- Saudi Arabia

- /

- Insurance

- /

- SASE:8190

United Cooperative Assurance Company (TADAWUL:8190) Soars 25% But It's A Story Of Risk Vs Reward

Despite an already strong run, United Cooperative Assurance Company (TADAWUL:8190) shares have been powering on, with a gain of 25% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 51% in the last year.

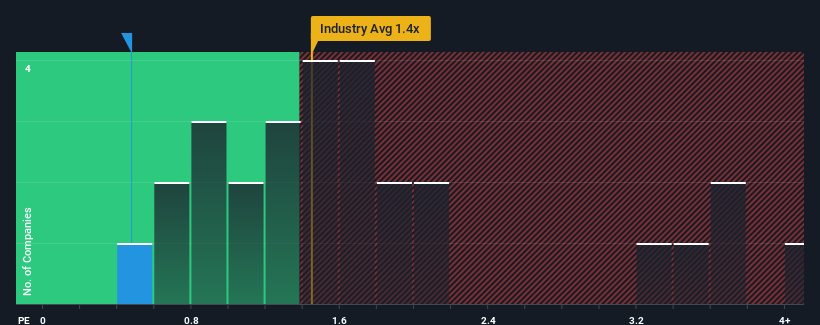

In spite of the firm bounce in price, given about half the companies operating in Saudi Arabia's Insurance industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider United Cooperative Assurance as an attractive investment with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for United Cooperative Assurance

What Does United Cooperative Assurance's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, United Cooperative Assurance has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Although there are no analyst estimates available for United Cooperative Assurance, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is United Cooperative Assurance's Revenue Growth Trending?

United Cooperative Assurance's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 65%. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 20% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that United Cooperative Assurance is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does United Cooperative Assurance's P/S Mean For Investors?

The latest share price surge wasn't enough to lift United Cooperative Assurance's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of United Cooperative Assurance revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Having said that, be aware United Cooperative Assurance is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8190

United Cooperative Assurance

Offers cooperative insurance and reinsurance products in the Kingdom of Saudi Arabia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives