- Saudi Arabia

- /

- Insurance

- /

- SASE:8230

Is Al Rajhi Company for Cooperative Insurance's (TADAWUL:8230) Recent Performance Tethered To Its Attractive Financial Prospects?

Al Rajhi Company for Cooperative Insurance's (TADAWUL:8230) stock is up by 2.5% over the past three months. Given its impressive performance, we decided to study the company's key financial indicators as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Al Rajhi Company for Cooperative Insurance's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Al Rajhi Company for Cooperative Insurance

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Al Rajhi Company for Cooperative Insurance is:

15% = ر.س164m ÷ ر.س1.1b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every SAR1 worth of equity, the company was able to earn SAR0.15 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Al Rajhi Company for Cooperative Insurance's Earnings Growth And 15% ROE

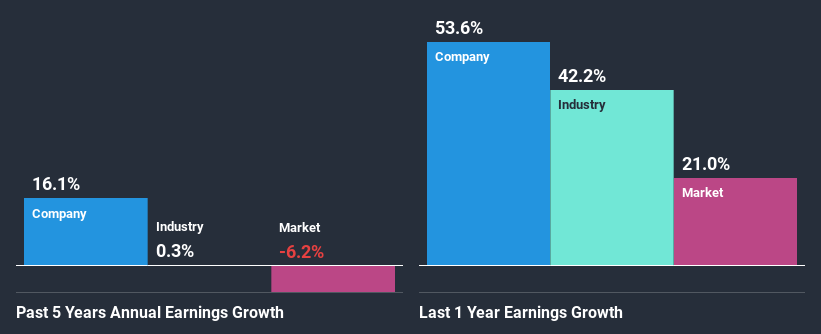

When you first look at it, Al Rajhi Company for Cooperative Insurance's ROE doesn't look that attractive. However, the fact that the company's ROE is higher than the average industry ROE of 9.3%, is definitely interesting. This certainly adds some context to Al Rajhi Company for Cooperative Insurance's moderate 16% net income growth seen over the past five years. That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. So there might well be other reasons for the earnings to grow. E.g the company has a low payout ratio or could belong to a high growth industry.

As a next step, we compared Al Rajhi Company for Cooperative Insurance's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 0.3%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Al Rajhi Company for Cooperative Insurance fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Al Rajhi Company for Cooperative Insurance Using Its Retained Earnings Effectively?

Summary

On the whole, we feel that Al Rajhi Company for Cooperative Insurance's performance has been quite good. In particular, it's great to see that the company has seen significant growth in its earnings backed by a respectable ROE and a high reinvestment rate. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you’re looking to trade Al Rajhi Company for Cooperative Insurance, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:8230

Al Rajhi Company for Cooperative Insurance

Provides various insurance products and services to individuals and businesses in the Kingdom of Saudi Arabia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives