- Saudi Arabia

- /

- Consumer Services

- /

- SASE:4292

Atea Leads Three Exceptional Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

Amid a backdrop of shifting market dynamics, where small-cap and value shares are gaining favor over their growth-oriented counterparts, investors might find it prudent to consider the stability and potential of companies with high insider ownership. Such firms often exhibit alignment between management's interests and shareholder returns, a particularly reassuring trait during periods of economic uncertainty and market volatility.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 25.4% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 36.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.5% | 60.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Vow (OB:VOW) | 31.7% | 97.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 122.7% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

Let's uncover some gems from our specialized screener.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atea ASA specializes in providing IT infrastructure and related solutions to businesses and public-sector organizations across the Nordic countries and Baltic regions, with a market capitalization of NOK 15.77 billion.

Operations: Atea's revenue is generated through IT infrastructure solutions in Norway (NOK 8.39 billion), Sweden (NOK 12.15 billion), Denmark (NOK 7.30 billion), Finland (NOK 3.64 billion), and the Baltics (NOK 1.74 billion).

Insider Ownership: 28.5%

Earnings Growth Forecast: 22% p.a.

Atea, a growth company with high insider ownership, is trading at 39.3% below its estimated fair value, presenting a potential opportunity for value investors. While Atea's revenue growth of 8.1% per year is modest compared to some high-growth benchmarks, it still outpaces the Norwegian market's 2% growth rate. However, its dividend sustainability is questionable as it isn't well covered by earnings or free cash flows. Recent financial reports show a decline in sales and net income compared to the previous year, indicating some operational challenges despite a robust forecasted annual profit growth of 22%.

- Navigate through the intricacies of Atea with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Atea is trading behind its estimated value.

Ataa Educational (SASE:4292)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ataa Educational Company operates in the Kingdom of Saudi Arabia, focusing on establishing national and international schools for kindergarten through secondary education for both boys and girls, with a market capitalization of SAR 2.82 billion.

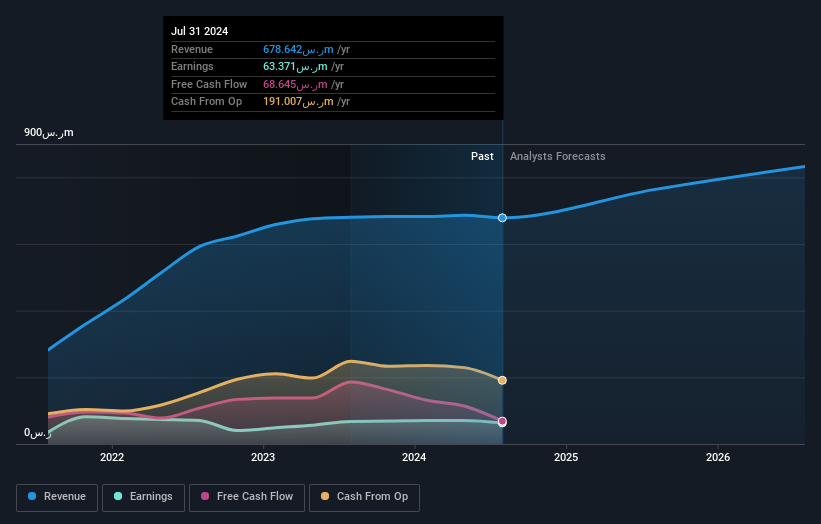

Operations: The company generates revenue primarily through education, with SAR 637.69 million, training services at SAR 32.76 million, and recruitment activities contributing SAR 15.45 million.

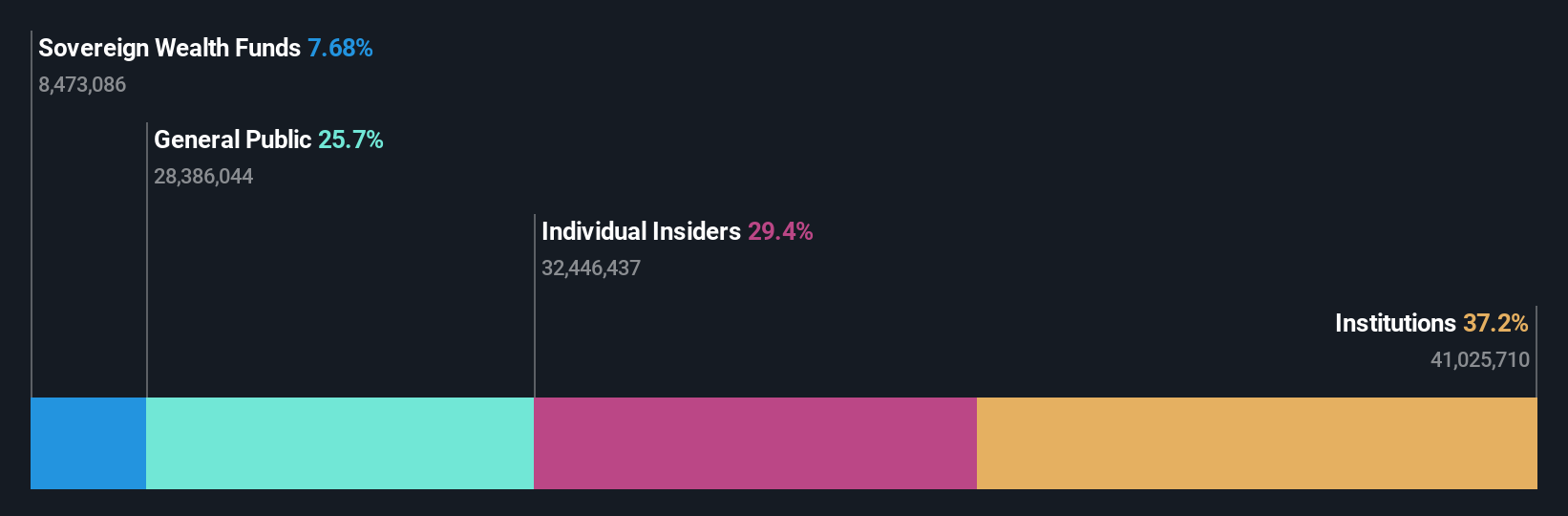

Insider Ownership: 18.5%

Earnings Growth Forecast: 21.3% p.a.

Ataa Educational, a company with significant insider ownership, reported a solid earnings growth of 25.7% last year. Despite its P/E ratio being slightly below the industry average at 39.3x, it's expected to see substantial profit growth annually over the next three years. Recently, Ataa expanded its strategic presence by partnering with Buckswood Education Global to establish a British school in Riyadh, aligning with Saudi Arabia's Vision 2030 goals. However, challenges include covering interest payments adequately and a modest forecasted revenue growth rate of 6.1% per year.

- Click here and access our complete growth analysis report to understand the dynamics of Ataa Educational.

- Our expertly prepared valuation report Ataa Educational implies its share price may be lower than expected.

B-SOFTLtd (SZSE:300451)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: B-SOFT Co., Ltd. operates in the medical and health industry in China, with a market capitalization of approximately CN¥5.53 billion.

Operations: The company generates its revenue primarily from the medical and health sectors in China.

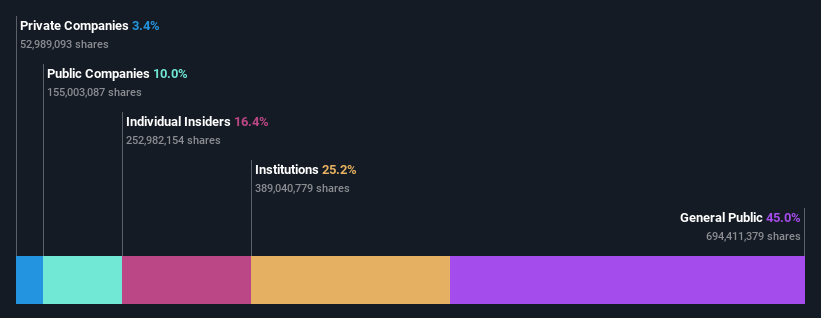

Insider Ownership: 16.4%

Earnings Growth Forecast: 50.3% p.a.

B-SOFTLtd, despite recent removals from major indices, maintains a robust growth trajectory with revenue and earnings increasing to CNY 375.49 million and CNY 12.36 million respectively in Q1 2024. The company's earnings are projected to expand by a significant margin annually, outpacing the Chinese market average. However, its Return on Equity is expected to remain low at 6.5% in three years, indicating potential challenges in generating shareholder value relative to capital employed.

- Dive into the specifics of B-SOFTLtd here with our thorough growth forecast report.

- Our valuation report here indicates B-SOFTLtd may be overvalued.

Summing It All Up

- Gain an insight into the universe of 1445 Fast Growing Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4292

Ataa Educational

Engages in the establishment of private and international, kindergarten, primary, intermediate, and secondary schools for boys and girls in the Kingdom of Saudi Arabia.

Moderate growth potential unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives