- Saudi Arabia

- /

- Food and Staples Retail

- /

- SASE:4162

Here's Why We're Wary Of Buying Almunajem Foods' (TADAWUL:4162) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Almunajem Foods Company (TADAWUL:4162) is about to trade ex-dividend in the next three days. The ex-dividend date is usually set to be two business days before the record date, which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase Almunajem Foods' shares before the 7th of December to receive the dividend, which will be paid on the 16th of December.

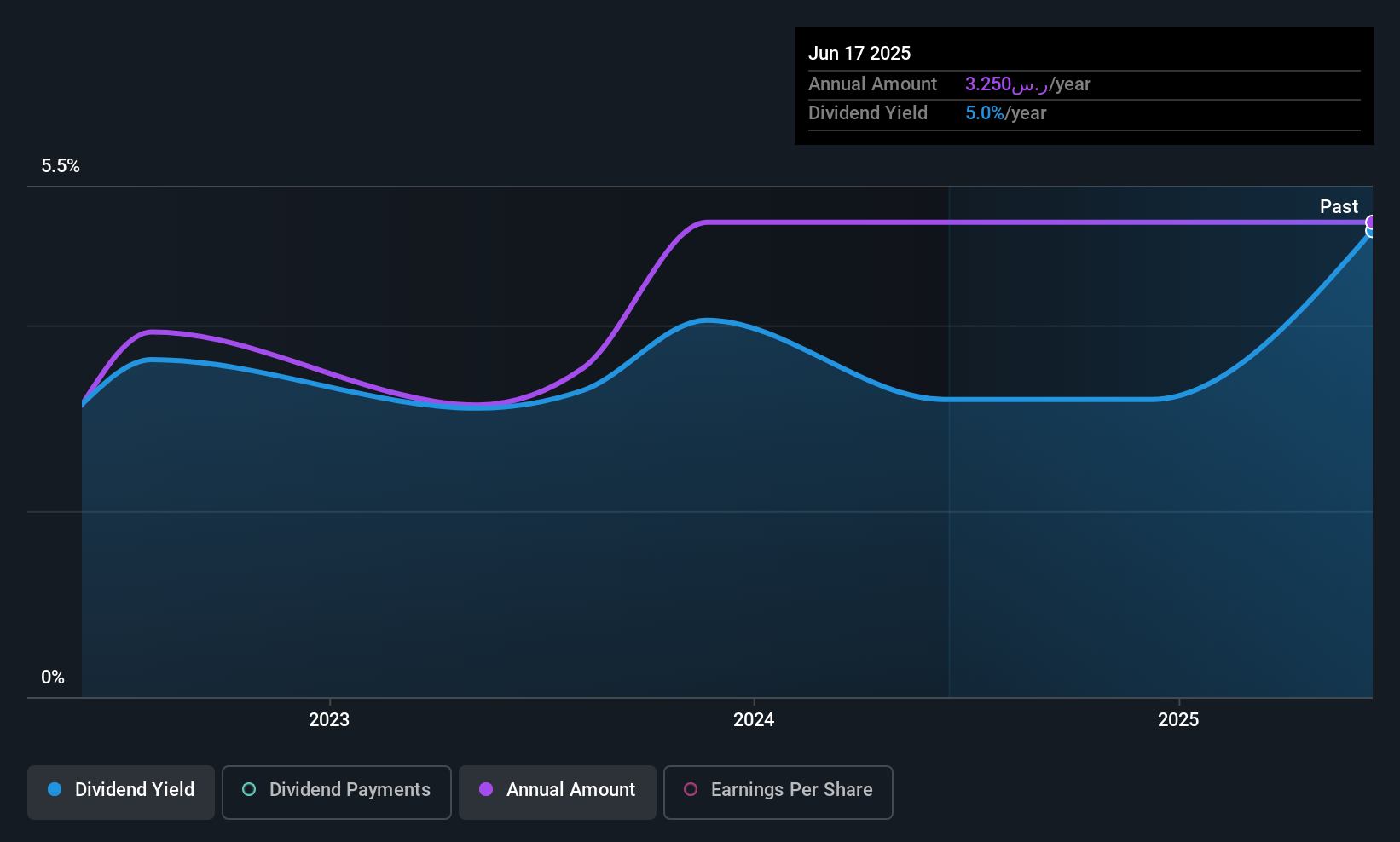

The company's next dividend payment will be ر.س1.00 per share, on the back of last year when the company paid a total of ر.س3.25 to shareholders. Calculating the last year's worth of payments shows that Almunajem Foods has a trailing yield of 6.0% on the current share price of ر.س54.30. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Almunajem Foods distributed an unsustainably high 110% of its profit as dividends to shareholders last year. Without extenuating circumstances, we'd consider the dividend at risk of a cut. A useful secondary check can be to evaluate whether Almunajem Foods generated enough free cash flow to afford its dividend. Over the last year, it paid out dividends equivalent to 222% of what it generated in free cash flow, a disturbingly high percentage. It's pretty hard to pay out more than you earn, so we wonder how Almunajem Foods intends to continue funding this dividend, or if it could be forced to cut the payment.

Cash is slightly more important than profit from a dividend perspective, but given Almunajem Foods's payouts were not well covered by either earnings or cash flow, we would be concerned about the sustainability of this dividend.

See our latest analysis for Almunajem Foods

Click here to see how much of its profit Almunajem Foods paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Readers will understand then, why we're concerned to see Almunajem Foods's earnings per share have dropped 18% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Almunajem Foods has delivered an average of 13% per year annual increase in its dividend, based on the past four years of dividend payments. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. Almunajem Foods is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

The Bottom Line

Has Almunajem Foods got what it takes to maintain its dividend payments? Not only are earnings per share declining, but Almunajem Foods is paying out an uncomfortably high percentage of both its earnings and cashflow to shareholders as dividends. This is a clearly suboptimal combination that usually suggests the dividend is at risk of being cut. If not now, then perhaps in the future. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Almunajem Foods.

With that in mind though, if the poor dividend characteristics of Almunajem Foods don't faze you, it's worth being mindful of the risks involved with this business. We've identified 2 warning signs with Almunajem Foods (at least 1 which is a bit unpleasant), and understanding these should be part of your investment process.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SASE:4162

Almunajem Foods

Together with its subsidiary, engages in the wholesale and retail trade of fruits, vegetables, cold and frozen poultry and meat, bottled, and food stuff in Saudi Arabia.

Flawless balance sheet with limited growth.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026