- Saudi Arabia

- /

- Insurance

- /

- SASE:8230

Is Now The Time To Put Al Rajhi Company for Cooperative Insurance (TADAWUL:8230) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Al Rajhi Company for Cooperative Insurance (TADAWUL:8230). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Al Rajhi Company for Cooperative Insurance

Al Rajhi Company for Cooperative Insurance's Earnings Per Share Are Growing

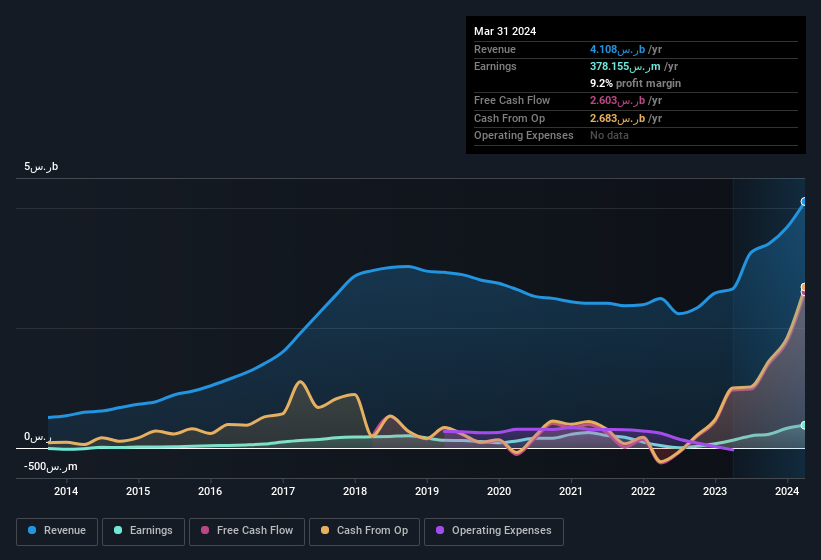

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Al Rajhi Company for Cooperative Insurance grew its EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Al Rajhi Company for Cooperative Insurance's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The music to the ears of Al Rajhi Company for Cooperative Insurance shareholders is that EBIT margins have grown from 6.5% to 15% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Al Rajhi Company for Cooperative Insurance's balance sheet strength, before getting too excited.

Are Al Rajhi Company for Cooperative Insurance Insiders Aligned With All Shareholders?

Owing to the size of Al Rajhi Company for Cooperative Insurance, we wouldn't expect insiders to hold a significant proportion of the company. But we do take comfort from the fact that they are investors in the company. Holding ر.س360m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. This should keep them focused on creating long term value for shareholders.

Does Al Rajhi Company for Cooperative Insurance Deserve A Spot On Your Watchlist?

One positive for Al Rajhi Company for Cooperative Insurance is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. You still need to take note of risks, for example - Al Rajhi Company for Cooperative Insurance has 1 warning sign we think you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Saudi companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:8230

Al Rajhi Company for Cooperative Insurance

Provides various insurance products and services to individuals and businesses in the Kingdom of Saudi Arabia.

Excellent balance sheet with poor track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026