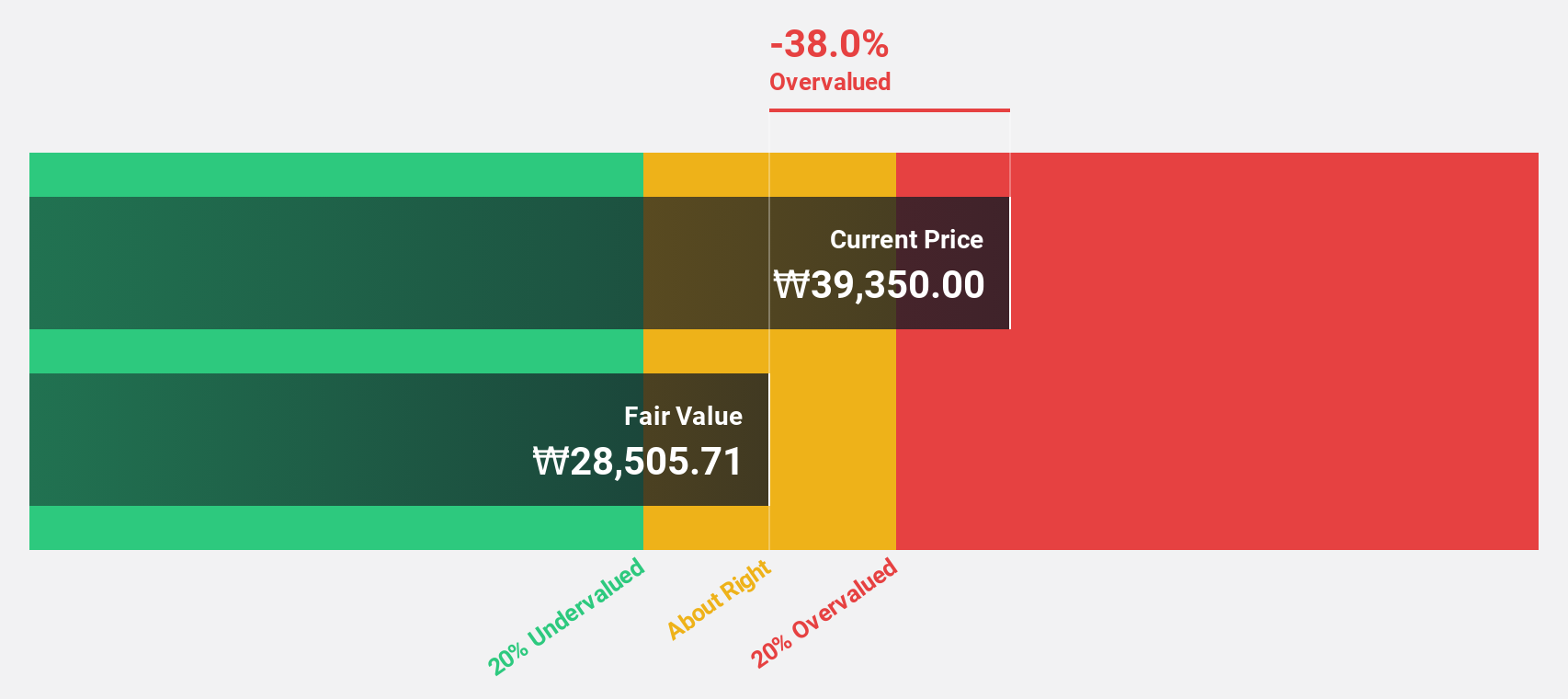

Estimated Discount To Fair Value: 37.2%

TSE Co., Ltd is trading at ₩49,250, significantly below its estimated fair value of ₩78,432.06, suggesting undervaluation based on cash flows. Despite a recent dividend decrease to KRW 400 per share, the company has become profitable this year and forecasts show earnings growth of 33.47% annually over the next three years—outpacing the Korean market's average. However, its return on equity is expected to remain relatively low at 12.1%.

- Our comprehensive growth report raises the possibility that TSE is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of TSE stock in this financial health report.

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation operates globally in the manufacturing, marketing, and distribution of chemicals, polymers, plastics, and agri-nutrients with a market cap of SAR190.20 billion.

Operations: The company's revenue is primarily derived from its Petrochemicals & Specialties segment, which generated SAR129.50 billion, and its Agri-Nutrients segment, contributing SAR10.48 billion.

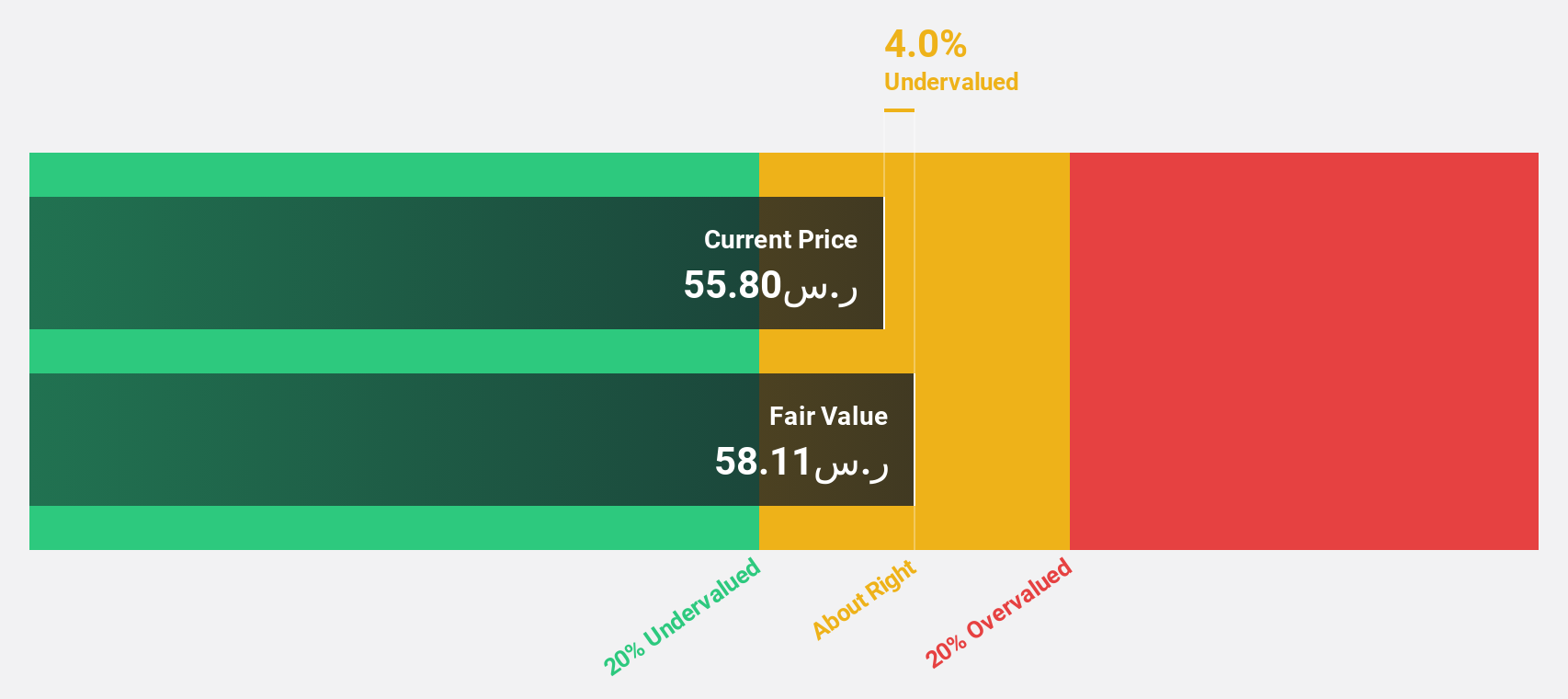

Estimated Discount To Fair Value: 33.4%

Saudi Basic Industries is trading at SAR 63.3, well below its estimated fair value of SAR 95.09, highlighting potential undervaluation based on cash flows. The company reported a net income of SAR 1.54 billion for 2024, reversing the previous year's loss, with basic earnings per share rising to SAR 0.51 from a loss of SAR 0.92. Despite this turnaround, its dividend yield of 5.37% is not adequately covered by earnings or free cash flows.

- Insights from our recent growth report point to a promising forecast for Saudi Basic Industries' business outlook.

- Click here to discover the nuances of Saudi Basic Industries with our detailed financial health report.

Taking Advantage

- Get an in-depth perspective on all 497 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:AEFES

Anadolu Efes Biracilik ve Malt Sanayii Anonim Sirketi

Engages in the production, bottling, distribution, and sale of beer, malt, non-carbonated, and non-alcoholic beverages in Turkey and internationally.

High growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives