- Saudi Arabia

- /

- Insurance

- /

- SASE:8310

Amana Cooperative Insurance Company (TADAWUL:8310) Looks Just Right With A 25% Price Jump

Amana Cooperative Insurance Company (TADAWUL:8310) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 54% in the last year.

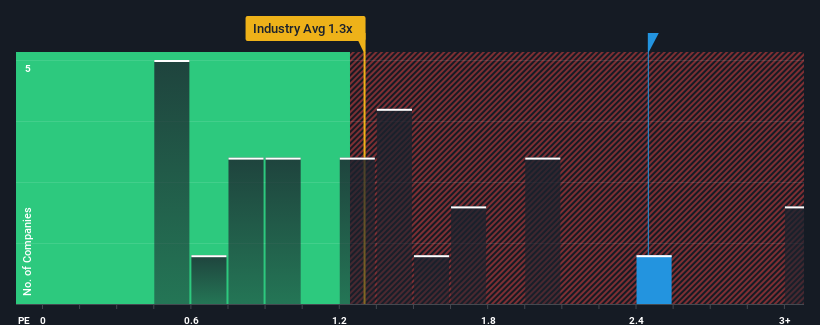

After such a large jump in price, given close to half the companies operating in Saudi Arabia's Insurance industry have price-to-sales ratios (or "P/S") below 1.3x, you may consider Amana Cooperative Insurance as a stock to potentially avoid with its 2.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Amana Cooperative Insurance

What Does Amana Cooperative Insurance's P/S Mean For Shareholders?

For example, consider that Amana Cooperative Insurance's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Amana Cooperative Insurance's earnings, revenue and cash flow.How Is Amana Cooperative Insurance's Revenue Growth Trending?

In order to justify its P/S ratio, Amana Cooperative Insurance would need to produce impressive growth in excess of the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.9%. As a result, revenue from three years ago have also fallen 5.6% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

This is in contrast to the rest of the industry, which is expected to decline by 14% over the next year, even worse than the company's recent medium-term annualised revenue decline.

With this in consideration, it's no surprise that Amana Cooperative Insurance's P/S exceeds that of its industry peers. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Key Takeaway

Amana Cooperative Insurance shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Amana Cooperative Insurance confirms that the company's less severe contraction in revenue over the past three-year years is a major contributor to its higher than industry P/S, given the industry is set to decline even more. At this stage investors feel the potential for outperformance relative to the industry justifies a premium on the P/S ratio. We still remain cautious about the company's ability to stay its recent course and avoid revenues slipping in line with the industry. Otherwise, it's hard to see the share price falling strongly in the near future if its outlook remains more positive than the rest of its peers.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Amana Cooperative Insurance with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Amana Cooperative Insurance, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8310

Amana Cooperative Insurance

Provides various insurance products and services in the Kingdom of Saudi Arabia.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives