Undiscovered Gems And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience, with indices like the Russell 2000 posting gains amid broader market volatility. In this environment, identifying promising small-cap companies requires a keen eye for those with strong fundamentals and potential to thrive despite economic headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Walaa Cooperative Insurance (SASE:8060)

Simply Wall St Value Rating: ★★★★★☆

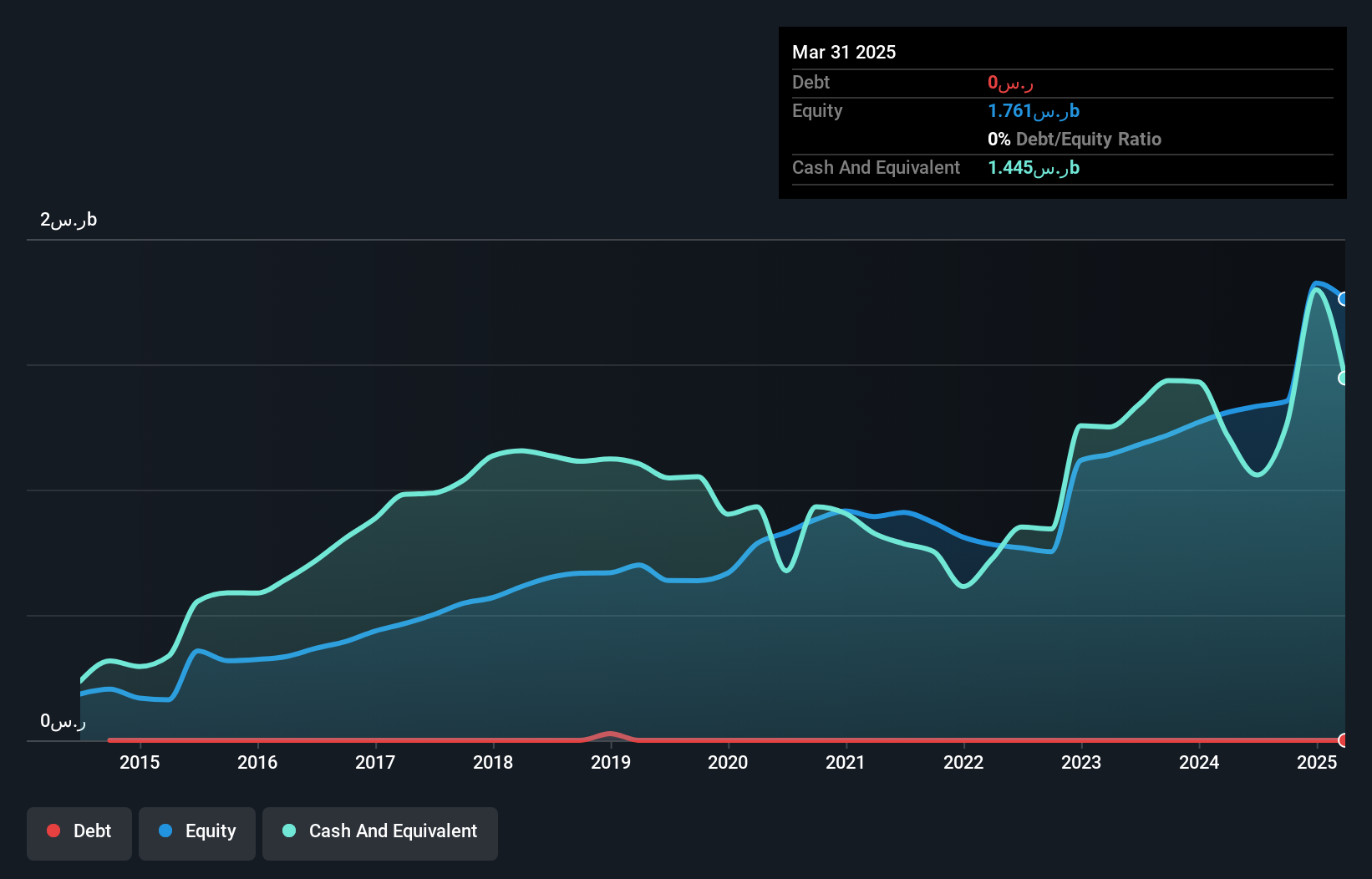

Overview: Walaa Cooperative Insurance Company operates in the Kingdom of Saudi Arabia, offering a range of cooperative insurance and reinsurance products and services, with a market capitalization of SAR1.56 billion.

Operations: Walaa's primary revenue streams are derived from the vehicle and medical insurance segments, contributing SAR776.39 million and SAR645.48 million, respectively. The company also generates income from property, engineering, energy, and protection & saving products. Vehicle insurance is the largest contributor to revenue among these segments.

Walaa Cooperative Insurance, a nimble player in the insurance sector, boasts high-quality earnings with a price-to-earnings ratio of 12.6x, undercutting the SA market's 23.2x. Despite recent volatility in its share price, Walaa remains debt-free and has seen an impressive earnings growth of 42% over the past year, outpacing the industry's -6.9%. However, net income for Q3 was SAR 20 million compared to SAR 40 million last year. The company recently completed a follow-on equity offering worth SAR 467.5 million through rights issuance at SAR 11 per share, indicating strategic capital raising efforts.

- Dive into the specifics of Walaa Cooperative Insurance here with our thorough health report.

Understand Walaa Cooperative Insurance's track record by examining our Past report.

JWIPC Technology (SZSE:001339)

Simply Wall St Value Rating: ★★★★★☆

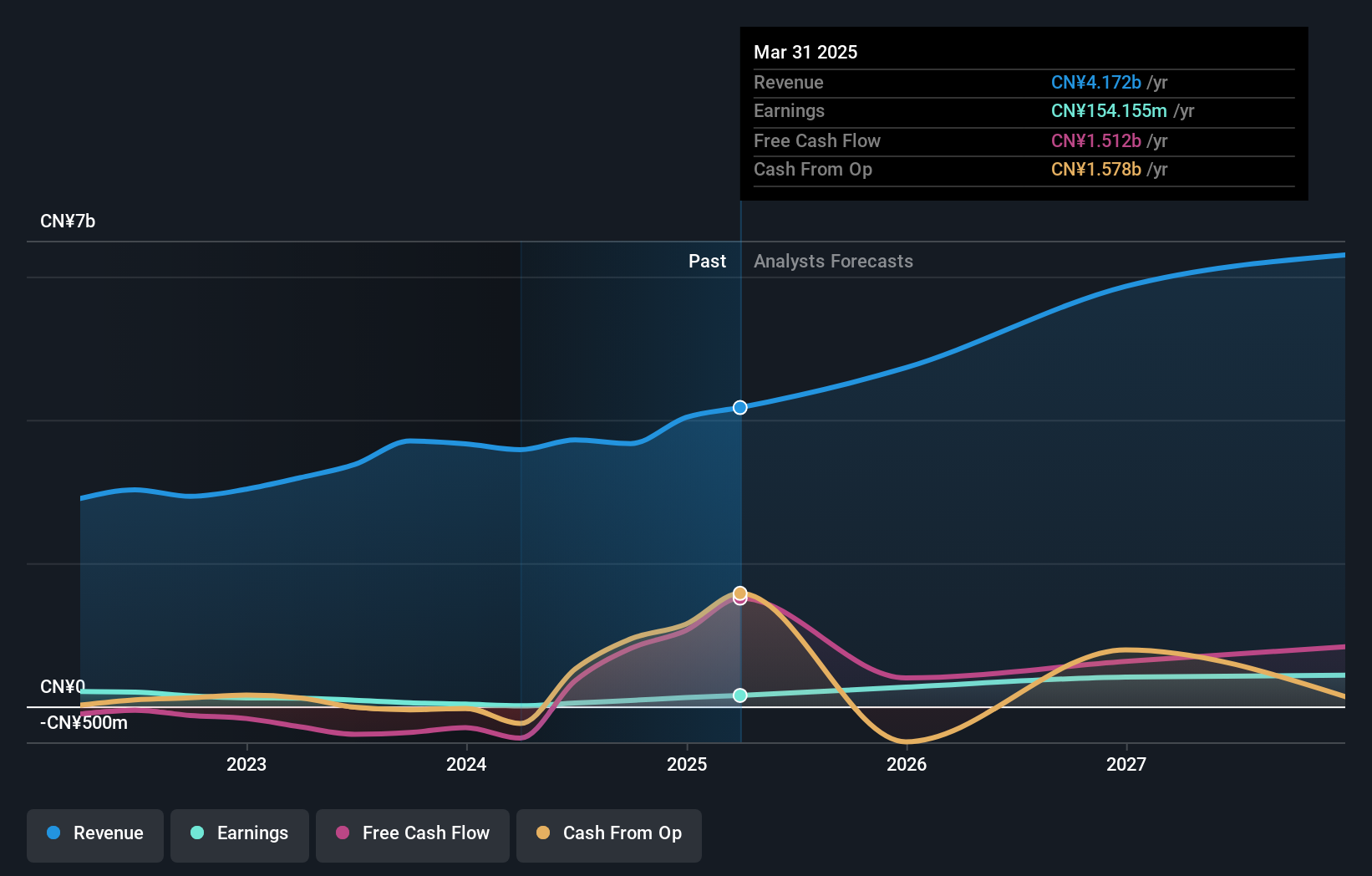

Overview: JWIPC Technology Co., Ltd. focuses on researching, developing, and manufacturing IoT hardware solutions with a market cap of CN¥8.69 billion.

Operations: The company generates revenue primarily from its IoT hardware solutions. The net profit margin has shown variability, reflecting changes in operational efficiency and cost management.

JWIPC Technology, a smaller player in the tech scene, is making waves with its impressive earnings growth of 65.4% over the past year, significantly outpacing the broader industry. The company reported net income of CNY 82.2 million for the first nine months of 2024, up from CNY 31.33 million a year ago, showcasing its strong performance trajectory. Trading at an estimated 88.5% below fair value suggests potential upside for investors seeking undervalued opportunities. Despite an increase in debt to equity ratio to 8.6% over five years, JWIPC's cash position comfortably covers its total debt obligations and supports ongoing profitability without concerns about cash runway limitations.

Changzhou Qianhong BiopharmaLTD (SZSE:002550)

Simply Wall St Value Rating: ★★★★★★

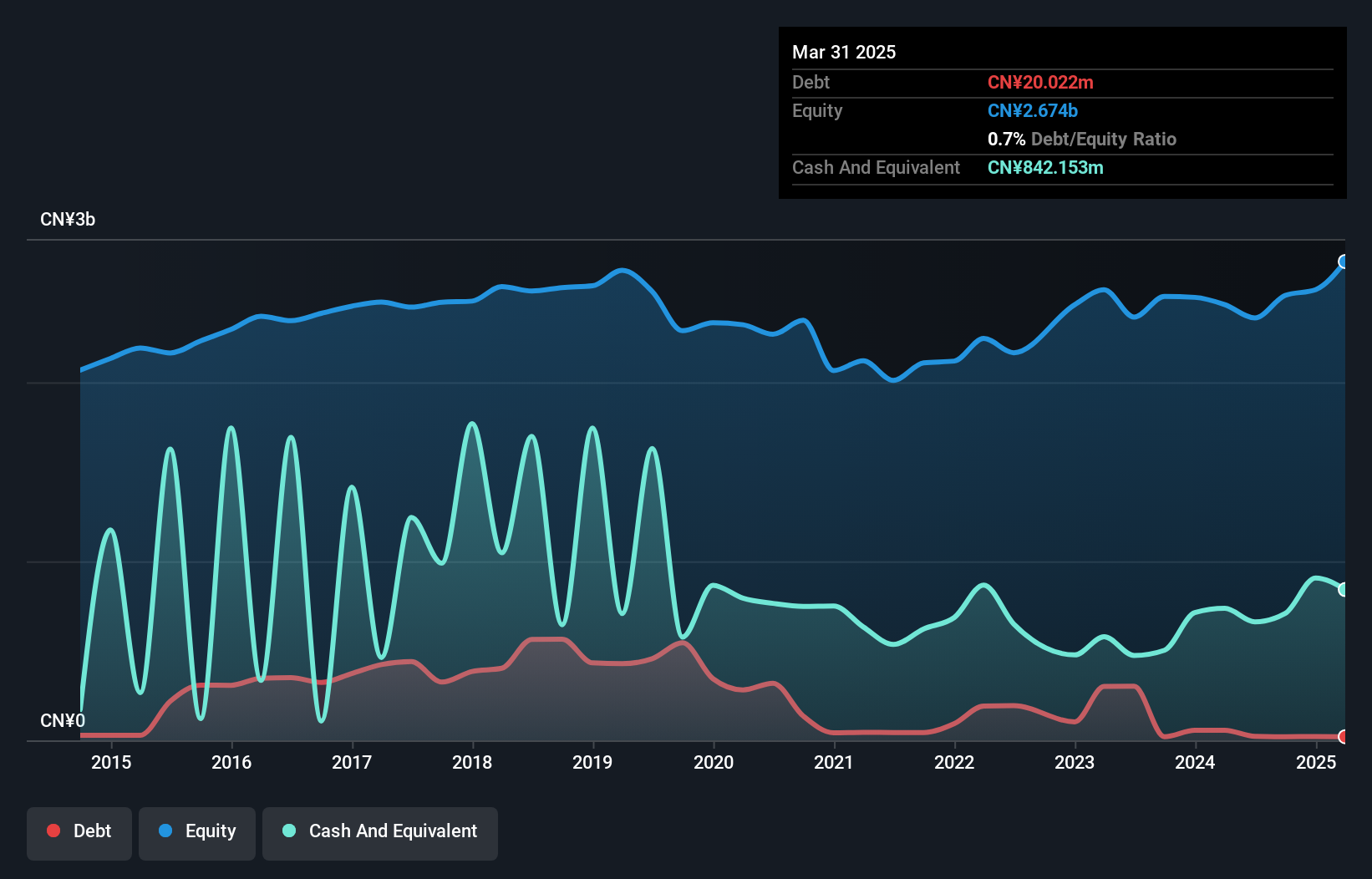

Overview: Changzhou Qianhong Biopharma Co., Ltd. is a company that specializes in the manufacturing and distribution of polysaccharide and protease drugs in China, with a market cap of CN¥7.99 billion.

Operations: Qianhong Biopharma generates revenue primarily through the sale of polysaccharide and protease drugs. The company focuses on optimizing its cost structure to enhance profitability, reflected in its net profit margin trends.

Qianhong Biopharma, a nimble player in the pharmaceutical space, showcases robust financial health with earnings growth of 16.1% over the past year, outpacing its industry peers. The company’s debt-to-equity ratio impressively improved from 23.8% to 0.8% in five years, suggesting prudent financial management. Trading at a significant discount to its estimated fair value by 77.8%, it seems undervalued relative to its potential earnings growth of 16.74% annually. Recent earnings highlight a net income jump to CNY 309 million from CNY 198 million last year, despite sales dipping slightly from CNY 1,466 million to CNY 1,208 million.

Seize The Opportunity

- Dive into all 4626 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002550

Changzhou Qianhong BiopharmaLTD

Manufactures and distributes polysaccharide and protease drugs in China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives