- Saudi Arabia

- /

- Food

- /

- SASE:9559

Balady Poultry (TADAWUL:9559) Ticks All The Boxes When It Comes To Earnings Growth

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Balady Poultry (TADAWUL:9559). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Balady Poultry

Balady Poultry's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. Balady Poultry's EPS has risen over the last 12 months, growing from ر.س10.92 to ر.س12.67. This amounts to a 16% gain; a figure that shareholders will be pleased to see.

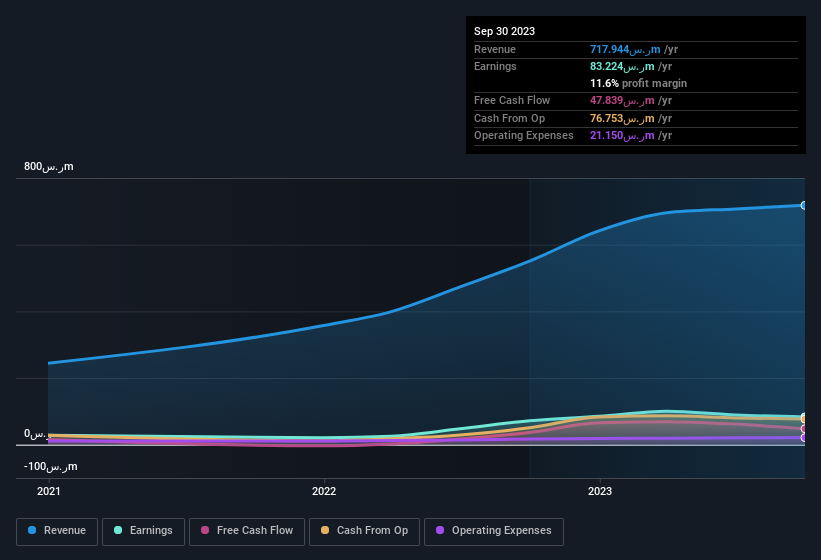

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Balady Poultry achieved similar EBIT margins to last year, revenue grew by a solid 30% to ر.س718m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Balady Poultry's balance sheet strength, before getting too excited.

Are Balady Poultry Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So we're pleased to report that Balady Poultry insiders own a meaningful share of the business. To be exact, company insiders hold 71% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. And their holding is extremely valuable at the current share price, totalling ر.س1.4b. That means they have plenty of their own capital riding on the performance of the business!

Does Balady Poultry Deserve A Spot On Your Watchlist?

One important encouraging feature of Balady Poultry is that it is growing profits. To add an extra spark to the fire, significant insider ownership in the company is another highlight. The combination definitely favoured by investors so consider keeping the company on a watchlist. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Balady Poultry that you should be aware of.

Although Balady Poultry certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Saudi companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Balady Poultry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:9559

Balady Poultry

Produces poultry products in the Kingdom of Saudi Arabia, other GCC countries, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives