- Saudi Arabia

- /

- Pharma

- /

- SASE:4016

None Reveals 3 Undiscovered Gems For Your Portfolio

Reviewed by Simply Wall St

As 2024 draws to a close, global markets have experienced a mix of gains and setbacks, with U.S. consumer confidence dipping in December and major stock indexes showing moderate increases during the holiday-shortened week. Amidst this backdrop, small-cap stocks have faced challenges due to declining manufacturing data and fluctuating consumer sentiment, yet they continue to offer unique opportunities for investors seeking growth potential in less crowded spaces. In this environment, identifying promising small-cap stocks requires careful consideration of factors such as resilient business models and strong management teams that can navigate economic uncertainties while capitalizing on niche market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| QuickLtd | 0.62% | 9.82% | 15.64% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Saudi Steel Pipes (SASE:1320)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Steel Pipes Company manufactures and sells steel pipes both in the Kingdom of Saudi Arabia and internationally, with a market capitalization of SAR3.27 billion.

Operations: The primary revenue stream for Saudi Steel Pipes comes from its steel pipes segment, generating SAR1.86 billion.

Saudi Steel Pipes, a notable player in its sector, has demonstrated solid financial health with earnings growing at 77.5% annually over the past five years. The company's debt-to-equity ratio improved from 54% to 34.5%, indicating effective debt management. Trading at 4.9% below its estimated fair value suggests potential undervaluation relative to peers and industry standards. Recent financials show robust performance, with third-quarter sales rising to SAR 380 million from SAR 317 million year-on-year and net income climbing to SAR 64 million from SAR 38 million previously, reflecting strong operational efficiency and profitability improvements.

- Delve into the full analysis health report here for a deeper understanding of Saudi Steel Pipes.

Gain insights into Saudi Steel Pipes' past trends and performance with our Past report.

Al Masane Al Kobra Mining (SASE:1322)

Simply Wall St Value Rating: ★★★★★★

Overview: Al Masane Al Kobra Mining Company operates in the production of non-ferrous metal ores and precious metals in the Kingdom of Saudi Arabia, with a market capitalization of SAR6.03 billion.

Operations: The company's revenue primarily comes from the Al Masane Mine, contributing SAR353.54 million, and the Mount Guyan Mine, which adds SAR190.02 million.

Al Masane Al Kobra Mining stands out with its impressive financial metrics, showcasing a net income of SAR 59.75 million for Q3 2024, significantly up from SAR 5.18 million the previous year. The company's earnings per share rose to SAR 0.68 from SAR 0.07, reflecting robust growth in profitability. Over the past five years, it has reduced its debt to equity ratio from 62.8% to a satisfactory 4.3%, highlighting strong financial management and stability within the industry context of metals and mining where earnings grew by an average of 18.5% annually over this period.

- Take a closer look at Al Masane Al Kobra Mining's potential here in our health report.

Learn about Al Masane Al Kobra Mining's historical performance.

Middle East Pharmaceutical Industries (SASE:4016)

Simply Wall St Value Rating: ★★★★★☆

Overview: Middle East Pharmaceutical Industries Company focuses on the research, development, manufacture, and marketing of generic medicines and pharmaceutical preparations in Saudi Arabia and internationally, with a market cap of SAR2.43 billion.

Operations: The company generates revenue primarily from private customers, contributing SAR244.49 million, followed by public customers at SAR88.23 million and export customers at SAR54.46 million. The focus on private customer sales forms the largest portion of its revenue streams.

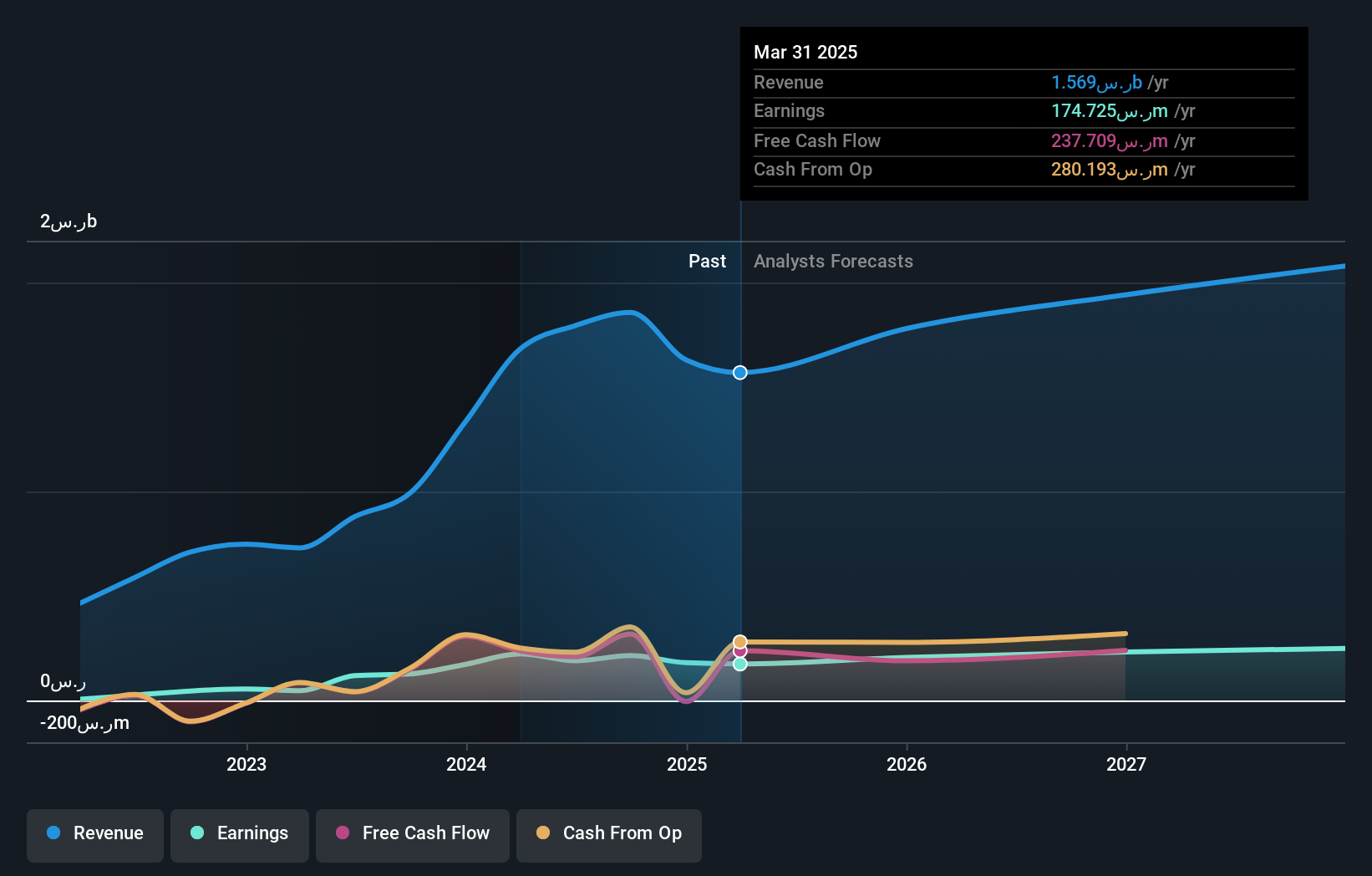

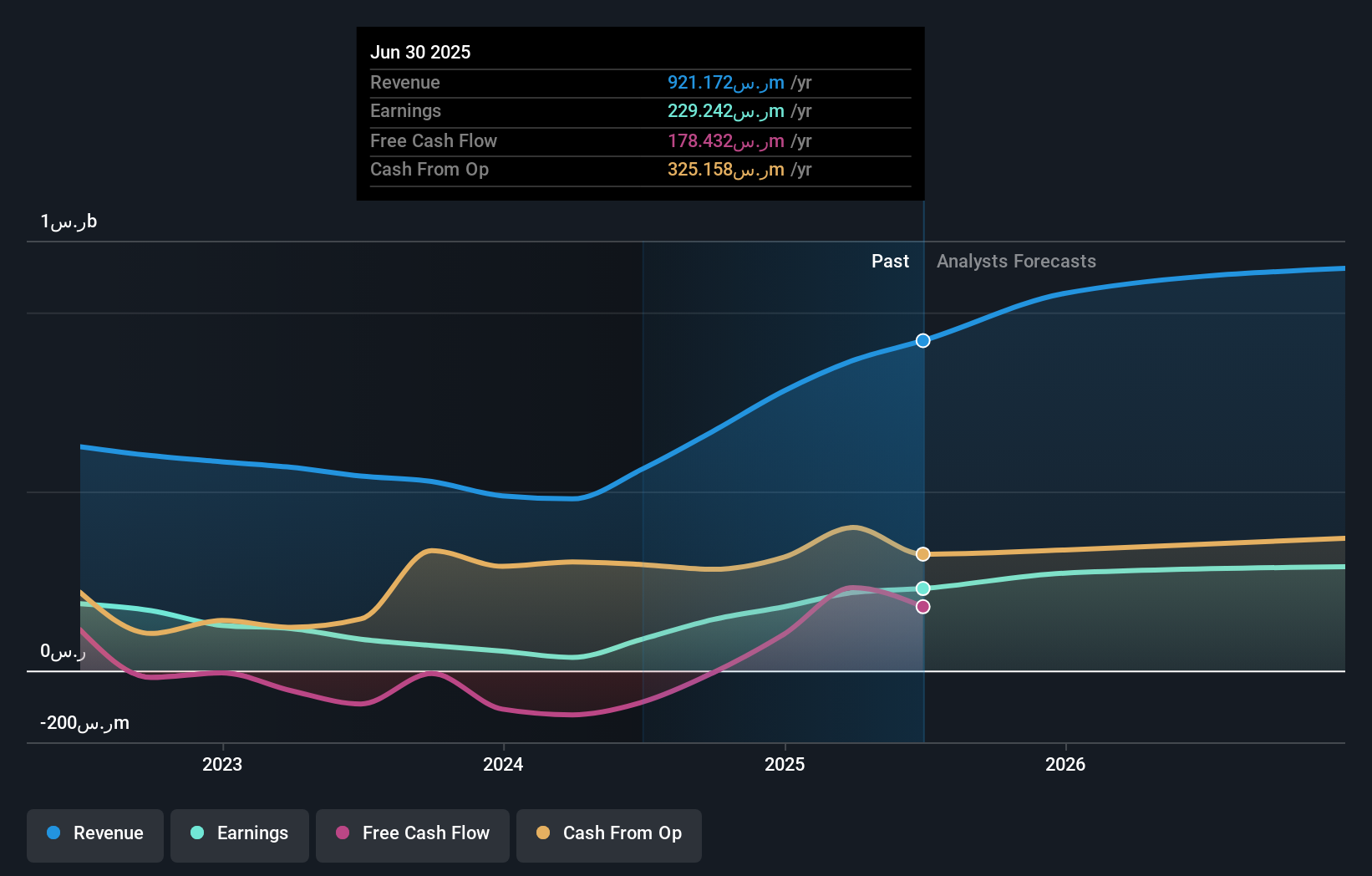

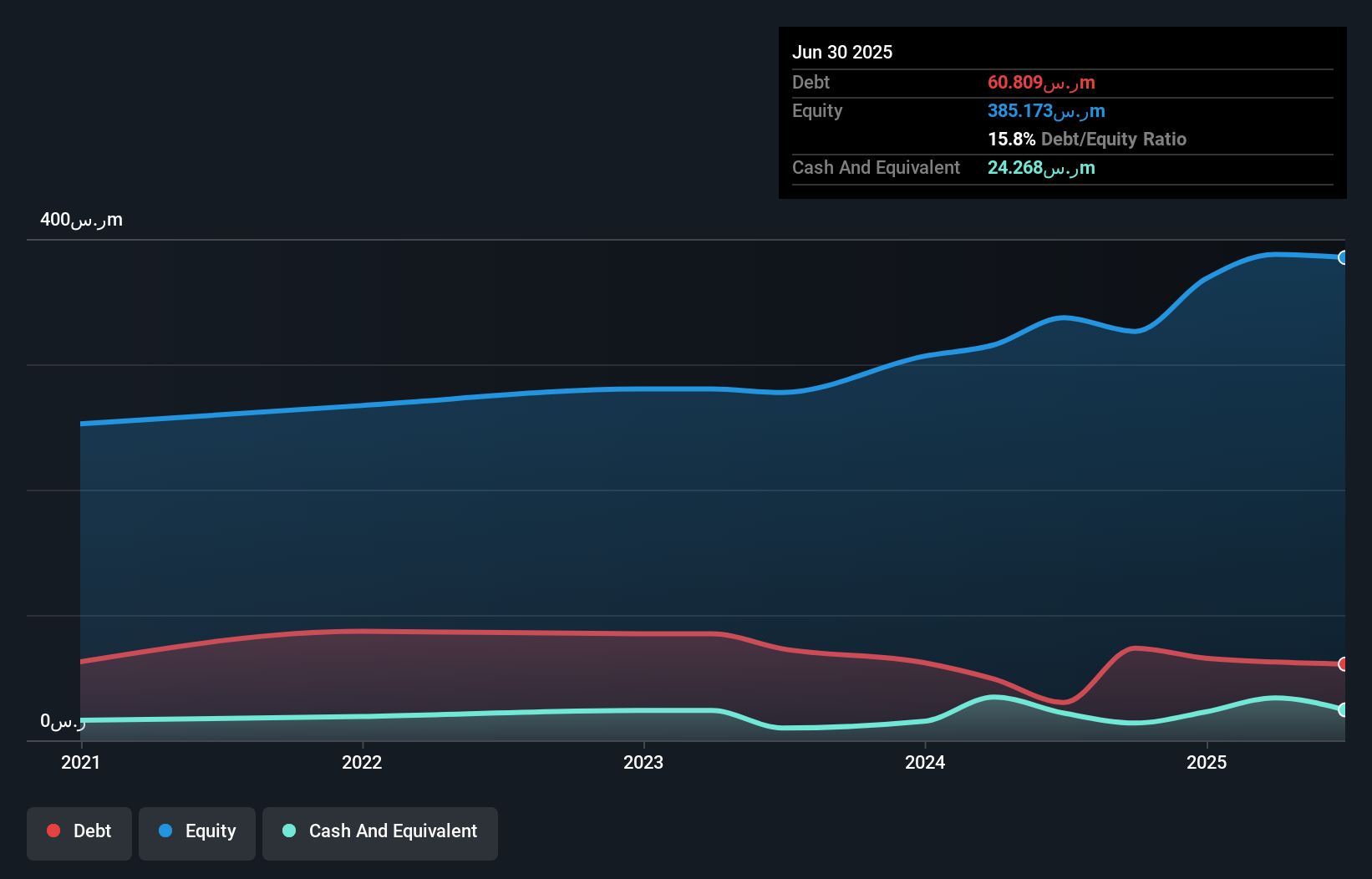

Middle East Pharmaceutical Industries, a promising player in the pharmaceutical sector, has demonstrated impressive earnings growth of 94.7% over the past year, significantly outpacing the industry average of 7.1%. The company's financial health appears robust with a satisfactory net debt to equity ratio of 18.3%, indicating prudent leverage management. Furthermore, its interest obligations are well covered by EBIT at 19.7 times, showcasing strong operational performance. Free cash flow remains positive and consistent with figures like US$73 million in June 2024 and US$32 million by December 2024, suggesting efficient cash management despite increased capital expenditures throughout the year.

Where To Now?

- Investigate our full lineup of 4629 Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4016

Middle East Pharmaceutical Industries

Engages in the research, development, manufacture, and marketing of generic medicines and pharmaceutical preparations in the Kingdom of Saudi Arabia and internationally.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives