- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1320

Is Weakness In Saudi Steel Pipes Company (TADAWUL:1320) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

Saudi Steel Pipes (TADAWUL:1320) has had a rough three months with its share price down 26%. However, stock prices are usually driven by a company’s financial performance over the long term, which in this case looks quite promising. In this article, we decided to focus on Saudi Steel Pipes' ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Saudi Steel Pipes is:

21% = ر.س243m ÷ ر.س1.2b (Based on the trailing twelve months to March 2025).

The 'return' is the yearly profit. So, this means that for every SAR1 of its shareholder's investments, the company generates a profit of SAR0.21.

View our latest analysis for Saudi Steel Pipes

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Saudi Steel Pipes' Earnings Growth And 21% ROE

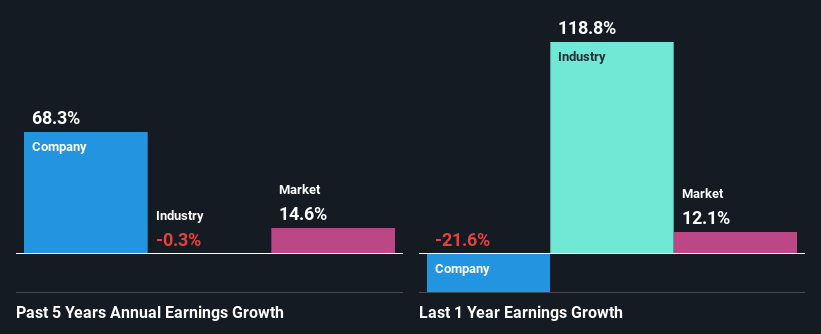

On the face of it, Saudi Steel Pipes' ROE is not much to talk about. However, the fact that the company's ROE is higher than the average industry ROE of 11%, is definitely interesting. Even more so after seeing Saudi Steel Pipes' exceptional 68% net income growth over the past five years. Bear in mind, the company does have a moderately low ROE. It is just that the industry ROE is lower. Therefore, the growth in earnings could also be the result of other factors. For example, it is possible that the broader industry is going through a high growth phase, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that the growth figure reported by Saudi Steel Pipes compares quite favourably to the industry average, which shows a decline of 0.3% over the last few years.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Is Saudi Steel Pipes fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Saudi Steel Pipes Using Its Retained Earnings Effectively?

Saudi Steel Pipes' three-year median payout ratio to shareholders is 19%, which is quite low. This implies that the company is retaining 81% of its profits. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

While Saudi Steel Pipes has seen growth in its earnings, it only recently started to pay a dividend. It is most likely that the company decided to impress new and existing shareholders with a dividend. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 22% of its profits over the next three years. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 20%.

Summary

Overall, we are quite pleased with Saudi Steel Pipes' performance. Particularly, we like that the company is reinvesting heavily into its business at a moderate rate of return. Unsurprisingly, this has led to an impressive earnings growth. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you're looking to trade Saudi Steel Pipes, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:1320

Saudi Steel Pipes

Manufactures and distributes steel pipes in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives