- Turkey

- /

- Residential REITs

- /

- IBSE:EKGYO

Discovering Middle East's Undiscovered Gems in May 2025

Reviewed by Simply Wall St

As Middle Eastern markets experience a positive shift, with most Gulf indices settling higher amid the cautious optimism surrounding the U.S.-China trade truce, investors are increasingly focusing on small-cap stocks that may offer unique growth opportunities. In this dynamic environment, identifying stocks with strong fundamentals and potential resilience to global economic fluctuations can be key to uncovering hidden gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Amanat Holdings PJSC | 12.00% | 34.39% | -9.61% | ★★★★★☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Emlak Konut Gayrimenkul Yatirim Ortakligi (IBSE:EKGYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emlak Konut Gayrimenkul Yatirim Ortakligi, established in 1953, focuses on urbanization and enhancing quality of life through real estate development, with a market cap of TRY53.05 billion.

Operations: Emlak Konut generates revenue primarily from real estate sales and development activities. The company focuses on urbanization projects, aiming to enhance the quality of life through its developments. It has a market capitalization of TRY53.05 billion, reflecting its significant presence in the real estate sector.

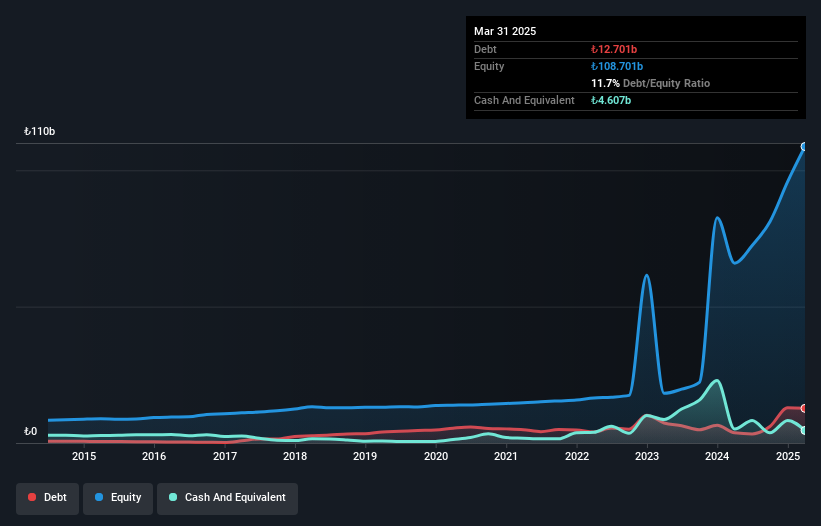

Emlak Konut, a notable player in the Middle Eastern real estate scene, has shown significant financial improvement. The debt to equity ratio has impressively dropped from 34.7% to 13.5% over five years, indicating stronger balance sheet health. With a net income of TRY 3,253 million for Q1 2025 compared to TRY 113 million the previous year and an attractive price-to-earnings ratio of just 4x against the TR market's average of 18.9x, Emlak Konut seems undervalued. Although free cash flow remains negative, its profitability and high-quality earnings suggest potential for robust future growth in revenue forecasted at an annual rate of 24%.

Saudi Steel Pipes (SASE:1320)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Steel Pipes Company manufactures and distributes steel pipes in the Kingdom of Saudi Arabia and internationally, with a market cap of SAR2.86 billion.

Operations: Saudi Steel Pipes generates revenue primarily from the manufacturing and distribution of steel pipes. The company focuses on serving both domestic and international markets, contributing to its financial performance. With a market cap of SAR2.86 billion, it operates within the industrial sector in Saudi Arabia.

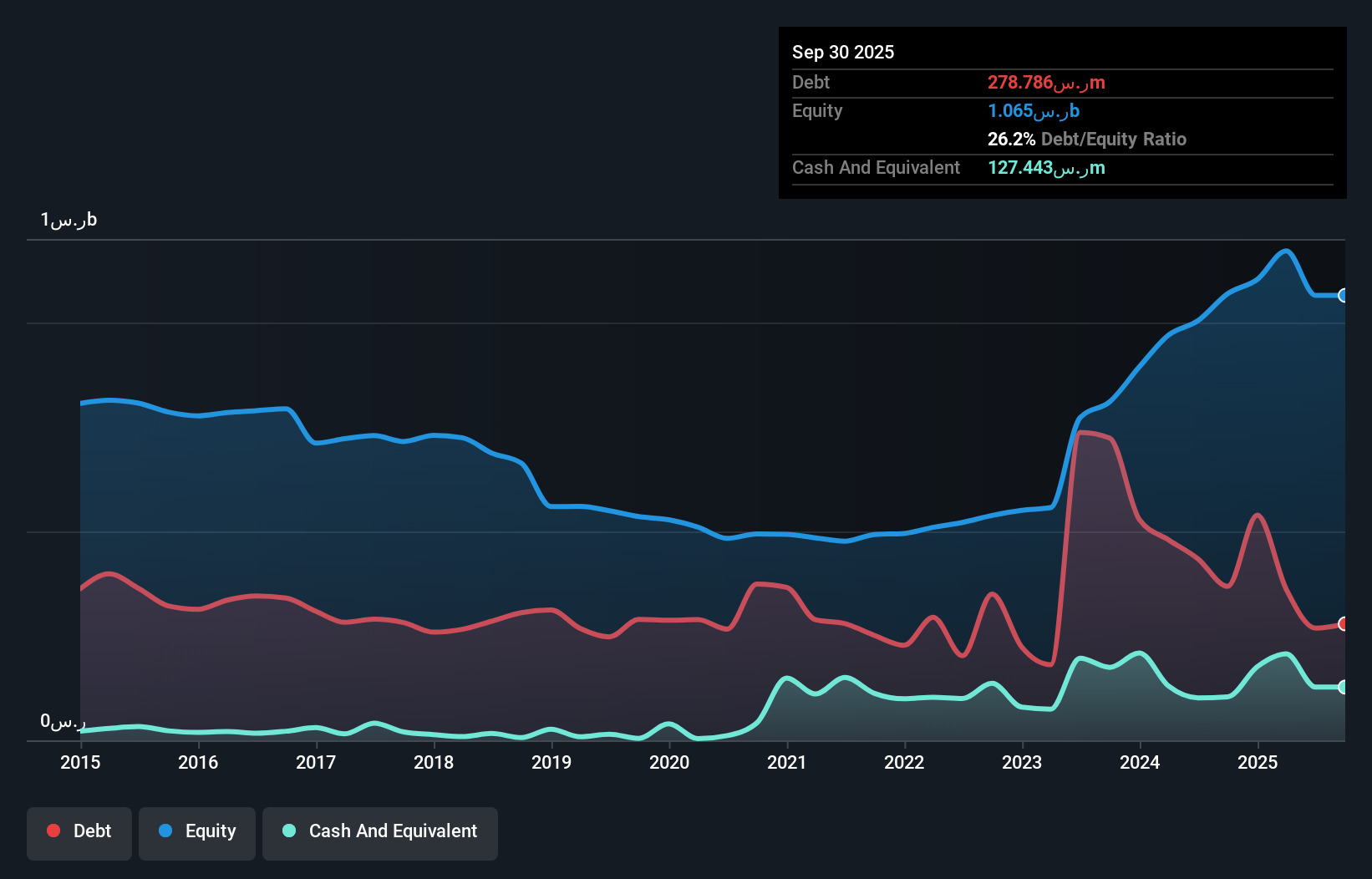

Saudi Steel Pipes is a promising player in the Middle East's industrial landscape, with a net debt to equity ratio of 13.2%, reflecting prudent financial management. The company has reduced its debt to equity ratio from 56.6% to 30.8% over five years, showcasing effective leverage control. Despite facing a negative earnings growth of -21.6% last year against industry norms, it remains well-positioned with interest payments covered by EBIT at 9.4 times over, indicating robust operational efficiency. Recent reports show sales at SAR 453 million and net income at SAR 50 million for Q1 2025, slightly down from the previous year but still solid overall performance indicators.

- Delve into the full analysis health report here for a deeper understanding of Saudi Steel Pipes.

Evaluate Saudi Steel Pipes' historical performance by accessing our past performance report.

Matrix IT (TASE:MTRX)

Simply Wall St Value Rating: ★★★★★★

Overview: Matrix IT Ltd., along with its subsidiaries, offers a range of information technology solutions and services across Israel, the United States, Europe, and other international markets, with a market capitalization of ₪6.12 billion.

Operations: Matrix IT generates revenue primarily from its Information Technology Solutions and Services in Israel, which accounts for ₪3.34 billion, followed by Cloud and Computing Infrastructure at ₪1.52 billion. The company's marketing and support of software products contribute ₪456.77 million, while its U.S.-based IT solutions add another ₪460.94 million to the total revenue stream.

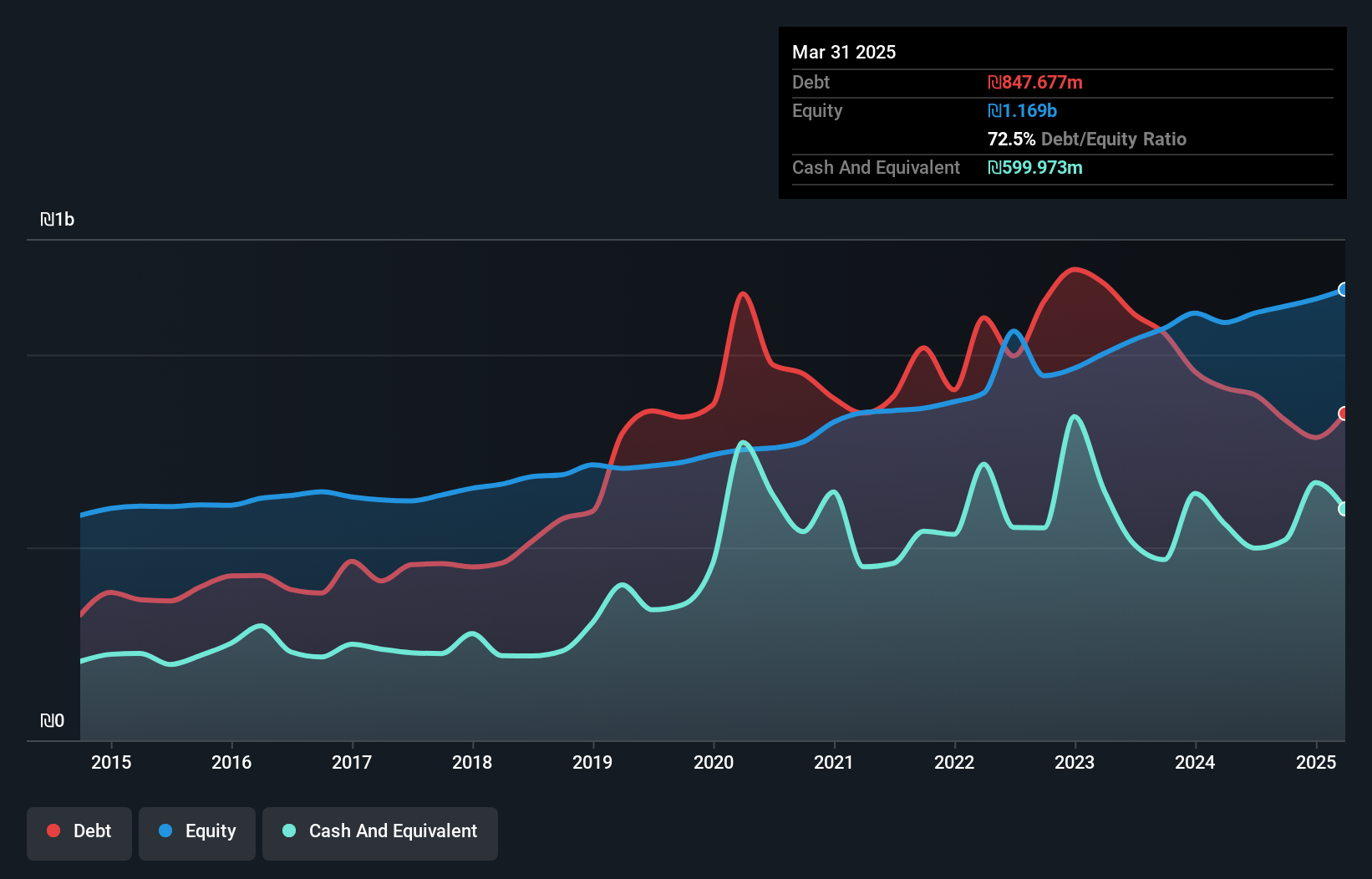

Matrix IT showcases a solid financial profile with high-quality earnings and positive free cash flow. Trading at 38.9% below its estimated fair value, it seems undervalued given its consistent performance. Over five years, the company reduced its debt to equity ratio from 117.4% to 68.6%, indicating improved financial health, while maintaining satisfactory net debt levels at 10.2%. Despite not outpacing the IT industry's growth of 24.5%, Matrix's earnings grew by a respectable 19.8% last year and have increased by an average of 10.4% annually over five years, highlighting steady progress in profitability and operational efficiency.

- Click here to discover the nuances of Matrix IT with our detailed analytical health report.

Examine Matrix IT's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Navigate through the entire inventory of 248 Middle Eastern Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Emlak Konut Gayrimenkul Yatirim Ortakligi, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emlak Konut Gayrimenkul Yatirim Ortakligi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EKGYO

Emlak Konut Gayrimenkul Yatirim Ortakligi

In 1953, a mentality that would lead the urbanization efforts of a country and improve the people’s life quality was born.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives