- Saudi Arabia

- /

- Oil and Gas

- /

- SASE:4030

National Shipping Company of Saudi Arabia (TADAWUL:4030) shareholders have earned a 14% CAGR over the last five years

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. Buying under-rated businesses is one path to excess returns. To wit, the National Shipping Company of Saudi Arabia share price has climbed 69% in five years, easily topping the market return of 30% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 32% in the last year, including dividends.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for National Shipping Company of Saudi Arabia

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

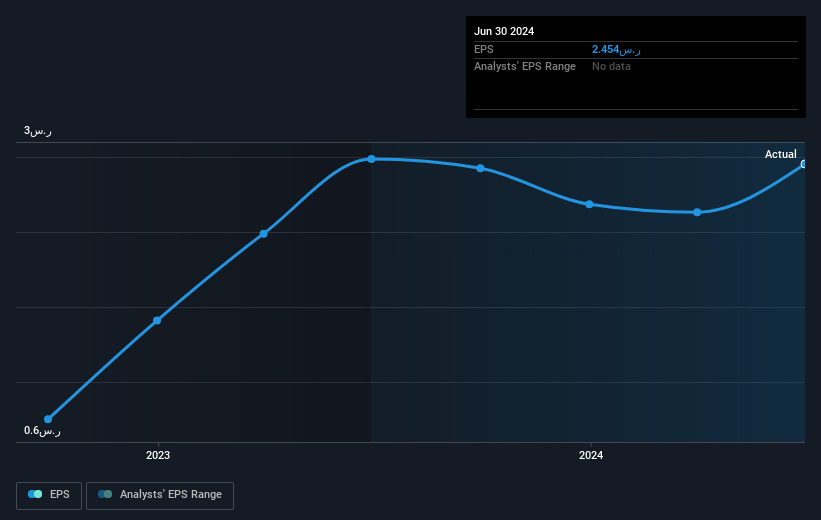

Over half a decade, National Shipping Company of Saudi Arabia managed to grow its earnings per share at 35% a year. The EPS growth is more impressive than the yearly share price gain of 11% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. This cautious sentiment is reflected in its (fairly low) P/E ratio of 11.76.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into National Shipping Company of Saudi Arabia's key metrics by checking this interactive graph of National Shipping Company of Saudi Arabia's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, National Shipping Company of Saudi Arabia's TSR for the last 5 years was 95%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that National Shipping Company of Saudi Arabia has rewarded shareholders with a total shareholder return of 32% in the last twelve months. And that does include the dividend. That gain is better than the annual TSR over five years, which is 14%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand National Shipping Company of Saudi Arabia better, we need to consider many other factors. Even so, be aware that National Shipping Company of Saudi Arabia is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

If you're looking to trade National Shipping Company of Saudi Arabia, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if National Shipping Company of Saudi Arabia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4030

National Shipping Company of Saudi Arabia

The National Shipping Company of Saudi Arabia, together with its subsidiaries, purchases, sells, and operates vessels for the transportation of cargo in the Kingdom of Saudi Arabia.

Proven track record with adequate balance sheet.