- Saudi Arabia

- /

- Diversified Financial

- /

- SASE:4280

We Wouldn't Be Too Quick To Buy Kingdom Holding Company (TADAWUL:4280) Before It Goes Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Kingdom Holding Company (TADAWUL:4280) is about to go ex-dividend in just three days. If you purchase the stock on or after the 3rd of January, you won't be eligible to receive this dividend, when it is paid on the 15th of January.

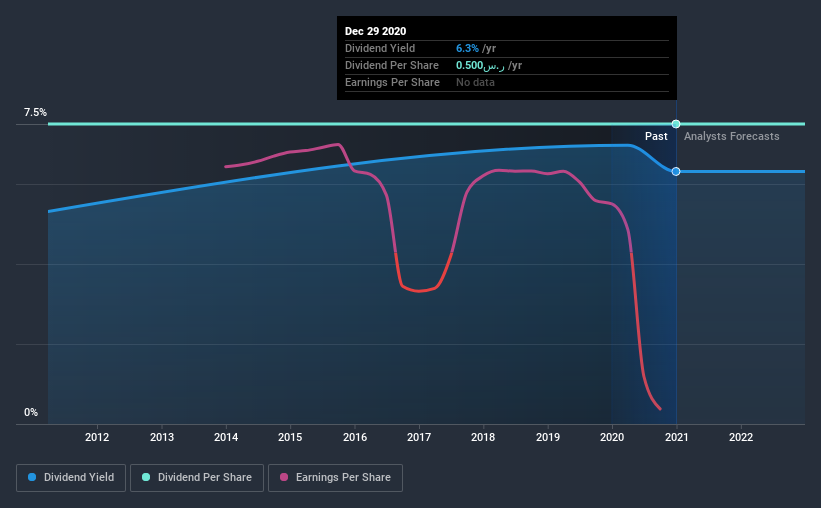

Kingdom Holding's next dividend payment will be ر.س0.13 per share, and in the last 12 months, the company paid a total of ر.س0.50 per share. Based on the last year's worth of payments, Kingdom Holding stock has a trailing yield of around 6.3% on the current share price of SAR7.92. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for Kingdom Holding

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Kingdom Holding lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable.

Click here to see how much of its profit Kingdom Holding paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Kingdom Holding was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Kingdom Holding's dividend payments are effectively flat on where they were 10 years ago. If a company's dividend stays flat while earnings are in decline, this is typically a sign that it is paying out a larger percentage of its earnings. This can become unsustainable if earnings fall far enough.

We update our analysis on Kingdom Holding every 24 hours, so you can always get the latest insights on its financial health, here.

The Bottom Line

Should investors buy Kingdom Holding for the upcoming dividend? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Worse, the general trend in its earnings looks negative in recent years. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

With that being said, if you're still considering Kingdom Holding as an investment, you'll find it beneficial to know what risks this stock is facing. Case in point: We've spotted 2 warning signs for Kingdom Holding you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Kingdom Holding, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kingdom Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4280

Kingdom Holding

A private equity firm specializing in making investments in banking and financial services, real estate, luxury hotels and hotel management, digital services, e-commerce, investment funds, hospitality, aviation, hotel real estate, petrochemicals, ride sharing, media and publishing, entertainment, healthcare including healthcare provision and healthcare management and consultancy, education, energy, manufacturing, consumer and retail, agriculture, social media, technology and industrial sectors.

Mediocre balance sheet second-rate dividend payer.