- Saudi Arabia

- /

- Insurance

- /

- SASE:8150

Allied Cooperative Insurance Group (TADAWUL:8150 shareholders incur further losses as stock declines 11% this week, taking three-year losses to 48%

For many investors, the main point of stock picking is to generate higher returns than the overall market. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Allied Cooperative Insurance Group (TADAWUL:8150) shareholders have had that experience, with the share price dropping 68% in three years, versus a market decline of about 1.8%. Shareholders have had an even rougher run lately, with the share price down 31% in the last 90 days.

If the past week is anything to go by, investor sentiment for Allied Cooperative Insurance Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Allied Cooperative Insurance Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Allied Cooperative Insurance Group moved from a loss to profitability. We would usually expect to see the share price rise as a result. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 28% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Allied Cooperative Insurance Group more closely, as sometimes stocks fall unfairly. This could present an opportunity.

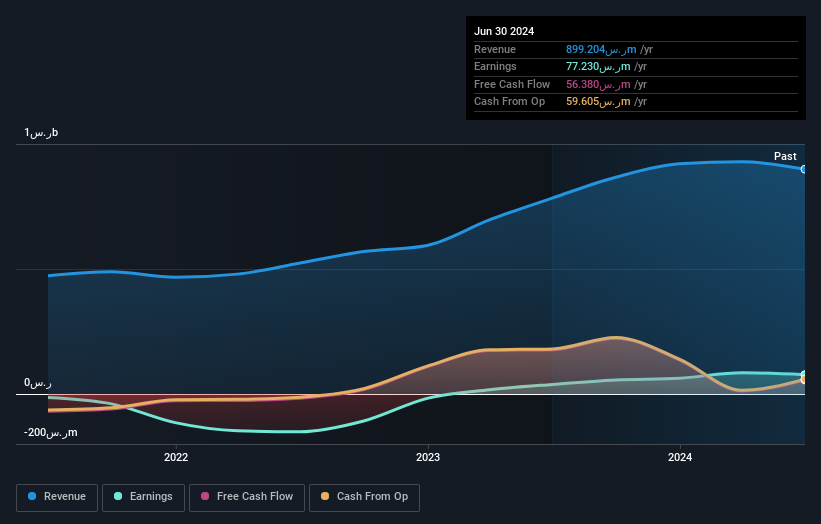

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Allied Cooperative Insurance Group's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

We've already covered Allied Cooperative Insurance Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Allied Cooperative Insurance Group hasn't been paying dividends, but its TSR of -48% exceeds its share price return of -68%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

It's nice to see that Allied Cooperative Insurance Group shareholders have received a total shareholder return of 4.6% over the last year. Notably the five-year annualised TSR loss of 1.6% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Before forming an opinion on Allied Cooperative Insurance Group you might want to consider these 3 valuation metrics.

We will like Allied Cooperative Insurance Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:8150

Allied Cooperative Insurance Group

Engages in the cooperative insurance operations and related activities in the Kingdom of Saudi Arabia.

Flawless balance sheet and slightly overvalued.