- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1321

Optimistic Investors Push East Pipes Integrated Company for Industry (TADAWUL:1321) Shares Up 26% But Growth Is Lacking

Despite an already strong run, East Pipes Integrated Company for Industry (TADAWUL:1321) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 28% in the last year.

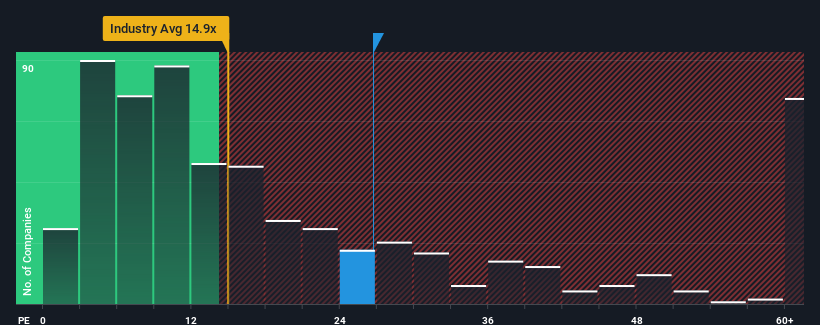

Although its price has surged higher, there still wouldn't be many who think East Pipes Integrated Company for Industry's price-to-earnings (or "P/E") ratio of 26.7x is worth a mention when the median P/E in Saudi Arabia is similar at about 25x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

The recent earnings growth at East Pipes Integrated Company for Industry would have to be considered satisfactory if not spectacular. One possibility is that the P/E is moderate because investors think this good earnings growth might only be parallel to the broader market in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for East Pipes Integrated Company for Industry

Is There Some Growth For East Pipes Integrated Company for Industry?

In order to justify its P/E ratio, East Pipes Integrated Company for Industry would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a worthy increase of 5.2%. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 88% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 15% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that East Pipes Integrated Company for Industry is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

East Pipes Integrated Company for Industry appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of East Pipes Integrated Company for Industry revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

There are also other vital risk factors to consider and we've discovered 4 warning signs for East Pipes Integrated Company for Industry (3 are a bit concerning!) that you should be aware of before investing here.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if East Pipes Integrated Company for Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1321

East Pipes Integrated Company for Industry

Manufactures and sells pipes, tubes, and hollow shapes from iron and steel in the Kingdom of Saudi Arabia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives