- Saudi Arabia

- /

- Diversified Financial

- /

- SASE:4280

Kingdom Holding (TADAWUL:4280) Is Due To Pay A Dividend Of ر.س0.13

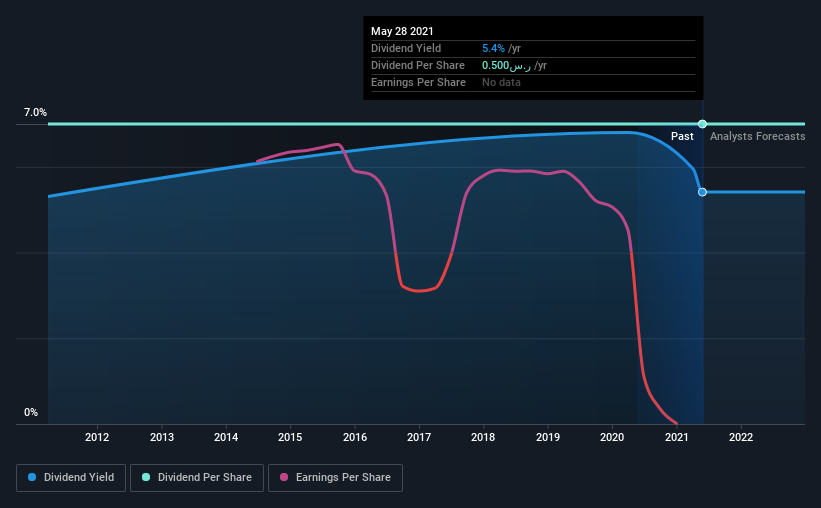

Kingdom Holding Company's (TADAWUL:4280) investors are due to receive a payment of ر.س0.13 per share on 18th of July. This makes the dividend yield 5.4%, which will augment investor returns quite nicely.

View our latest analysis for Kingdom Holding

Kingdom Holding Might Find It Hard To Continue The Dividend

A big dividend yield for a few years doesn't mean much if it can't be sustained. Kingdom Holding isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. These payout levels would generally be quite difficult to keep up.

Recent, EPS has fallen by 31.6%, so this could continue over the next year. This means the company will be unprofitable and managers could face the tough choice between continuing to pay the dividend or taking pressure off the balance sheet.

Kingdom Holding Has A Solid Track Record

The company has an extended history of paying stable dividends. The payments haven't really changed that much since 10 years ago. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Dividend Growth Potential Is Shaky

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Kingdom Holding's EPS has declined at around 32% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

Kingdom Holding's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Kingdom Holding's payments, as there could be some issues with sustaining them into the future. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Kingdom Holding that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kingdom Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:4280

Kingdom Holding

A private equity firm specializing in making investments in banking and financial services, real estate, luxury hotels and hotel management, digital services, e-commerce, investment funds, hospitality, aviation, hotel real estate, petrochemicals, ride sharing, media and publishing, entertainment, healthcare including healthcare provision and healthcare management and consultancy, education, energy, manufacturing, consumer and retail, agriculture, social media, technology and industrial sectors.

Acceptable track record second-rate dividend payer.