- Saudi Arabia

- /

- Insurance

- /

- SASE:8230

Investors Who Bought Al Rajhi Company for Cooperative Insurance (TADAWUL:8230) Shares Five Years Ago Are Now Up 389%

For many, the main point of investing in the stock market is to achieve spectacular returns. And we've seen some truly amazing gains over the years. For example, the Al Rajhi Company for Cooperative Insurance (TADAWUL:8230) share price is up a whopping 389% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. And in the last month, the share price has gained 7.4%.

See our latest analysis for Al Rajhi Company for Cooperative Insurance

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

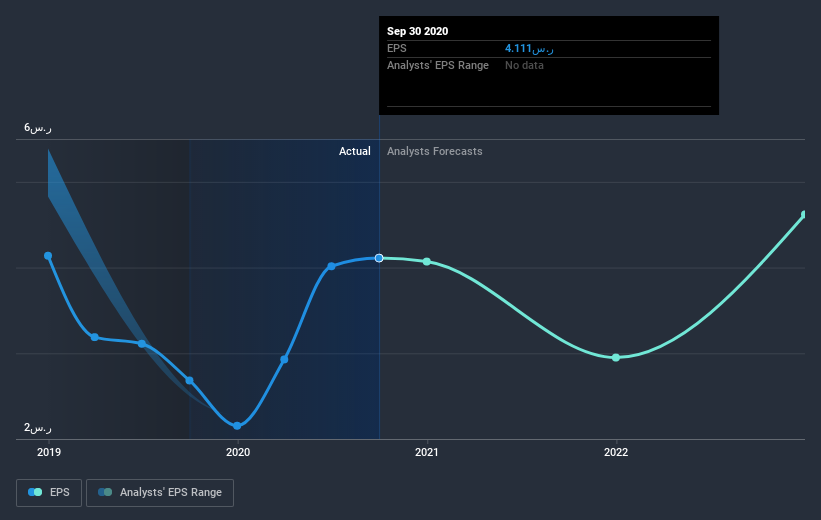

During five years of share price growth, Al Rajhi Company for Cooperative Insurance achieved compound earnings per share (EPS) growth of 36% per year. That makes the EPS growth particularly close to the yearly share price growth of 37%. This indicates that investor sentiment towards the company has not changed a great deal. Indeed, it would appear the share price is reacting to the EPS.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Al Rajhi Company for Cooperative Insurance has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

We're pleased to report that Al Rajhi Company for Cooperative Insurance shareholders have received a total shareholder return of 36% over one year. Having said that, the five-year TSR of 37% a year, is even better. Is Al Rajhi Company for Cooperative Insurance cheap compared to other companies? These 3 valuation measures might help you decide.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

If you decide to trade Al Rajhi Company for Cooperative Insurance, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:8230

Al Rajhi Company for Cooperative Insurance

Provides various insurance products and services to individuals and businesses in the Kingdom of Saudi Arabia.

Excellent balance sheet with questionable track record.