- Saudi Arabia

- /

- Food

- /

- SASE:2050

3 Dividend Stocks To Consider With Up To 6.4% Yield

Reviewed by Simply Wall St

As global markets react to political shifts and economic indicators, U.S. stocks have reached record highs, buoyed by optimism around potential trade deals and AI investments. Amidst this backdrop of market enthusiasm and fluctuating growth dynamics, dividend stocks stand out as a compelling choice for investors seeking steady income streams in an evolving landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

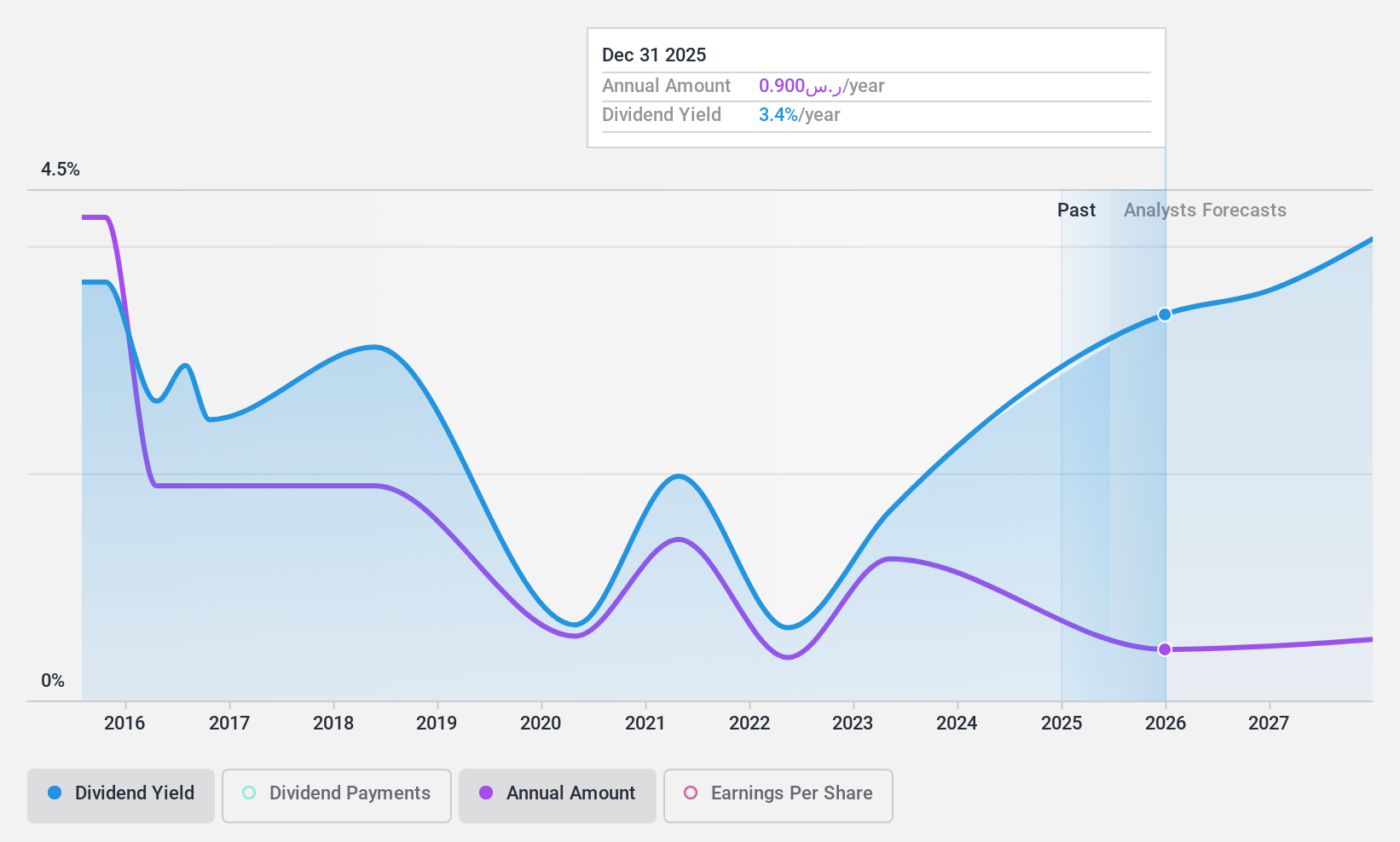

Savola Group (SASE:2050)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Savola Group Company, along with its subsidiaries, is involved in the production, marketing, and distribution of food products and has a market capitalization of SAR11.32 billion.

Operations: Savola Group's revenue segments consist of Retail (SAR10.49 billion), Investments (SAR28.30 million), Frozen Foods (SAR740.58 million), Food Services (SAR1.17 billion), and Food Processing (SAR13.82 billion).

Dividend Yield: 6.4%

Savola Group's dividend profile shows mixed signals. While the company offers a high dividend yield, placing it in the top 25% of Saudi Arabia's market, its dividends have been volatile and unreliable over the past decade. The payout ratio of 45.8% suggests dividends are well-covered by earnings, yet cash flow coverage is tighter at 89.3%. Recent stock splits and significant shareholder dilution could impact future dividend stability and investor sentiment.

- Click here and access our complete dividend analysis report to understand the dynamics of Savola Group.

- Our comprehensive valuation report raises the possibility that Savola Group is priced lower than what may be justified by its financials.

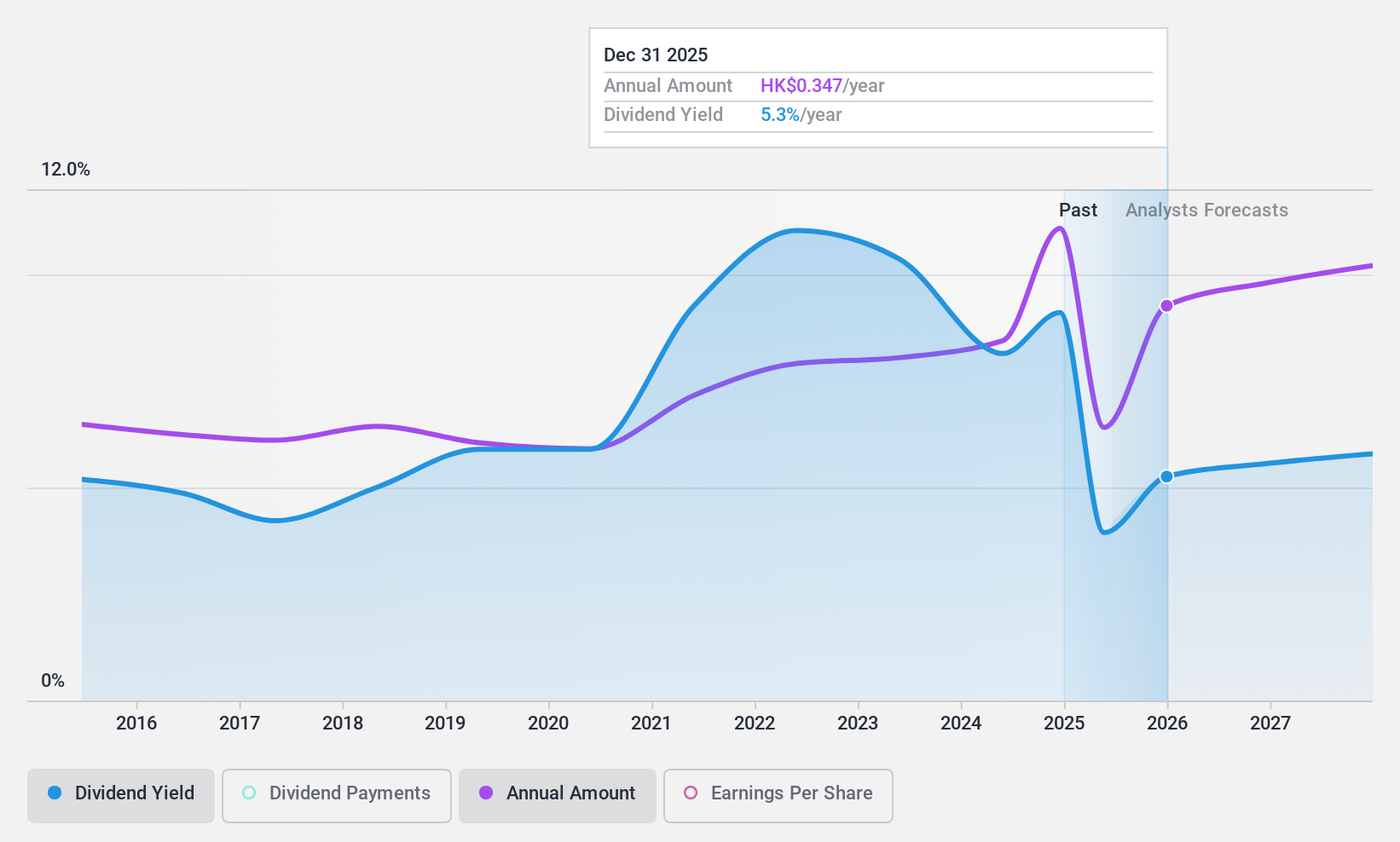

Chongqing Rural Commercial Bank (SEHK:3618)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chongqing Rural Commercial Bank Co., Ltd. provides banking services in the People’s Republic of China and has a market capitalization of approximately HK$68.58 billion.

Operations: Chongqing Rural Commercial Bank Co., Ltd. generates its revenue through various banking services offered in the People’s Republic of China.

Dividend Yield: 6.4%

Chongqing Rural Commercial Bank's dividend is well-supported by a low payout ratio of 29.8%, indicating sustainability. The bank has maintained stable and reliable dividends over the past decade, with payments showing consistent growth. Although its current yield of 6.42% is below the top tier in Hong Kong, it remains attractive for income investors due to its strong coverage by earnings and expected continued coverage at a similar level in three years. Recent executive changes are unlikely to affect dividend stability significantly.

- Unlock comprehensive insights into our analysis of Chongqing Rural Commercial Bank stock in this dividend report.

- Our valuation report unveils the possibility Chongqing Rural Commercial Bank's shares may be trading at a discount.

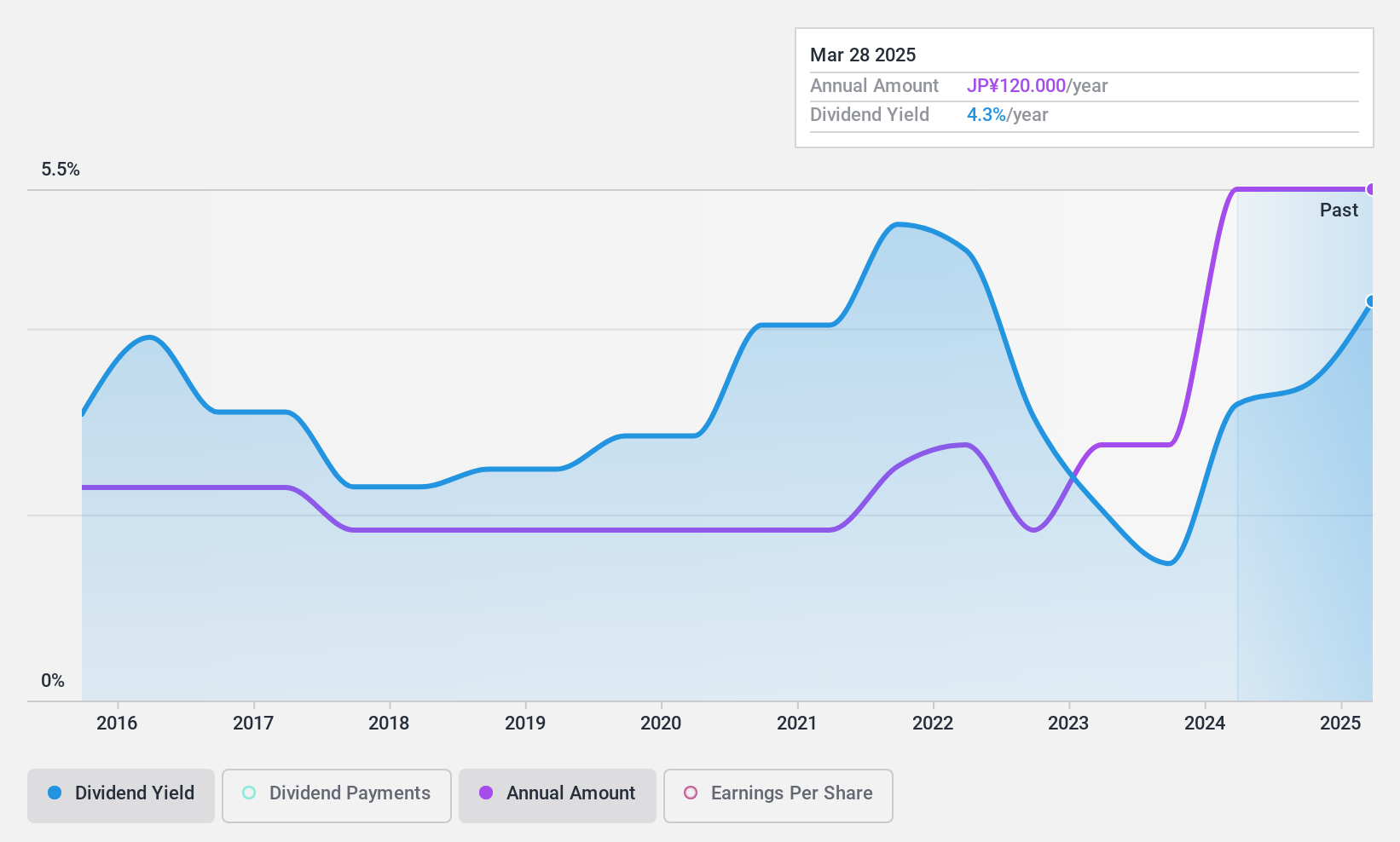

Daikoku Denki (TSE:6430)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daikoku Denki Co., Ltd. is involved in the development, production, and sale of computer and information system equipment for pachinko halls in Japan, with a market cap of ¥44.06 billion.

Operations: Daikoku Denki Co., Ltd. generates revenue through the development, production, and sale of computer and information system equipment for pachinko halls in Japan.

Dividend Yield: 4%

Daikoku Denki's dividend is well-supported by a low payout ratio of 11.3% and a cash payout ratio of 27.6%, ensuring sustainability through earnings and cash flows. Despite an increase in dividends over the past decade, payments have been volatile, with significant annual drops exceeding 20%. Trading at 68% below its estimated fair value, the stock offers a yield of 4.03%, placing it in the top quartile among Japanese dividend payers.

- Take a closer look at Daikoku Denki's potential here in our dividend report.

- Our valuation report here indicates Daikoku Denki may be undervalued.

Seize The Opportunity

- Get an in-depth perspective on all 1981 Top Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2050

Solid track record and good value.

Market Insights

Community Narratives