- Saudi Arabia

- /

- Hospitality

- /

- SASE:6012

Recent 3.2% pullback isn't enough to hurt long-term Raydan Food (TADAWUL:6012) shareholders, they're still up 135% over 3 years

While Raydan Food Company (TADAWUL:6012) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 26% in the last quarter. But that doesn't change the fact that the returns over the last three years have been respectable. In fact the stock is up 78%, which is better than the market return of 66%.

Since the long term performance has been good but there's been a recent pullback of 3.2%, let's check if the fundamentals match the share price.

See our latest analysis for Raydan Food

Given that Raydan Food didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Raydan Food saw its revenue shrink by 24% per year. Despite the lack of revenue growth, the stock has returned 21%, compound, over three years. Unless the company is going to make profits soon, we would be pretty cautious about it.

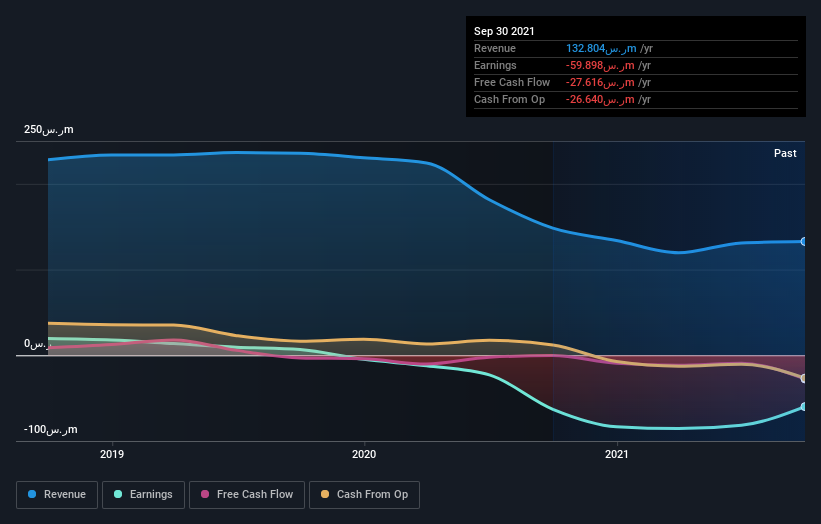

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Raydan Food's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Raydan Food's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Raydan Food's TSR of 135% over the last 3 years is better than the share price return.

A Different Perspective

While the market return was 16% in the last year, Raydan Food returned 15% to shareholders. Notably, the longer term shareholders are better off with their TSR of 33% per year over the last three years. Share price gains are anything but steady, so it's a positive to see that the longer term returns are reasonable. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Raydan Food (1 is potentially serious!) that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SA exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SASE:6012

Raydan Food

Operates and franchises restaurants in the Kingdom of Saudi Arabia.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives