- Israel

- /

- Specialty Stores

- /

- TASE:DLTI

Discovering Undiscovered Gems in January 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of easing inflation and robust bank earnings, small-cap stocks have captured attention with the S&P MidCap 400 and Russell 2000 indices showing notable gains. In this environment, identifying promising companies involves looking for those that not only demonstrate resilience amid economic shifts but also possess unique growth potential, setting them apart as true undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Albaraka Türk Katilim Bankasi (IBSE:ALBRK)

Simply Wall St Value Rating: ★★★★★★

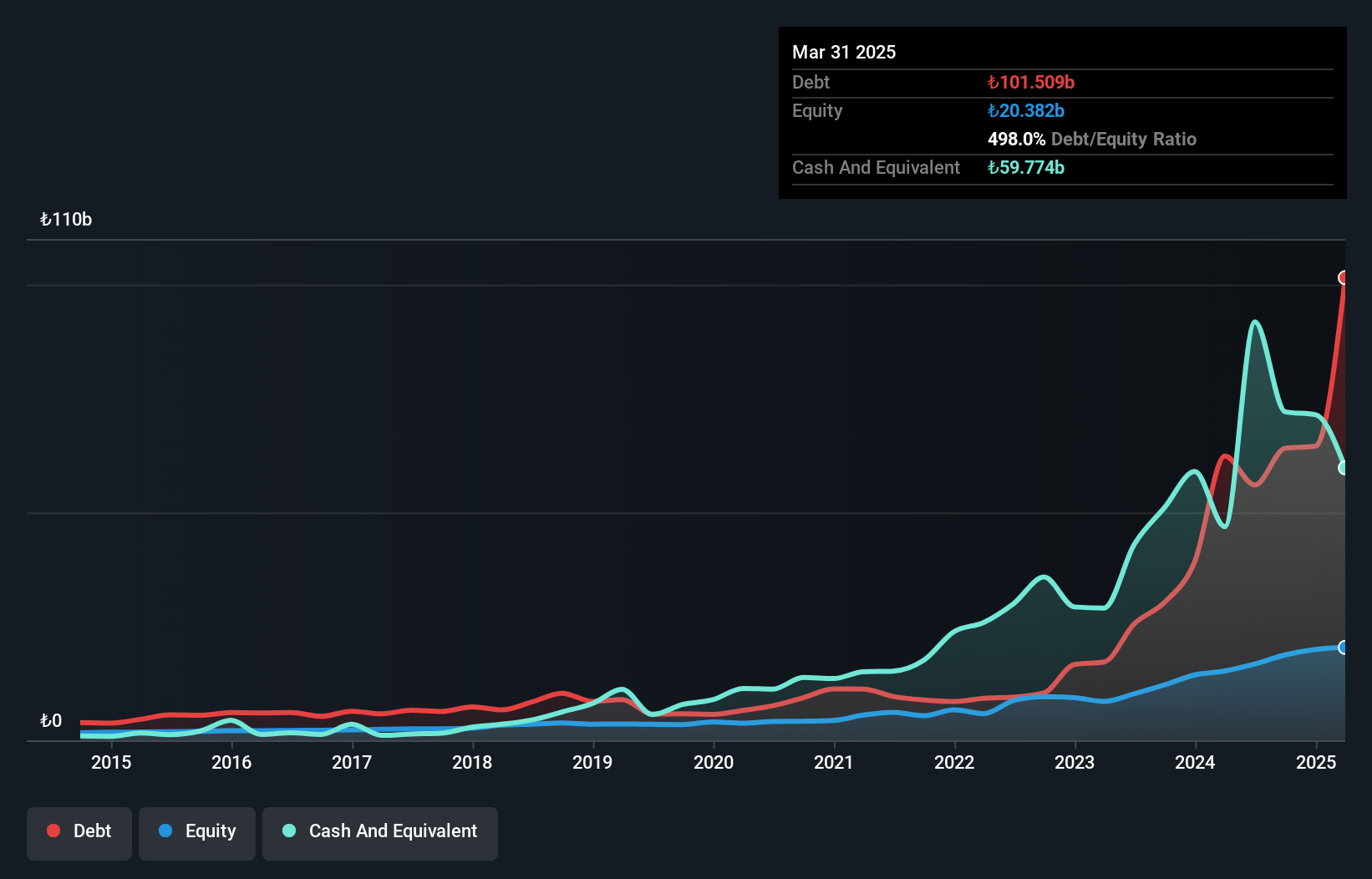

Overview: Albaraka Türk Katilim Bankasi A.S. offers a range of banking products and services in Turkey, with a market capitalization of TRY18.20 billion.

Operations: The bank's revenue primarily comes from its Commercial and Corporate segment, generating TRY33.27 billion, followed by the Treasury segment with TRY18.51 billion. Retail banking contributes TRY8.53 billion to the total revenue stream.

Albaraka Türk Katilim Bankasi, a notable player in its space, showcases a compelling profile with its price-to-earnings ratio at 3.4x, significantly below the market average of 15.9x, indicating potential value. The bank's earnings grew by 40% over the past year, outpacing the industry growth of 13.4%, and are forecasted to grow by another 21% annually. With total assets of TRY299.6 billion and an allowance for bad loans at a robust 163%, it demonstrates prudent risk management while maintaining primarily low-risk funding sources through customer deposits that comprise 70% of liabilities.

Rasan Information Technology (SASE:8313)

Simply Wall St Value Rating: ★★★★★★

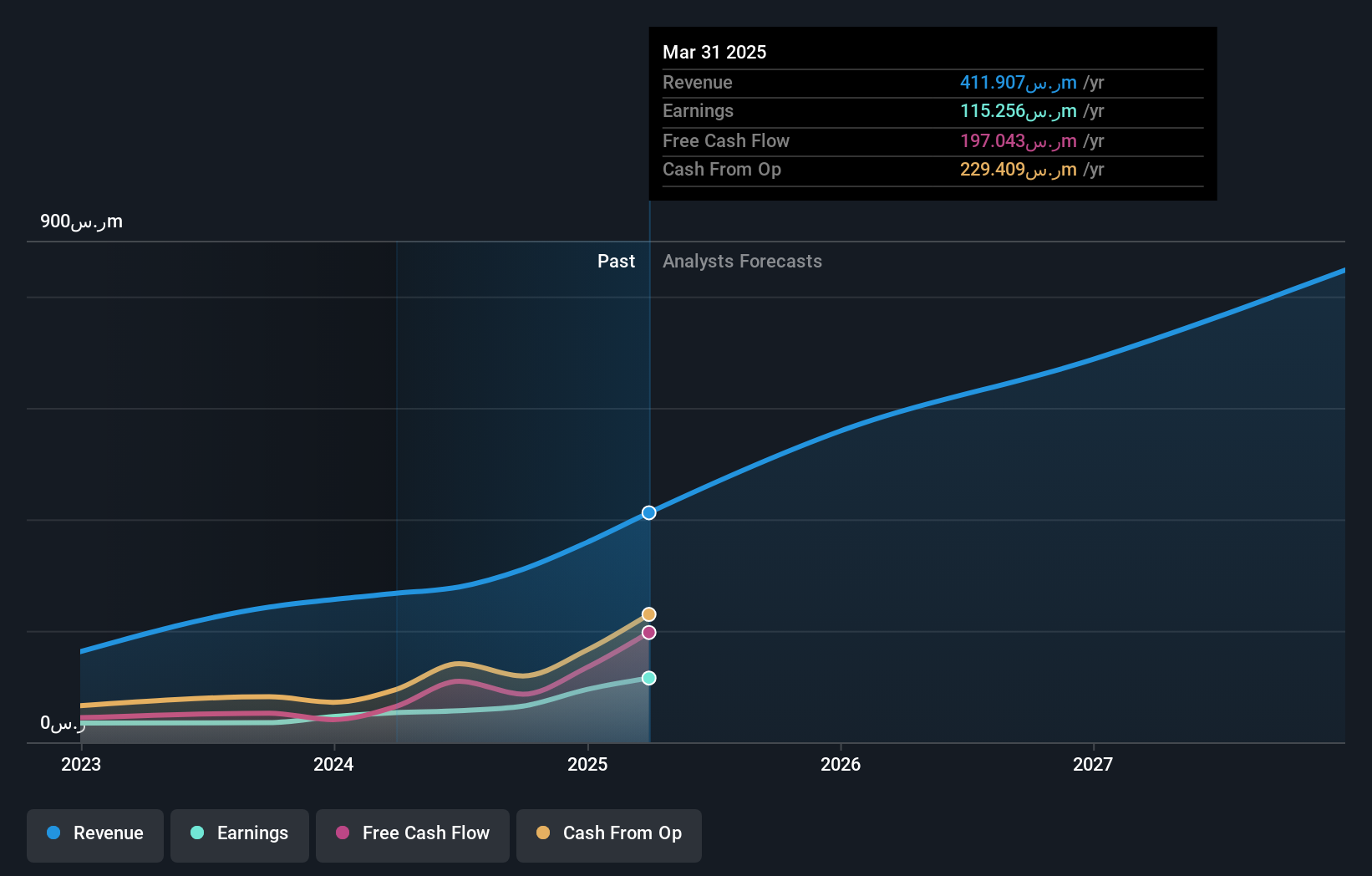

Overview: Rasan Information Technology Company is a financial technology firm offering insurance and financial services in Saudi Arabia, with a market capitalization of SAR6.07 billion.

Operations: The company's revenue is primarily derived from its Tameeni - Motors and Leasing segments, contributing SAR187.93 million and SAR77.92 million, respectively. The Tameeni - Health segment adds SAR40.40 million to the total revenue stream.

Rasan Information Technology, a nimble player in its field, has shown an impressive earnings growth of 84% over the past year, outpacing the insurance industry's -6.9%. The company is debt-free and boasts high-quality earnings, which enhances its financial stability. Recent inclusion in major indices like the S&P Pan Arab Composite and S&P Global BMI Index highlights its growing recognition. Despite a volatile share price recently, Rasan's forecasted revenue growth of 28% per year suggests potential for continued expansion. With positive free cash flow reaching US$109.65 million by mid-2024, Rasan seems well-positioned for future opportunities.

- Click here and access our complete health analysis report to understand the dynamics of Rasan Information Technology.

Gain insights into Rasan Information Technology's past trends and performance with our Past report.

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

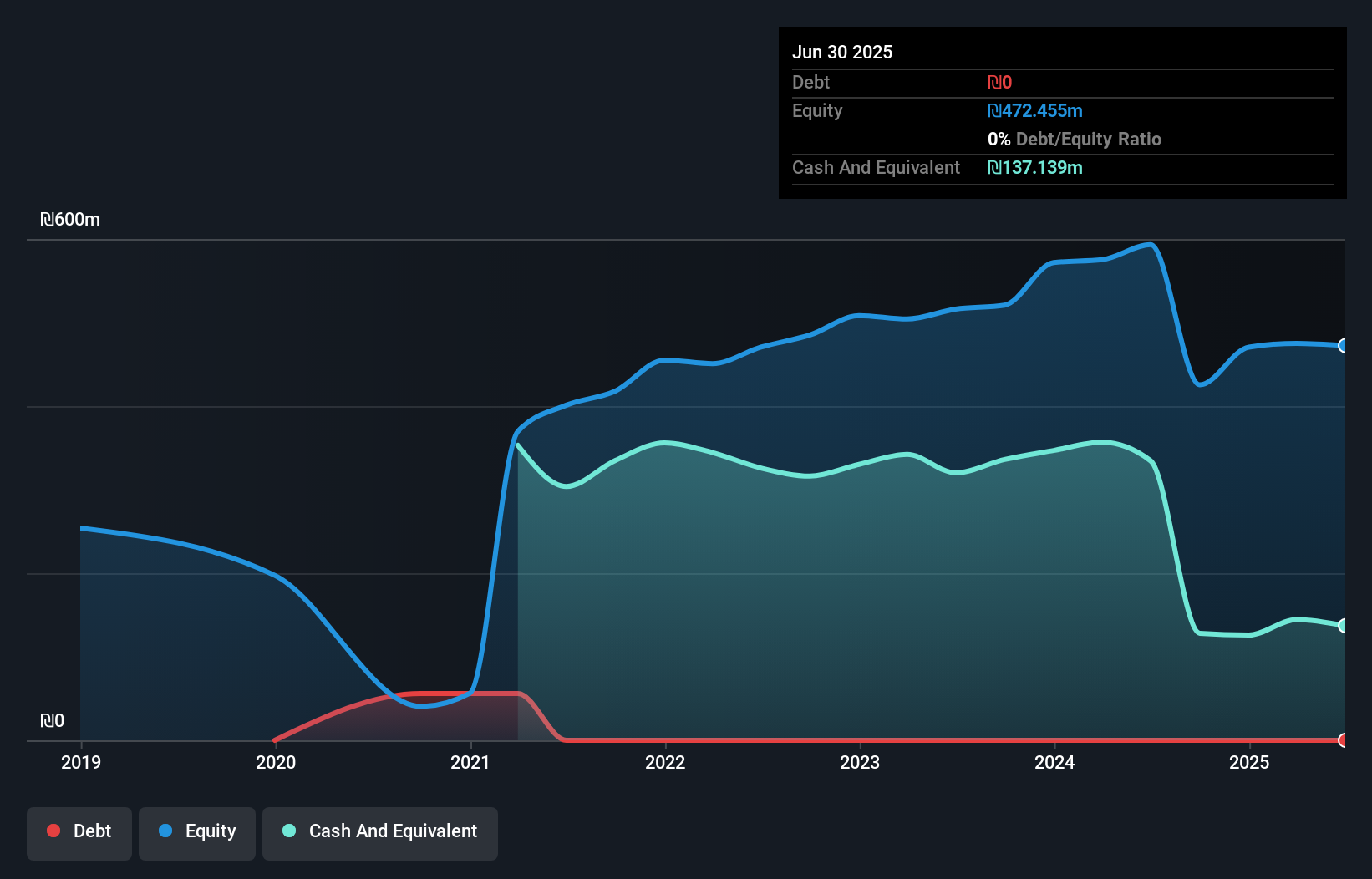

Overview: Delta Israel Brands Ltd. designs, develops, markets, and sells various clothing products in Israel with a market cap of ₪1.72 billion.

Operations: Delta Israel Brands generates revenue primarily from the sale of clothing products. The company's financial performance can be analyzed through its net profit margin, which is a key indicator of profitability.

Delta Israel Brands seems to be making waves with impressive financial health and growth. The company is debt-free, a stark contrast to five years ago when its debt-to-equity ratio was 79%. Over the past year, earnings surged by 85.2%, outpacing the Specialty Retail industry, which saw a -22.2% change. Recent results show net income climbing to ILS 30.58 million for Q3 from ILS 16.27 million last year, with sales reaching ILS 288.83 million from ILS 214.38 million previously. Trading at about 68% below estimated fair value suggests potential upside for investors seeking opportunities in this space.

Make It Happen

- Delve into our full catalog of 4654 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DLTI

Delta Israel Brands

Designs, develops, markets, and sells various clothing products in Israel.

Outstanding track record with flawless balance sheet.