- Saudi Arabia

- /

- Hospitality

- /

- SASE:6002

Herfy Food Services Company (TADAWUL:6002) Has Fared Decently But Fundamentals Look Uncertain: What Lies Ahead For The Stock?

Herfy Food Services' (TADAWUL:6002) stock up by 4.8% over the past three months. However, the company's financials look a bit inconsistent and market outcomes are ultimately driven by long-term fundamentals, meaning that the stock could head in either direction. Specifically, we decided to study Herfy Food Services' ROE in this article.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Herfy Food Services

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Herfy Food Services is:

8.6% = ر.س82m ÷ ر.س957m (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each SAR1 of shareholders' capital it has, the company made SAR0.09 in profit.

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Herfy Food Services' Earnings Growth And 8.6% ROE

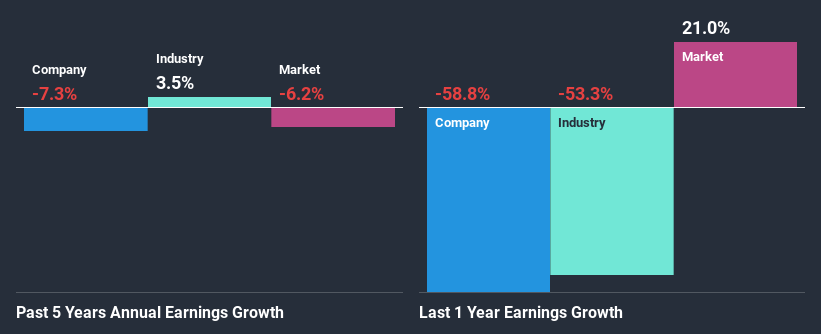

It is hard to argue that Herfy Food Services' ROE is much good in and of itself. However, when compared to the industry average of 4.8%, we do feel there's definitely more to the company. Or may be not, given Herfy Food Services' five year net income decline of 7.3% in the past five years. Remember, the company's ROE is quite low to begin with, just that it is higher than the industry average. Hence, this goes some way in explaining the shrinking earnings.

Next, we compared Herfy Food Services' performance against the industry and found that the industry shrunk its earnings at 18% in the same period, which suggests that the company's earnings have been shrinking at a slower rate than its industry, This does appease the negative sentiment around the company to a certain extent.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Herfy Food Services is trading on a high P/E or a low P/E, relative to its industry.

Is Herfy Food Services Efficiently Re-investing Its Profits?

With a high three-year median payout ratio of 68% (implying that 32% of the profits are retained), most of Herfy Food Services' profits are being paid to shareholders, which explains the company's shrinking earnings. With only a little being reinvested into the business, earnings growth would obviously be low or non-existent.

Additionally, Herfy Food Services has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 69%. However, Herfy Food Services' ROE is predicted to rise to 18% despite there being no anticipated change in its payout ratio.

Summary

On the whole, we feel that the performance shown by Herfy Food Services can be open to many interpretations. On the one hand, the company does have a decent rate of return, however, its earnings growth number is quite disappointing and as discussed earlier, the low retained earnings is hampering the growth. That being so, the latest industry analyst forecasts show that the analysts are expecting to see a huge improvement in the company's earnings growth rate. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

If you decide to trade Herfy Food Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Herfy Food Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SASE:6002

Herfy Food Services

Herfy Food Services Company establishes, operates, and franchises restaurants in the Kingdom of Saudi Arabia and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives