In recent weeks, most Gulf bourses have seen an uptick, buoyed by rising oil prices and anticipation around the U.S. Federal Reserve's policy meeting. This positive sentiment in the Middle East market sets a promising backdrop for identifying undiscovered gems among small-cap stocks, which often thrive on strong economic indicators and favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 17.10% | 23.35% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Y.D. More Investments | 50.84% | 28.28% | 35.02% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Tamkeen Human Resources (SASE:1835)

Simply Wall St Value Rating: ★★★★★★

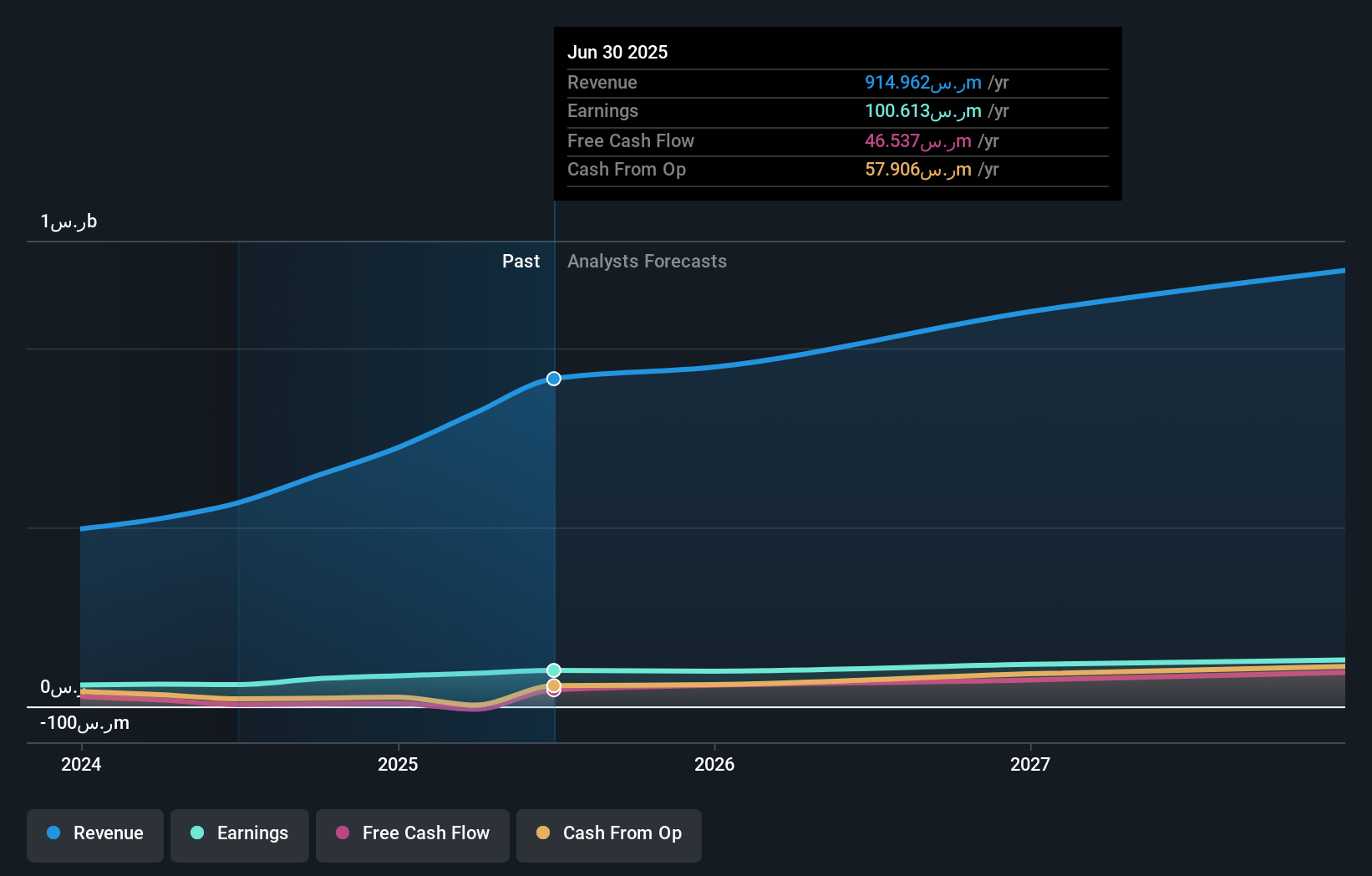

Overview: Tamkeen Human Resources Company provides labor recruitment and manpower services in Saudi Arabia, with a market capitalization of SAR 1.61 billion.

Operations: Tamkeen generates revenue primarily from two segments: Corporate, contributing SAR 714.57 million, and Individuals, adding SAR 200.39 million.

Tamkeen Human Resources, a smaller player in the Middle East market, has shown impressive growth with earnings surging by 65.7% over the past year, outpacing industry averages. The company reported second-quarter sales of SAR 265 million, up from SAR 169 million in the previous year, while net income rose to SAR 26.7 million from SAR 18.65 million. With no debt on its books and trading at approximately 13.8% below estimated fair value, Tamkeen seems well-positioned for continued growth. Additionally, a dividend of SAR 1.4 per share was recently announced for shareholders, reflecting strong financial health and shareholder commitment.

- Dive into the specifics of Tamkeen Human Resources here with our thorough health report.

Explore historical data to track Tamkeen Human Resources' performance over time in our Past section.

Nayifat Finance (SASE:4081)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nayifat Finance Company offers personal financing solutions in the Kingdom of Saudi Arabia with a market capitalization of SAR1.57 billion.

Operations: Nayifat Finance generates revenue primarily from personal financing, contributing SAR 241.36 million, followed by SME financing at SAR 40.96 million and Islamic credit cards at SAR 1.76 million.

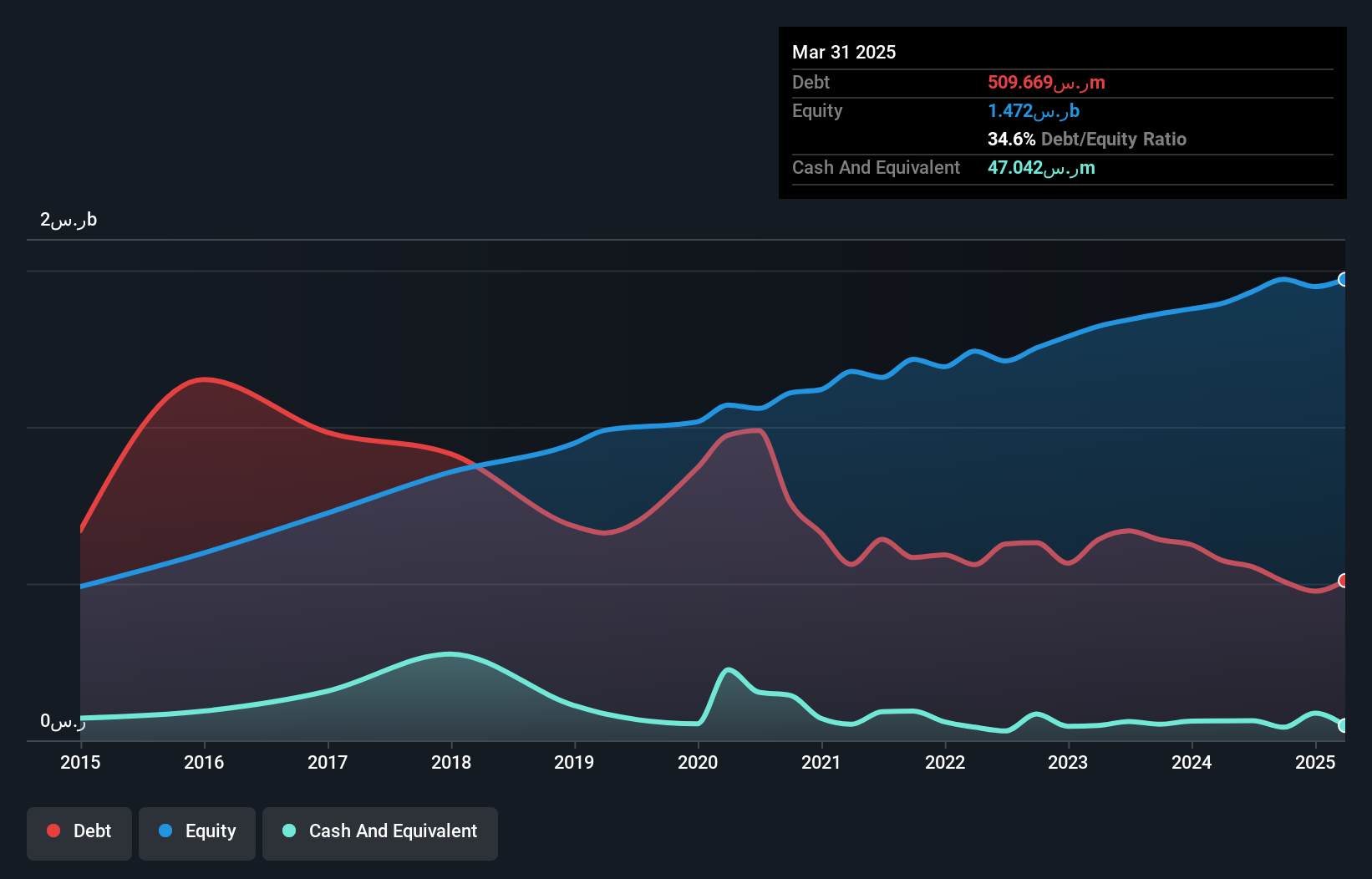

Nayifat Finance, a promising player in the Middle East financial sector, showcases a mixed performance. Over the past year, earnings surged by 26.9%, outpacing the Consumer Finance industry at 10.9%. However, net income for Q2 2025 was SAR 15.57 million compared to SAR 38.32 million last year, reflecting challenges in maintaining momentum. The debt-to-equity ratio improved significantly from 93.4% to 36.6% over five years, indicating prudent financial management and a satisfactory net debt-to-equity ratio of 33.3%. With high-quality past earnings and a price-to-earnings ratio of just 13.7x against the SA market's average of 20.8x, Nayifat offers value potential despite recent earnings contraction trends.

- Get an in-depth perspective on Nayifat Finance's performance by reading our health report here.

Assess Nayifat Finance's past performance with our detailed historical performance reports.

TSG IT Advanced Systems (TASE:TSG)

Simply Wall St Value Rating: ★★★★★☆

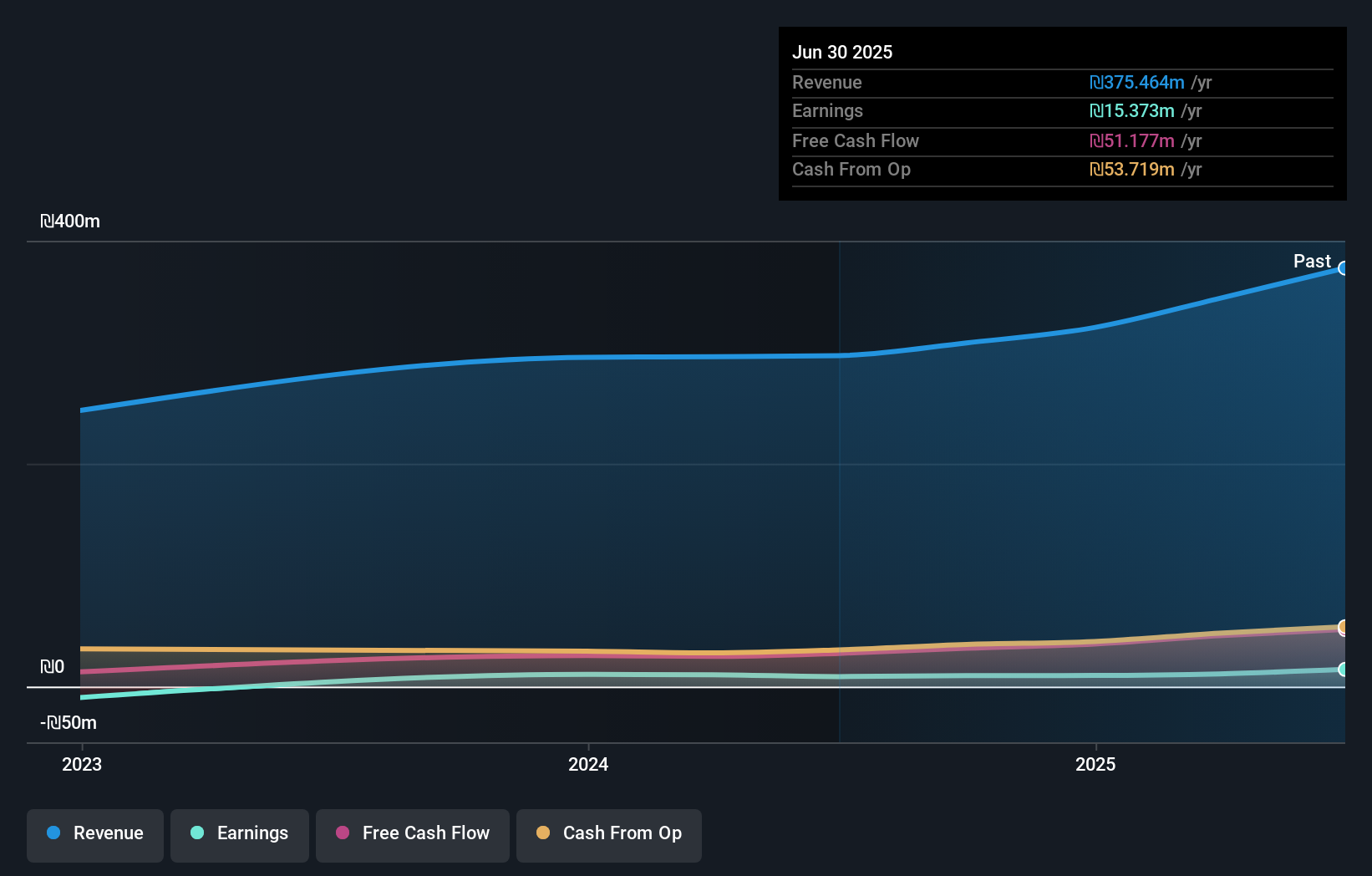

Overview: TSG IT Advanced Systems Ltd offers technological products and solutions for security, civil service, and municipal sectors with a market cap of ₪896.94 million.

Operations: TSG IT Advanced Systems generates revenue primarily from its Defense Activity Sector, contributing ₪287.37 million, and the Civil Activity Sector, adding ₪88.10 million.

TSG IT Advanced Systems, a small player in the tech sector, has shown remarkable earnings growth of 71.6% over the past year, outpacing the industry average of 26.6%. The company's net debt to equity ratio stands at a satisfactory 14.6%, indicating prudent financial management. Despite experiencing share price volatility recently, TSG's interest payments are well covered by EBIT with a coverage ratio of 3x. In recent results for Q2 2025, sales reached ILS 104.59 million from ILS 77.33 million last year, while net income rose to ILS 4.73 million from ILS 0.76 million previously—a clear indicator of robust performance and potential for future growth.

- Unlock comprehensive insights into our analysis of TSG IT Advanced Systems stock in this health report.

Gain insights into TSG IT Advanced Systems' past trends and performance with our Past report.

Key Takeaways

- Dive into all 209 of the Middle Eastern Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TSG IT Advanced Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:TSG

TSG IT Advanced Systems

Provides technological products and solutions for the fields of security, civil service, and the municipal sectors.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives