- Saudi Arabia

- /

- Healthcare Services

- /

- SASE:9527

Alf Meem Yaa for Medical Supplies and Equipment Company's (TADAWUL:9527) Price Is Right But Growth Is Lacking After Shares Rocket 33%

Alf Meem Yaa for Medical Supplies and Equipment Company (TADAWUL:9527) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. The last month tops off a massive increase of 106% in the last year.

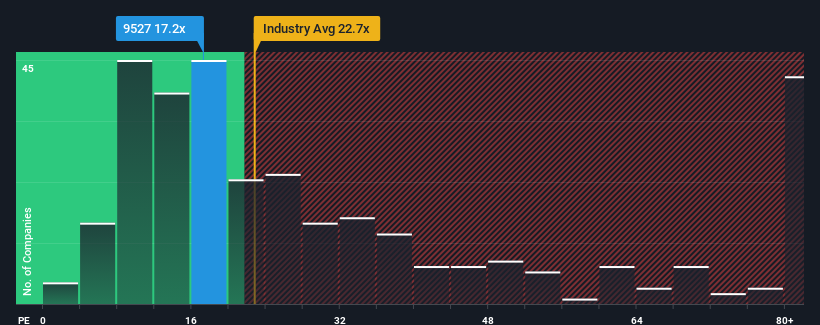

In spite of the firm bounce in price, given about half the companies in Saudi Arabia have price-to-earnings ratios (or "P/E's") above 25x, you may still consider Alf Meem Yaa for Medical Supplies and Equipment as an attractive investment with its 17.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Alf Meem Yaa for Medical Supplies and Equipment has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Alf Meem Yaa for Medical Supplies and Equipment

What Are Growth Metrics Telling Us About The Low P/E?

Alf Meem Yaa for Medical Supplies and Equipment's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 13% last year. This was backed up an excellent period prior to see EPS up by 36% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Alf Meem Yaa for Medical Supplies and Equipment's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Alf Meem Yaa for Medical Supplies and Equipment's P/E?

Despite Alf Meem Yaa for Medical Supplies and Equipment's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Alf Meem Yaa for Medical Supplies and Equipment revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Alf Meem Yaa for Medical Supplies and Equipment is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

If you're unsure about the strength of Alf Meem Yaa for Medical Supplies and Equipment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9527

Alf Meem Yaa for Medical Supplies and Equipment

Distributes medical devices, equipment, and supplies for the aesthetic market in the Kingdom of Saudi Arabia.

Flawless balance sheet with questionable track record.