- Saudi Arabia

- /

- Consumer Finance

- /

- SASE:4081

Exploring Three Promising Undiscovered Gems With Strong Potential

Reviewed by Simply Wall St

In recent weeks, global markets have been marked by volatility, with small-cap stocks underperforming their large-cap counterparts as the Russell 2000 Index dipped into correction territory. Amidst concerns over inflation and political uncertainty, investors are navigating a choppy start to the year while keeping an eye on upcoming corporate earnings and Federal Reserve updates. In such an environment, identifying promising stocks requires a focus on companies with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| NJS | NA | 5.31% | 7.12% | ★★★★★★ |

| GakkyushaLtd | 19.76% | 4.94% | 18.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chuo WarehouseLtd | 12.36% | 0.35% | 9.16% | ★★★★★★ |

| MIRARTH HOLDINGSInc | 261.26% | 3.32% | 0.93% | ★★★★★☆ |

| Hayleys | 140.54% | 19.07% | 20.35% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

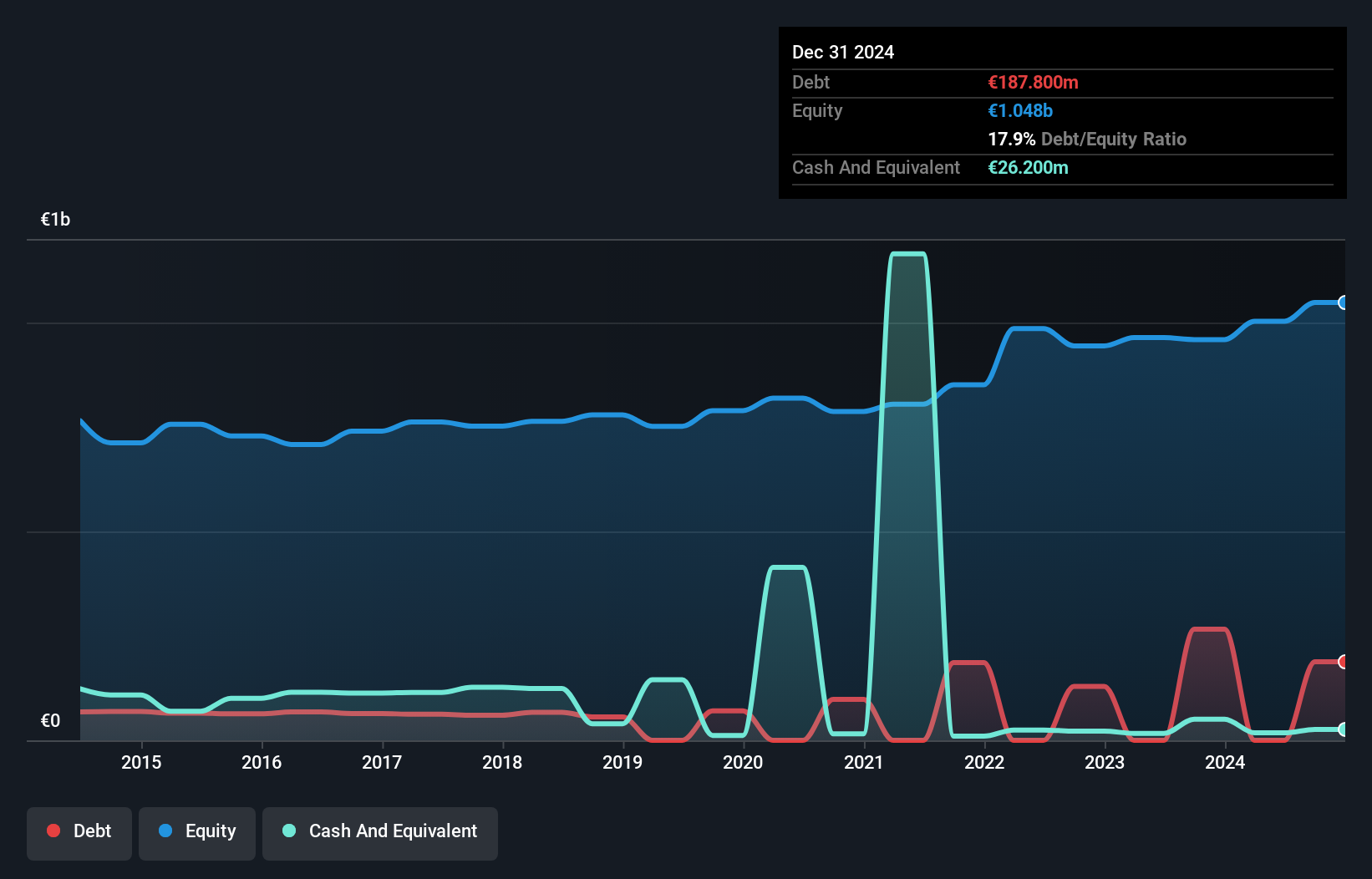

Gelsenwasser (DB:WWG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gelsenwasser AG operates in the water, wastewater, gas supply, and electricity sectors across Germany, the Czech Republic, and Poland with a market capitalization of €1.74 billion.

Operations: Gelsenwasser AG generates revenue primarily from energy sales (€3.93 billion) and energy grids (€271.20 million), with additional contributions from water services (€286.30 million) and wastewater management (€39.20 million). The company has a market capitalization of €1.74 billion, reflecting its significant presence in the utility sector across multiple regions.

Gelsenwasser, a relatively under-the-radar player in the utilities sector, boasts impressive financial health with no debt on its books for the past five years. Its earnings growth of 32.9% over the last year significantly outpaces the industry average of 2.6%, highlighting robust performance. The company is trading at a substantial discount, valued at 87.3% below fair value estimates, suggesting potential upside for investors seeking undervalued opportunities. With high-quality earnings and positive free cash flow, Gelsenwasser appears well-positioned within its sector despite not being widely recognized yet as an investment gem.

- Click to explore a detailed breakdown of our findings in Gelsenwasser's health report.

Examine Gelsenwasser's past performance report to understand how it has performed in the past.

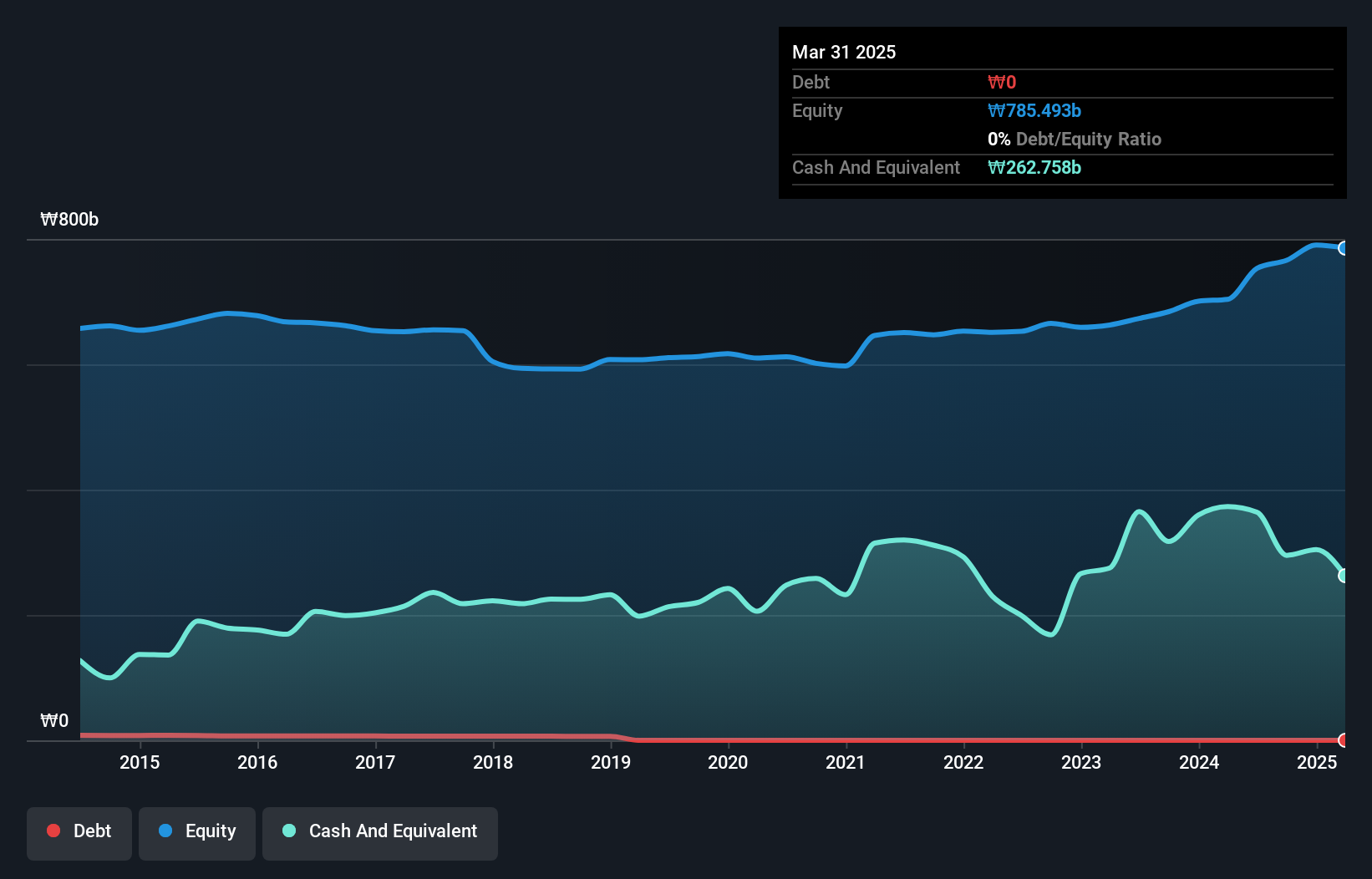

Snt DynamicsLtd (KOSE:A003570)

Simply Wall St Value Rating: ★★★★★★

Overview: Snt Dynamics Co., Ltd. specializes in the manufacturing and sale of precision machinery, with a market capitalization of ₩455.71 billion.

Operations: Snt Dynamics generates revenue primarily from its Transportation Equipment Business, contributing ₩586.42 billion, while the Machinery Business accounts for ₩4.97 billion.

Snt Dynamics Ltd. stands out with a robust performance, showcasing earnings growth of 139% over the past year, surpassing the Aerospace & Defense industry average of 130%. The company is debt-free, eliminating concerns over interest payments. Trading at a significant discount of 74% below its estimated fair value, it appears undervalued. Recent earnings reports highlight net income rising to KRW 17.45 billion in Q3 from KRW 13.48 billion a year prior, with basic EPS climbing to KRW 779 from KRW 602. Despite these strengths, forecasts suggest earnings may decline by an average of nearly 20% annually for the next three years.

- Get an in-depth perspective on Snt DynamicsLtd's performance by reading our health report here.

Gain insights into Snt DynamicsLtd's past trends and performance with our Past report.

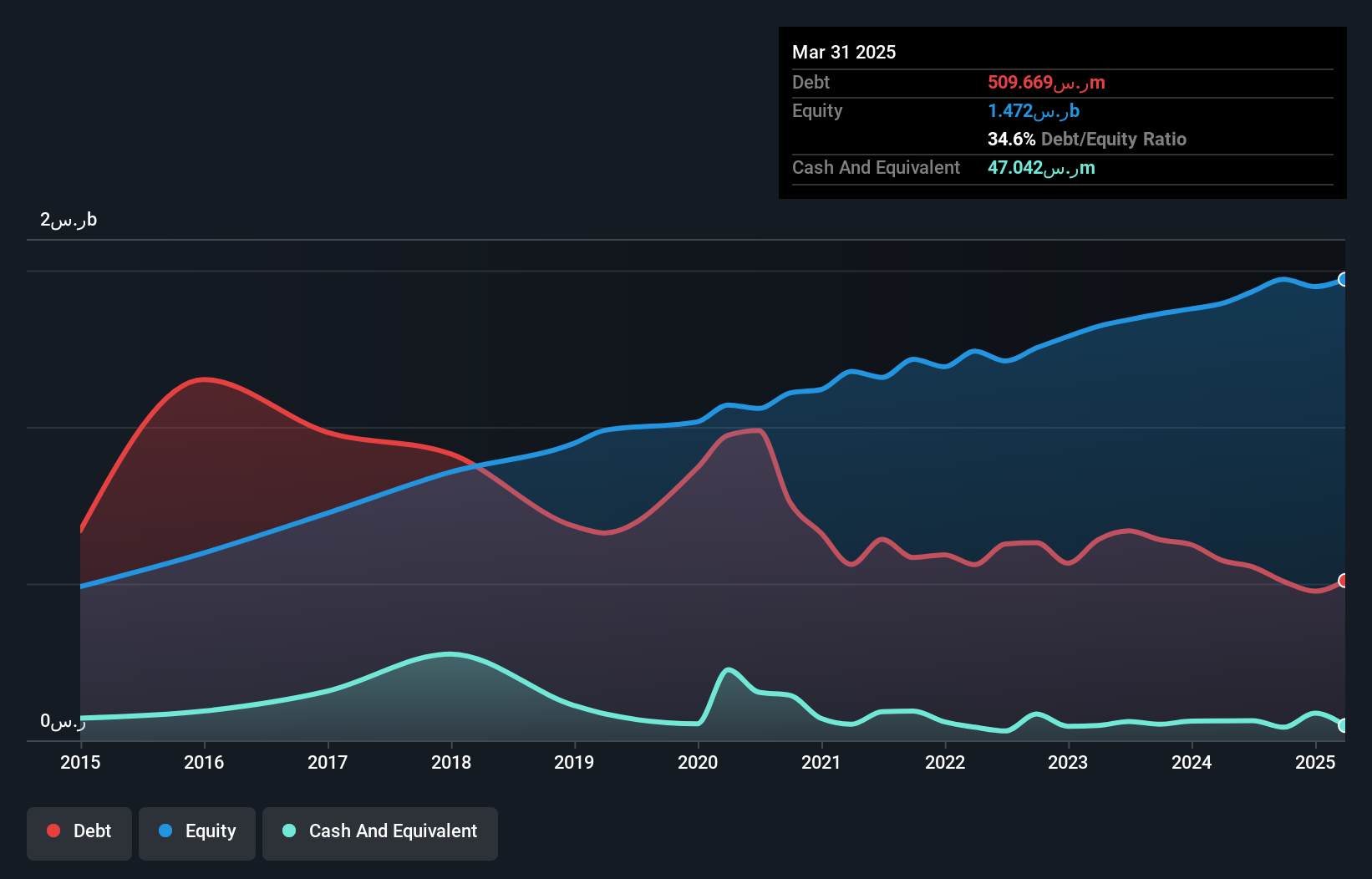

Nayifat Finance (SASE:4081)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nayifat Finance Company is a non-banking finance company offering Tawarruq cash financing solutions to consumers, SMEs, individuals, and corporates in Saudi Arabia, with a market capitalization of SAR1.81 billion.

Operations: Nayifat Finance generates revenue primarily through personal financing (SAR351.02 million), SME financing (SAR55.88 million), and Islamic credit cards (SAR12.03 million).

Nayifat Finance, a relatively small player in the consumer finance sector, has shown resilience despite its earnings growth of 1.2% lagging behind the industry average of 12.6%. The company boasts high-quality earnings and trades at a favorable price-to-earnings ratio of 16.5x compared to the SA market's 23.4x, suggesting it might be undervalued. Over five years, Nayifat has improved its financial health by reducing its debt-to-equity ratio from 79.4% to a more manageable 34.5%. Recent performance highlights include net income for Q3 at SAR 38.92 million and basic EPS doubling from SAR 0.16 to SAR 0.32 year-on-year, indicating solid profitability improvements amidst challenging conditions.

- Click here and access our complete health analysis report to understand the dynamics of Nayifat Finance.

Understand Nayifat Finance's track record by examining our Past report.

Make It Happen

- Embark on your investment journey to our 4536 Undiscovered Gems With Strong Fundamentals selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nayifat Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4081

Nayifat Finance

Provides personal financing solutions in the Kingdom of Saudi Arabia.

Adequate balance sheet unattractive dividend payer.

Market Insights

Community Narratives