- China

- /

- Semiconductors

- /

- SHSE:603212

Global Market's Estimated Value Picks For June 2025

Reviewed by Simply Wall St

As global markets navigate through a complex landscape marked by escalating Middle East tensions and fluctuating trade dynamics, investors are keenly observing the shifts in major indices. With U.S. stocks experiencing volatility and European markets facing renewed uncertainties, identifying undervalued stocks becomes crucial for those seeking potential value amidst the broader economic challenges. In such an environment, a good stock often exhibits strong fundamentals that may not be fully reflected in its current price, offering opportunities for growth as market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wanguo Gold Group (SEHK:3939) | HK$31.50 | HK$62.31 | 49.4% |

| Taiyo Yuden (TSE:6976) | ¥2337.00 | ¥4644.53 | 49.7% |

| Sparebank 68° Nord (OB:SB68) | NOK180.00 | NOK358.42 | 49.8% |

| Qt Group Oyj (HLSE:QTCOM) | €54.60 | €108.05 | 49.5% |

| Nanya New Material TechnologyLtd (SHSE:688519) | CN¥38.76 | CN¥77.06 | 49.7% |

| Livero (TSE:9245) | ¥1704.00 | ¥3371.47 | 49.5% |

| ISU Petasys (KOSE:A007660) | ₩46800.00 | ₩92562.17 | 49.4% |

| doValue (BIT:DOV) | €2.22 | €4.43 | 49.9% |

| Dive (TSE:151A) | ¥919.00 | ¥1834.22 | 49.9% |

| Boreo Oyj (HLSE:BOREO) | €14.85 | €29.48 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

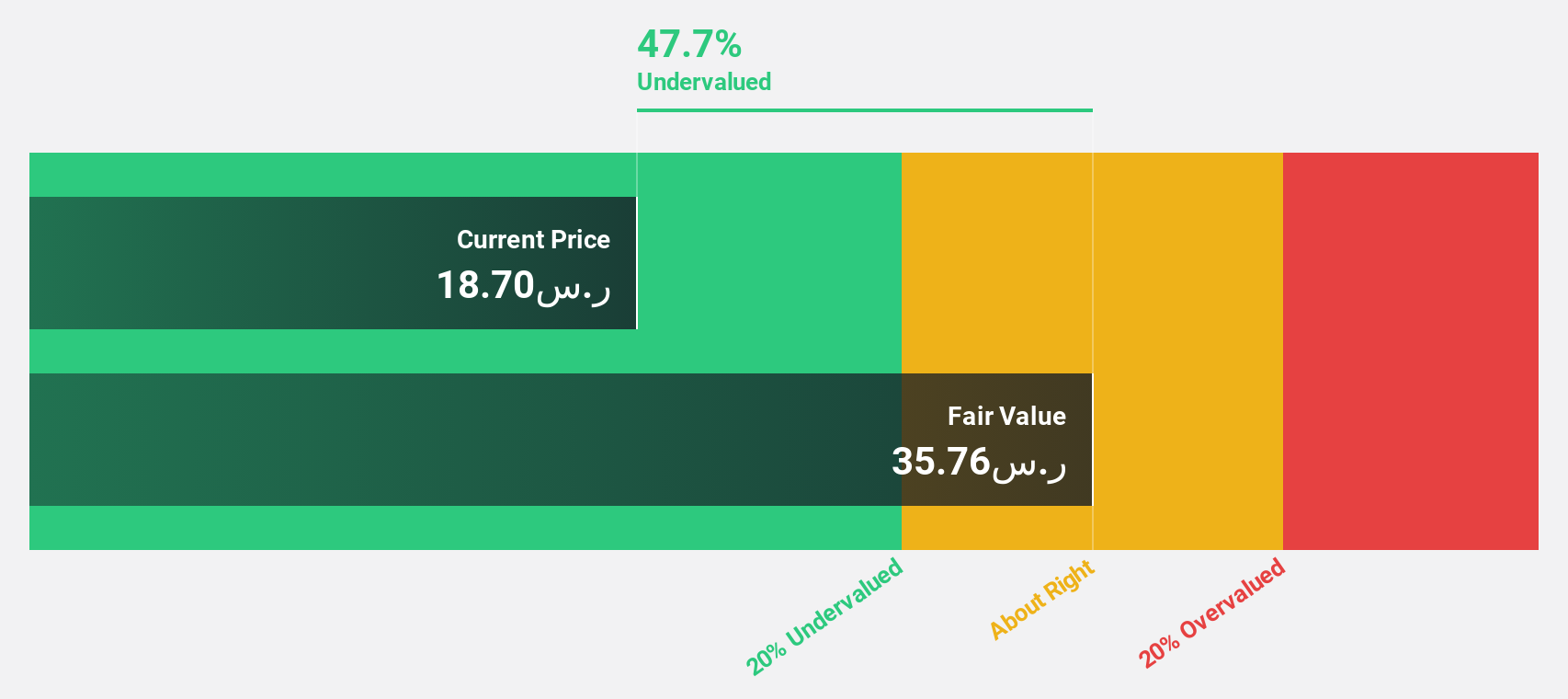

Seera Holding Group (SASE:1810)

Overview: Seera Holding Group, with a market cap of SAR6.33 billion, operates in the travel and tourism sector across Saudi Arabia, the United Kingdom, Egypt, the United Arab Emirates, Spain, and Kuwait through its subsidiaries.

Operations: The company's revenue is primarily derived from its Tourism segment at SAR1.64 billion, followed by Transportation at SAR1.56 billion, Ticketing at SAR671.28 million, Hospitality at SAR154.74 million, and Property Rentals (Excl. Hospitality) contributing SAR87.49 million.

Estimated Discount To Fair Value: 22.7%

Seera Holding Group is trading at SAR 23.8, below its estimated fair value of SAR 30.77, indicating it may be undervalued based on cash flows. Although earnings are forecast to grow significantly at 72.87% annually, revenue growth is expected to be moderate at 8.4% per year compared to the market's 2.2%. Recent earnings showed a slight decline in net income from the previous year, with sales increasing modestly to SAR 1,104.48 million.

- Our growth report here indicates Seera Holding Group may be poised for an improving outlook.

- Click here to discover the nuances of Seera Holding Group with our detailed financial health report.

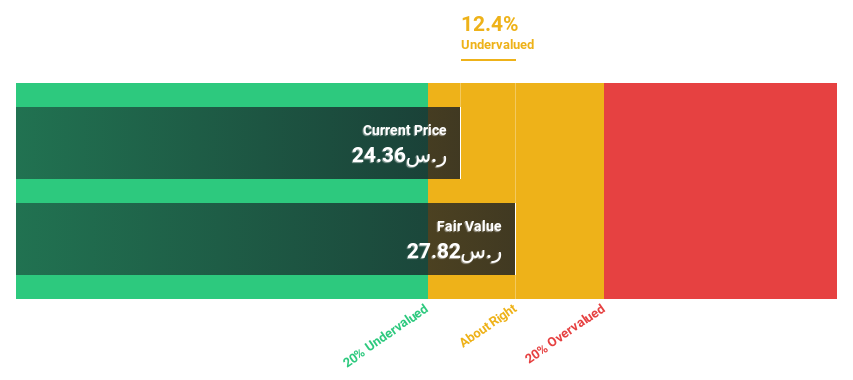

Sahara International Petrochemical (SASE:2310)

Overview: Sahara International Petrochemical Company operates industrial projects in the chemical and petrochemical sectors in Saudi Arabia, with a market cap of SAR13.69 billion.

Operations: The company's revenue segments include Trading (SAR4.82 billion), Polymers (SAR2.42 billion), Basic Chemicals (SAR2.26 billion), and Intermediate Chemicals (SAR2.02 billion).

Estimated Discount To Fair Value: 47.7%

Sahara International Petrochemical is trading at SAR 18.7, significantly below its estimated fair value of SAR 35.77, highlighting potential undervaluation based on cash flows. Despite a forecasted annual earnings growth of 24.66%, the company's profit margins have decreased from last year, and its dividend yield of 5.35% is not well covered by earnings. However, revenue growth outpaces the SA market at 5.2% annually, with recent quarterly results showing modest improvements in sales and net income.

- The growth report we've compiled suggests that Sahara International Petrochemical's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Sahara International Petrochemical.

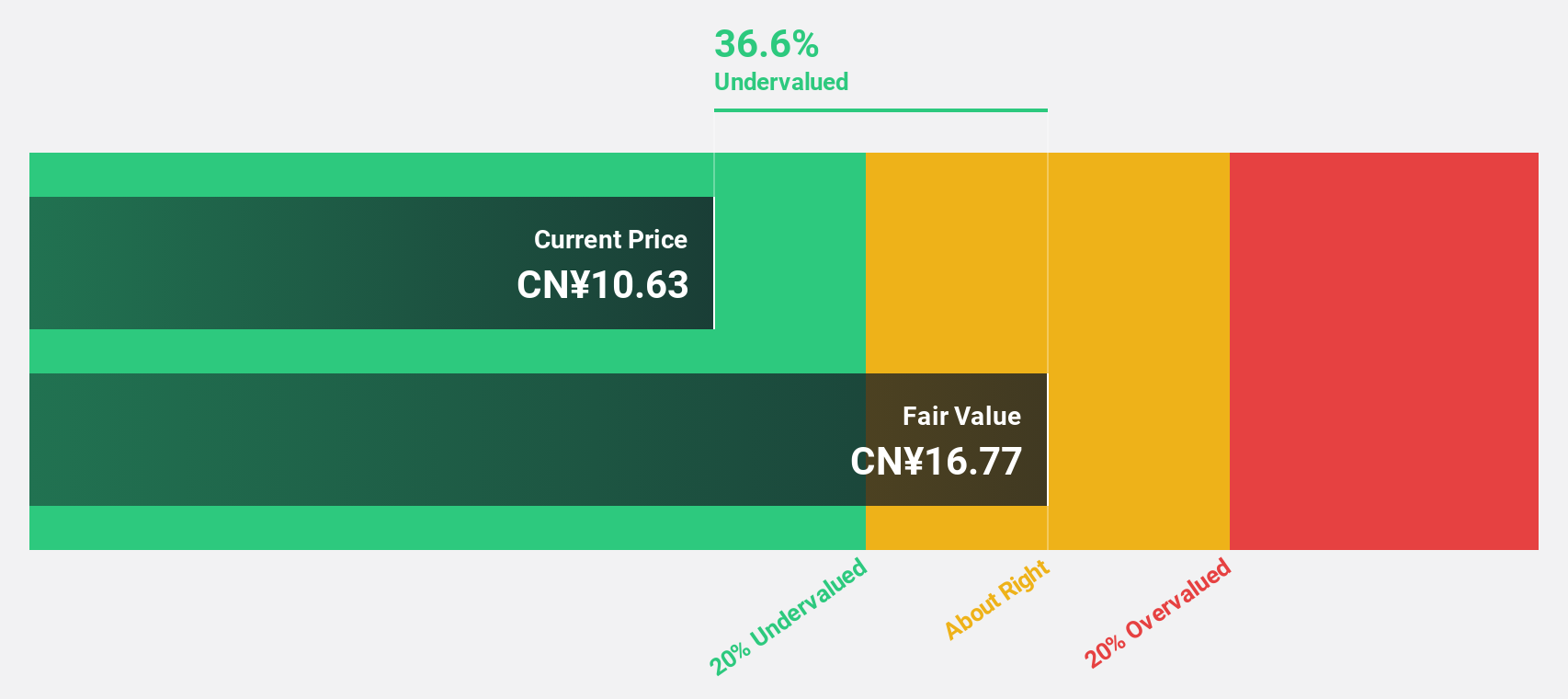

Cybrid Technologies (SHSE:603212)

Overview: Cybrid Technologies Inc. is involved in the development, production, and sales of functional polymer materials in China with a market cap of CN¥4.23 billion.

Operations: The company generates revenue of CN¥2.76 billion from its research and development, production, and sales of photovoltaic materials.

Estimated Discount To Fair Value: 35.8%

Cybrid Technologies is trading at CNY 10.63, well below its estimated fair value of CNY 16.56, indicating undervaluation based on cash flows. The company reported a net loss for both the first quarter and full year of 2024, with declining sales compared to previous periods. Despite this, revenue is forecasted to grow annually by 18%, surpassing the Chinese market's growth rate. Cybrid is expected to become profitable within three years, reflecting above-average market growth potential.

- Our earnings growth report unveils the potential for significant increases in Cybrid Technologies' future results.

- Click to explore a detailed breakdown of our findings in Cybrid Technologies' balance sheet health report.

Taking Advantage

- Investigate our full lineup of 493 Undervalued Global Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603212

Cybrid Technologies

Engages in the development, production and sales of functional polymer materials in China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives