- Saudi Arabia

- /

- Hospitality

- /

- SASE:6014

It Might Not Be A Great Idea To Buy Alamar Foods Company (TADAWUL:6014) For Its Next Dividend

It looks like Alamar Foods Company (TADAWUL:6014) is about to go ex-dividend in the next 3 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase Alamar Foods' shares before the 27th of November in order to receive the dividend, which the company will pay on the 10th of December.

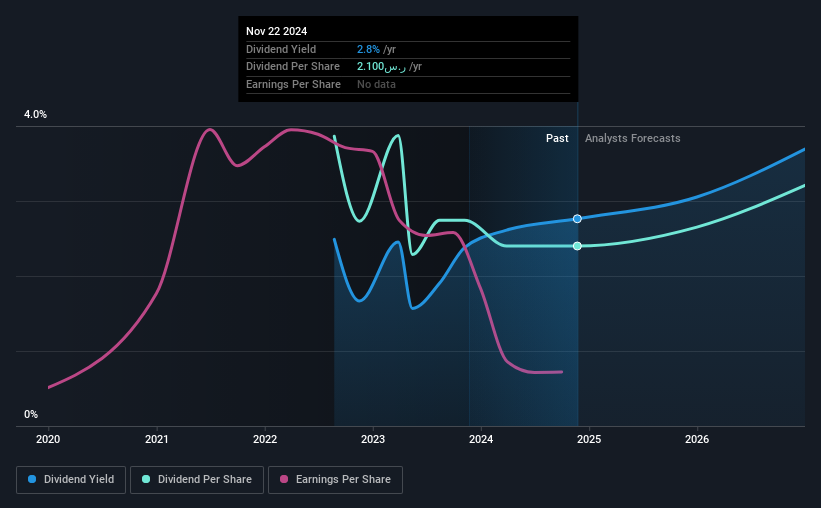

The company's next dividend payment will be ر.س0.60 per share, on the back of last year when the company paid a total of ر.س2.10 to shareholders. Calculating the last year's worth of payments shows that Alamar Foods has a trailing yield of 2.8% on the current share price of ر.س76.00. If you buy this business for its dividend, you should have an idea of whether Alamar Foods's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Alamar Foods

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Last year, Alamar Foods paid out 211% of its profit to shareholders in the form of dividends. This is not sustainable behaviour and requires a closer look on behalf of the purchaser. A useful secondary check can be to evaluate whether Alamar Foods generated enough free cash flow to afford its dividend. Over the last year it paid out 56% of its free cash flow as dividends, within the usual range for most companies.

It's good to see that while Alamar Foods's dividends were not covered by profits, at least they are affordable from a cash perspective. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. Readers will understand then, why we're concerned to see Alamar Foods's earnings per share have dropped 26% a year over the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Alamar Foods's dividend payments per share have declined at 21% per year on average over the past two years, which is uninspiring. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

The Bottom Line

Has Alamar Foods got what it takes to maintain its dividend payments? Earnings per share have been in decline, which is not encouraging. Additionally, Alamar Foods is paying out quite a high percentage of its earnings, and more than half its cash flow, so it's hard to evaluate whether the company is reinvesting enough in its business to improve its situation. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Alamar Foods. Our analysis shows 2 warning signs for Alamar Foods and you should be aware of them before buying any shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:6014

Alamar Foods

Alamar Foods Company, together with its subsidiaries, establishes, operates, and manages fast food restaurants in the Kingdom of Saudi Arabia, other Gulf Cooperation Council and Levant countries, and North Africa.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives